A reserve fund is a designated pool of money set aside by an organization or entity to address future expenses, unforeseen events, or to provide a financial cushion. It serves as a form of savings account, ensuring that funds are available when needed, thereby enhancing financial stability and mitigating risks. Reserve funds are commonly used in various sectors, including businesses, non-profit organizations, homeowners' associations, and government entities. It helps organizations avoid financial distress by ensuring there are sufficient funds available to address unforeseen circumstances or capital needs. A reserve fund is typically built up over time by allocating a portion of the organization's revenue or profits into the fund. Having a reserve fund provides peace of mind, improves financial resilience, and enables prudent financial management. In wealth management, a reserve fund plays a crucial role in maintaining financial health and safeguarding against unexpected economic shocks. It provides a buffer against unforeseen expenses, helping to preserve the value of the portfolio and maintain liquidity. Having a well-maintained reserve fund can make a significant difference during economic downturns or personal emergencies. It allows wealth managers and individuals to continue meeting their financial obligations without having to liquidate long-term investments at unfavorable prices. One of the primary purposes of a reserve fund is to ensure liquidity and financial stability. It provides readily accessible funds that can be used to cover short-term expenses or obligations. A reserve fund acts as a financial safety net, reducing the need to borrow or sell investments in response to an unexpected cash crunch. It helps maintain stability in a portfolio, providing the comfort of knowing that funds are available when needed. A reserve fund helps mitigate financial risks and uncertainties. By having a cushion of funds set aside, individuals and organizations can better handle sudden financial shocks or downturns. It reduces the risk of falling into debt or defaulting on obligations due to unforeseen expenses. Additionally, it allows for more flexibility and resilience in managing the investment portfolio, as the dependence on individual investments for liquidity is reduced. During periods of financial instability or market downturns, a reserve fund can serve as a lifeline, helping to meet ongoing expenses without having to dip into long-term investments or retirement savings. This function is particularly essential for corporations and governments, where an adequate reserve fund can help maintain operations and services in the face of reduced revenues or increased expenses. A reserve fund can be used to fund future capital expenditures. These could include property maintenance and improvements, equipment upgrades, or other significant investments. By setting aside funds in advance, entities can avoid the need to borrow or raise additional capital when these expenses arise. This can lead to significant cost savings and reduce financial strain. A reserve fund is also designed to meet unexpected expenses or contingencies. These could include medical emergencies, loss of income, unexpected repair costs, or sudden changes in financial circumstances. By having funds readily available, one can address these situations promptly without disrupting their regular cash flow or long-term financial plans. Cash reserves form an essential component of a reserve fund. This includes cash held in checking or savings accounts, which can be easily accessed for immediate needs. Having a sufficient amount of cash reserves ensures liquidity and enables quick response in case of financial emergencies. It also reduces the need to sell other investments under unfavorable market conditions. Marketable securities like government bonds, treasury bills, and money market funds are often included in a reserve fund. These securities are easily traded in the market and can be converted into cash on short notice. They offer a higher return than cash while still maintaining a high level of safety and liquidity. However, their value can fluctuate with changes in interest rates, so they carry some level of risk. Short-term investments are a component of a reserve fund that aims to generate a return while still preserving capital and maintaining liquidity. These may include certificates of deposit (CDs), short-term bonds, or other low-risk investments. While these assets may offer slightly higher returns than cash or marketable securities, they also carry higher risk. Therefore, their proportion within the reserve fund should be carefully considered based on the individual's or organization's risk tolerance. Fixed-income assets, such as bonds or bond funds, can form part of a reserve fund. They provide a regular income stream and return the principal amount at maturity. The inclusion of fixed-income assets in a reserve fund can provide a balance between risk and return. It can offer higher returns than cash or short-term investments, but with more risk and less liquidity. In some cases, real estate holdings may be considered part of a reserve fund. This could include properties that can be sold or rented out to generate funds. Real estate can offer substantial returns over the long term. However, it's less liquid than other components of a reserve fund and may be subject to market fluctuations and other risks. Alternative investments, such as commodities, hedge funds, or private equity, may also form part of a reserve fund. These investments can offer high returns and diversification benefits. However, they are generally less liquid and more risky than traditional investments. As such, their inclusion in a reserve fund should be carefully considered and monitored. The first step in building a reserve fund is to determine the target amount. This would depend on various factors such as monthly expenses, financial obligations, investment goals, and risk tolerance. A common rule of thumb is to aim for a reserve fund that can cover 3-6 months of expenses for individuals or a certain percentage of the annual budget for corporations and nonprofits. The optimal amount can vary based on specific circumstances and needs. After determining the target amount, it's important to set a realistic timeline for reaching this goal. Building a reserve fund is typically a gradual process that takes place over time. The timeline should take into account the individual's or organization's income, expenditure, and other financial commitments. It's crucial to strike a balance between building the reserve fund and meeting other financial objectives. To build a reserve fund, potential funding sources need to be identified. This could include regular income, savings, investment returns, or windfalls like bonuses or inheritances. One strategy could be to dedicate a fixed percentage of the income towards the reserve fund. Alternatively, one can look for areas to cut back on expenses and direct the savings to the fund. An Investment Policy Statement (IPS) can guide the management of the reserve fund. The IPS should detail the fund's objectives, acceptable risk levels, asset allocation strategy, and criteria for selecting investments. Having a well-defined IPS can help ensure that the reserve fund is managed in line with the individual's or organization's financial goals and risk tolerance. It can also provide a framework for making investment decisions and assessing performance. Regular contributions and systematic funding are key strategies for building a reserve fund. This could involve setting up automatic transfers from a checking account to the reserve fund or making regular deposits. Systematic funding can help make the process of building a reserve fund more manageable and consistent. It also takes advantage of dollar-cost averaging, which can reduce the impact of market volatility on the fund. Reinvesting gains and distributions can help grow the reserve fund over time. This involves reinvesting the income or returns generated by the fund's investments back into the fund. Reinvestment can take advantage of the power of compounding, where earnings generate further earnings. Over time, this can have a significant impact on the size of the reserve fund. A reserve fund enhances financial security by providing a safety net against unexpected financial shocks or downturns. It ensures that funds are readily available to cover emergencies or unforeseen expenses. Having a reserve fund can provide peace of mind, knowing that one is prepared for financial uncertainties. It also reduces the need to resort to high-cost borrowing or selling investments under duress. Reserve funds safeguard against unforeseen events, such as job loss, medical emergencies, or significant repair costs. These funds can be quickly accessed to cover these expenses, reducing financial stress during difficult times. By having a buffer against these unexpected events, one can maintain their financial stability and avoid disruptions to their lifestyle or long-term financial plans. Reserve funds provide flexibility in decision making. With a cushion of readily accessible funds, one has more flexibility to make financial decisions, take advantage of investment opportunities, or weather market downturns. This flexibility can be particularly valuable in times of uncertainty or volatility. It allows for a more proactive and responsive approach to managing finances. Reserve funds enable long-term planning. By setting aside funds for emergencies or future needs, one can focus on their long-term financial goals without worrying about short-term financial disruptions. Having a reserve fund can also encourage better financial discipline and planning. It helps individuals and organizations to live within their means, plan for the future, and avoid excessive debt. While the primary purpose of a reserve fund is to provide financial stability and liquidity, it can also generate potential income. The fund's assets can be invested in safe, low-risk instruments that provide a return. While the returns are typically modest, they can contribute to the growth of the reserve fund over time. This can help offset the effects of inflation and enhance the fund's purchasing power. One of the main challenges in managing a reserve fund is balancing liquidity and returns. The fund needs to be readily accessible, which limits the types of investments that can be held. However, holding too much cash can lead to low returns and the erosion of the fund's value due to inflation. Therefore, a balance must be struck between maintaining liquidity and generating a decent return. Another consideration in managing a reserve fund is monitoring and adjusting the investment allocation. The fund's investments should be regularly reviewed to ensure they align with the fund's objectives and risk tolerance. As market conditions change, it may be necessary to adjust the investment mix. This could involve reallocating funds between different asset classes or adjusting the proportion of cash and investments. Evaluating and managing risks is a critical aspect of managing a reserve fund. This includes the risk of loss from investments, the risk of inflation eroding the fund's value, and the risk of not having enough funds to cover emergencies or unforeseen expenses. Risk management strategies may include diversifying investments, holding a mix of different asset types, and regularly reviewing and adjusting the fund's risk profile. Inflation and currency fluctuations can affect the value of a reserve fund. Inflation can erode the purchasing power of the fund, while currency fluctuations can impact the value of foreign investments. To mitigate these risks, the fund's investment strategy should account for inflation and currency risks. This could involve investing in assets that provide a real return (i.e., above inflation) or hedging against currency risks. For organizations, managing a reserve fund involves adhering to legal and regulatory requirements. These may include reporting requirements, restrictions on the types of investments that can be held, and requirements for maintaining certain levels of reserves. Non-compliance with these requirements can result in penalties or legal consequences. Therefore, it's important to understand and adhere to any legal and regulatory requirements applicable to the fund. Corporate reserve funds are established by businesses to cover future expenses, emergencies, or downturns. These funds can help companies manage financial risks, invest in growth opportunities, and ensure financial stability. For example, a company might establish a reserve fund to cover future capital expenditures, such as equipment upgrades or facility expansions. Alternatively, a reserve fund could be used to safeguard against economic downturns or disruptions in cash flow. Nonprofit organizations often maintain reserve funds to ensure they can continue their programs and services in the face of financial uncertainties. These funds can help nonprofits manage fluctuations in funding, cover unexpected costs, and invest in new initiatives. For instance, a nonprofit might use its reserve fund to bridge funding gaps, ensuring continuity of services. Or, it might draw on the fund to cover unexpected costs like emergency repairs or sudden increases in demand for its services. Government reserve funds, often called sovereign wealth funds or stabilization funds, are pools of money that a government sets aside to achieve various financial objectives. These might include stabilizing the economy, investing in infrastructure, or saving for future generations. For example, a government might use a reserve fund to mitigate the effects of economic cycles, smoothing out spending and preventing drastic budget cuts during downturns. It might use the fund to invest in long-term initiatives that benefit the country's economic development. A reserve fund in finance is a designated pool of funds set aside by an individual, organization, or entity to address future expenses, unforeseen events, or provide financial security. The reserve fund is designed to create a safety net and ensure that funds are available when needed, thereby enhancing financial stability and mitigating risks. Components of a reserve fund may include cash, liquid investments, or other easily accessible assets. Strategies for building a reserve fund involve consistently allocating a portion of income or profits towards it. The benefits of maintaining a reserve fund include improved financial resilience, the ability to handle unexpected expenses or emergencies, and the provision of a financial cushion during economic downturns or market fluctuations. What Is a Reserve Fund?

Importance of Reserve Funds in Wealth Management

Purpose and Objectives of a Reserve Fund

Ensuring Liquidity and Financial Stability

Mitigating Financial Risks and Uncertainties

Protecting Against Economic Downturns

Funding Future Capital Expenditures

Meeting Unexpected Expenses or Contingencies

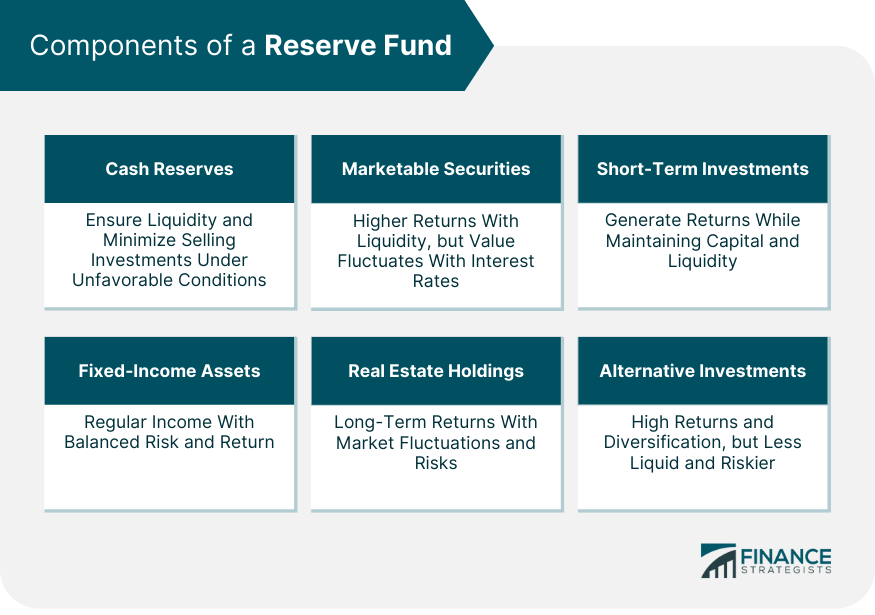

Components of a Reserve Fund

Cash Reserves

Marketable Securities

Short-Term Investments

Fixed-Income Assets

Real Estate Holdings

Alternative Investments

Strategies for Building a Reserve Fund

Determining the Target Amount

Setting a Realistic Timeline

Identifying Potential Funding Sources

Establishing an Investment Policy Statement

Regular Contributions and Systematic Funding

Reinvesting Gains and Distributions

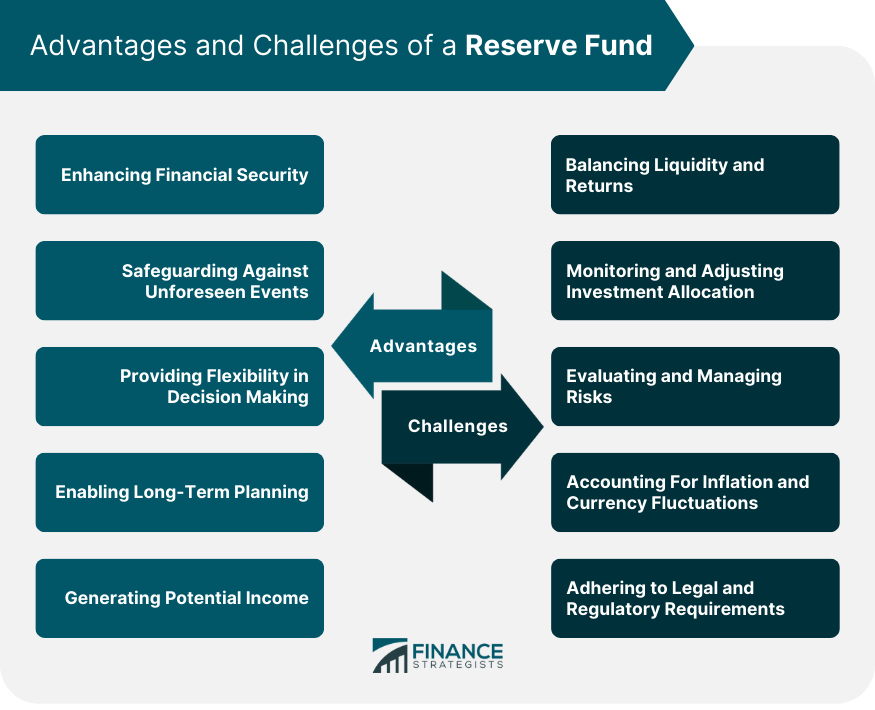

Advantages of a Reserve Fund

Enhancing Financial Security

Safeguarding Against Unforeseen Events

Providing Flexibility in Decision Making

Enabling Long-Term Planning

Generating Potential Income

Challenges in Managing a Reserve Fund

Balancing Liquidity and Returns

Monitoring and Adjusting Investment Allocation

Evaluating and Managing Risks

Accounting for Inflation and Currency Fluctuations

Adhering to Legal and Regulatory Requirements

Examples of Reserve Funds in Wealth Management

Corporate Reserve Funds

Nonprofit Organization Reserve Funds

Government Reserve Funds

Final Thoughts

Reserve Fund FAQs

A reserve fund is a pool of money set aside to cover unexpected costs, future expenses, or financial emergencies. It serves as a financial safety net, providing stability and reducing risk.

In wealth management, a reserve fund is crucial for maintaining financial health and safeguarding against unexpected economic shocks. It provides a buffer against unforeseen expenses, helps preserve the value of the portfolio, and maintains liquidity.

Strategies for building a reserve fund include determining the target amount, setting a realistic timeline, identifying potential funding sources, establishing an Investment Policy Statement (IPS), making regular contributions, and reinvesting gains.

Suitable investments for a reserve fund typically include low-risk, highly liquid assets such as cash, marketable securities, and short-term investments. The exact mix of investments will depend on the individual's or organization's risk tolerance and financial goals.

Challenges in managing a reserve fund include balancing liquidity and returns, monitoring and adjusting investment allocation, evaluating and managing risks, accounting for inflation and currency fluctuations, and adhering to legal and regulatory requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.