What Is Blend Investing?

Blend investing is an investment strategy that seeks to strike a balance between growth and value investments. This approach involves investing in companies that exhibit both growth potential and value characteristics, such as strong fundamentals, stable earnings, and attractive valuations.

Growth investments are typically associated with companies that have high growth potential, such as tech startups, while value investments are associated with companies that are undervalued or overlooked by the market.

By blending the two, investors can create a diversified portfolio that seeks to capture the best of both worlds.

One of the key benefits of blend investing is that it allows investors to participate in the growth potential of high-growth companies while also providing exposure to more stable, income-generating investments.

This balanced approach can help to reduce risk, as it diversifies the portfolio and helps to offset potential losses in any one investment.

To implement a blend investing strategy, investors typically choose a mix of growth stocks and value stocks, as well as other types of investments such as bonds and cash.

The allocation of each investment within the portfolio is based on the investor's risk tolerance, investment objectives, and market conditions.

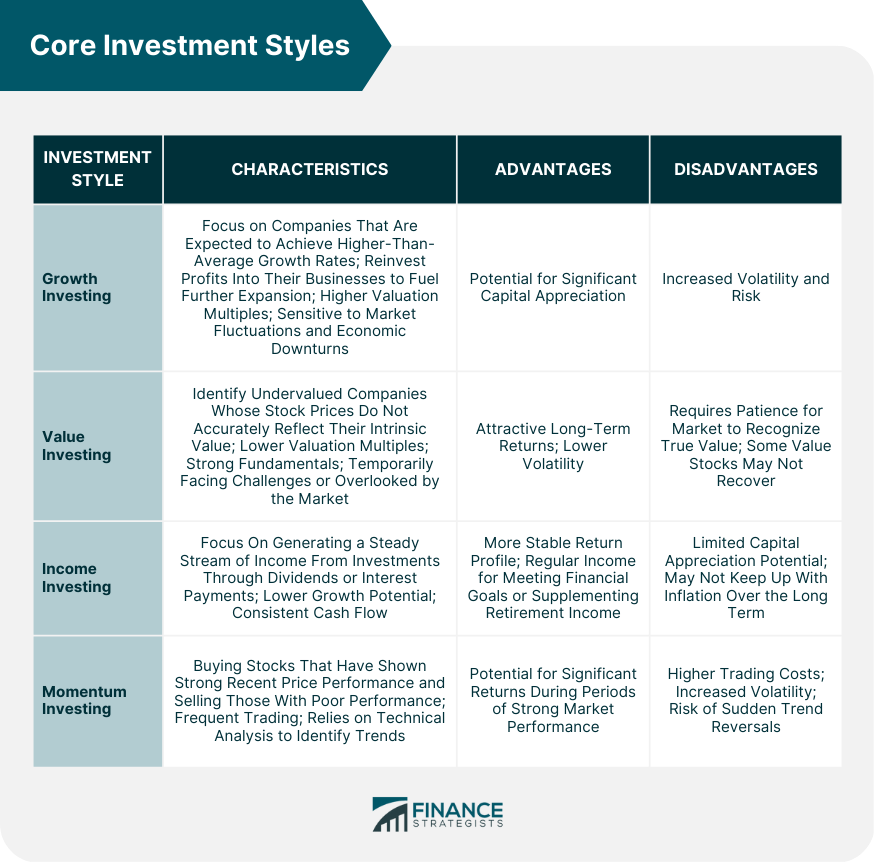

Core Investment Styles

Growth Investing

Characteristics

Growth investing focuses on companies that are expected to achieve higher-than-average growth rates in terms of revenue, earnings, or cash flow.

These companies often reinvest profits into their businesses to fuel further expansion. Growth stocks typically trade at higher valuation multiples, such as price-to-earnings (P/E) ratios, due to their expected future growth.

Advantages and Disadvantages

Growth investing can offer significant capital appreciation potential as the value of high-growth companies can increase rapidly over time.

However, these investments often come with increased volatility and risk, as growth stocks can be more sensitive to market fluctuations and economic downturns.

Value Investing

Characteristics

Value investing involves identifying undervalued companies whose stock prices do not accurately reflect their intrinsic value.

Value investors search for stocks with lower valuation multiples, such as P/E or price-to-book (P/B) ratios, and look for companies with strong fundamentals that are temporarily facing challenges or are overlooked by the market.

Advantages and Disadvantages

Value investing can provide attractive long-term returns as undervalued stocks eventually revert to their true value. Additionally, value stocks often have lower volatility and offer a margin of safety for investors.

However, value investing requires patience, as the market can take time to recognize the true value of these companies, and some value stocks may not recover as expected.

Income Investing

Characteristics

Income investing focuses on generating a steady stream of income from investments through dividends or interest payments. Income-oriented investments include dividend-paying stocks, bonds, real estate investment trusts (REITs), and preferred stocks.

These investments often have lower growth potential but provide consistent cash flow to investors.

Advantages and Disadvantages

Income investing can offer a more stable return profile and reduce portfolio volatility. Additionally, regular income can help investors meet financial goals or supplement retirement income.

However, income investments may have limited capital appreciation potential and may not keep up with inflation over the long term.

Momentum Investing

Characteristics

Momentum investing involves buying stocks that have shown strong recent price performance and selling those with poor performance. Momentum investors believe that stocks with positive momentum will continue to outperform, while those with negative momentum will underperform.

This strategy often involves frequent trading and relies on technical analysis to identify trends.

Advantages and Disadvantages

Momentum investing can generate significant returns during periods of strong market performance, as investors ride the wave of upward trends. However, this strategy can be subject to higher trading costs, increased volatility, and the risk of sudden trend reversals.

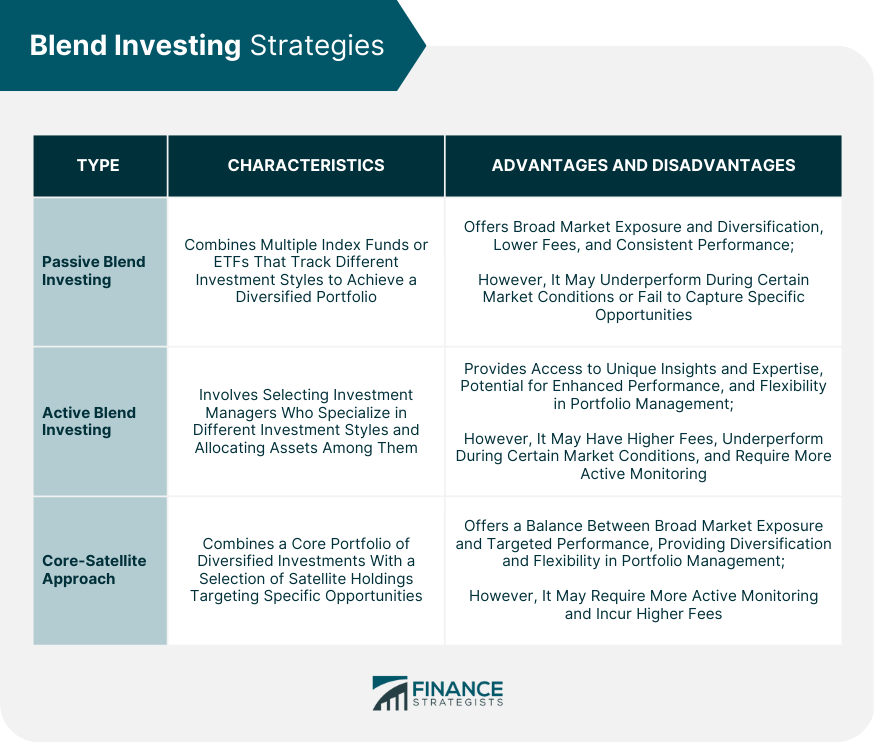

Blend Investing Strategies

Passive Blend Investing

Using Index Funds and ETFs

Passive blend investing combines multiple index funds or exchange-traded funds (ETFs) that track different investment styles, such as growth, value, or income.

By investing in a mix of these funds, investors can achieve a diversified portfolio that captures the benefits of various investment approaches.

Diversification and Asset Allocation

Diversification involves spreading investments across different asset classes, sectors, and investment styles to reduce overall portfolio risk.

In a passive blend investing strategy, investors determine an appropriate asset allocation based on their risk tolerance, investment goals, and time horizon. This allocation is periodically reviewed and rebalanced to maintain the desired diversification.

Active Blend Investing

Manager Selection and Performance

Active blend investing involves selecting investment managers who specialize in different investment styles and allocating assets among them.

By combining managers with expertise in growth, value, income, and momentum investing, investors can access the unique insights and approaches of each manager, potentially enhancing portfolio performance.

Tactical Asset Allocation

Tactical asset allocation is a more flexible approach to blend investing that involves making active decisions about the portfolio's exposure to different investment styles based on market conditions or economic trends.

Investors may adjust their allocations to take advantage of short-term opportunities or to protect the portfolio from anticipated risks.

Core-Satellite Approach

Core Holdings for Diversification

The core-satellite approach to blend investing combines a core portfolio of diversified investments, such as index funds or ETFs, with a selection of satellite holdings targeting specific investment styles or opportunities.

The core portfolio provides broad exposure to the market and ensures diversification, while the satellite holdings can enhance performance or provide exposure to specific themes or trends.

Satellite Holdings for Targeted Performance

Satellite holdings can include actively managed funds, individual stocks, or alternative investments that are chosen based on their potential to deliver targeted performance.

These holdings allow investors to take advantage of their unique insights or convictions, while the core holdings provide a stable foundation for the overall portfolio.

Implementing Blend Investing

Assessing Risk Tolerance and Investment Goals

Before implementing a blend investing strategy, investors should assess their risk tolerance, investment goals, and time horizon. This assessment helps determine the appropriate asset allocation and blend of investment styles for the portfolio.

Developing an Investment Policy Statement

An investment policy statement (IPS) outlines the investor's objectives, risk tolerance, and investment strategy.

The IPS serves as a guide for selecting investments and making portfolio decisions, helping to ensure that the blend investing strategy remains aligned with the investor's goals and risk tolerance.

Selecting Suitable Investments

Individual Stocks and Bonds

Investors can build a blend investing portfolio by selecting individual stocks and bonds that represent various investment styles. This approach allows for more control over the specific investments in the portfolio but requires a higher level of research and analysis.

Mutual Funds and ETFs

Mutual funds and ETFs provide a convenient way to access diversified portfolios representing different investment styles. These funds can be used as building blocks for a blend investing strategy, allowing investors to easily adjust their exposure to various styles over time.

Alternative Investments

Alternative investments, such as real estate, commodities, or private equity, can also be incorporated into a blend investing strategy to further diversify the portfolio and potentially enhance returns.

Monitoring and Adjusting the Portfolio

Periodic Rebalancing

Regularly monitoring and rebalancing the blend investing portfolio helps maintain the desired asset allocation and investment style exposures.

This process may involve selling investments that have performed well and buying those that have underperformed to bring the portfolio back in line with its target allocation.

Tax Considerations

When implementing a blend investing strategy, investors should consider the tax implications of their investment decisions. This may involve selecting tax-efficient investments or managing the portfolio in a tax-advantaged account, such as an individual retirement account (IRA) or a 401(k).

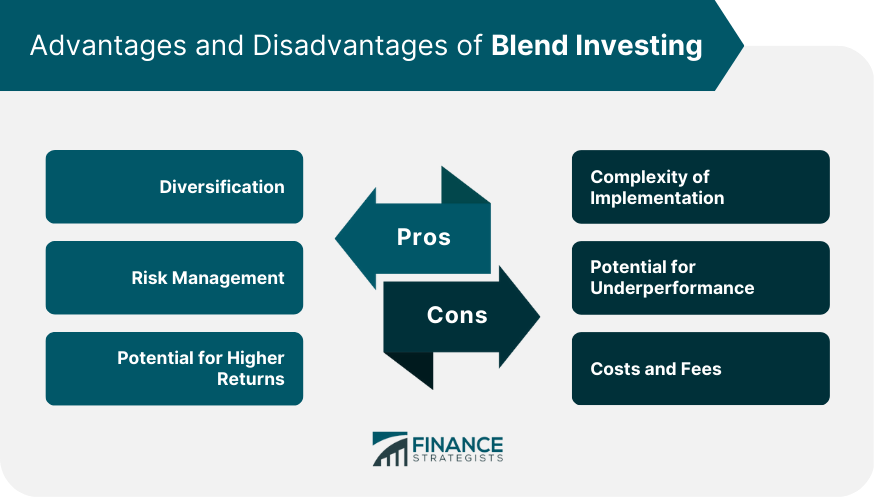

Advantages and Disadvantages of Blend Investing

Advantages

Diversification Benefits

Blend investing provides diversification benefits by combining various investment styles, which can help reduce overall portfolio risk and smooth out returns over time.

Risk Management

By allocating assets across different investment styles, blend investing can help manage risk more effectively, as the performance of each style may be influenced by different factors or market conditions.

Potential for Higher Returns

Blend investing can potentially deliver higher returns by capturing the unique benefits of each investment style and taking advantage of opportunities presented by changing market conditions.

Disadvantages

Complexity of Implementation

Blend investing can be more complex to implement than a single-style investment approach. It requires a deeper understanding of various investment styles, asset allocation, and portfolio construction techniques.

Potential for Underperformance

There is no guarantee that a blend investing strategy will outperform a single-style approach or the broader market. The success of a blend investing strategy depends on the investor's ability to select the right combination of investment styles and make timely adjustments to the portfolio.

Costs and Fees

Blend investing may involve higher costs and fees, particularly for actively managed funds or frequent trading. These costs can reduce the overall returns of the portfolio and should be carefully considered when implementing a blend investing strategy.

Conclusion

Blend investing is an investment strategy that combines multiple investment styles to create a diversified and balanced portfolio. By combining growth, value, income, and momentum investing, investors can potentially achieve higher returns while effectively managing risk.

Successful implementation of blend investing requires careful consideration of risk tolerance, investment goals, and a thorough understanding of various investment styles and strategies.

By adapting to changing market conditions and maintaining a disciplined approach, blend investing can serve as a powerful tool for achieving long-term financial success.

Blend Investing FAQs

Blend investing is a type of investment strategy that involves combining both growth and value investments in a single portfolio. The idea behind blend investing is to create a balanced portfolio that offers both capital appreciation potential and steady income streams.

Blend investing differs from other investment strategies such as growth or value investing, which focus solely on either growth-oriented or value-oriented investments. Blend investing combines the two approaches, seeking to balance risk and return by including both growth and value stocks.

One advantage of blend investing is that it offers investors a diversified portfolio, which can help to minimize risk. Additionally, blend investing can provide both growth potential and income streams, making it an attractive option for investors who are looking for a balanced investment approach.

Blend investing is suitable for a wide range of investors, including those who are looking for a balanced investment approach, as well as those who are looking to minimize risk while still seeking growth potential. Blend investing may be particularly appealing to investors who are new to investing or who prefer a hands-off approach to managing their investments.

To get started with blend investing, you may want to consider working with a financial advisor who can help you develop a balanced investment strategy that meets your specific needs and goals. Alternatively, you can research and select individual stocks and funds that align with a blend investing approach, using a platform like a brokerage account or a robo-advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.