Risk reversal is a key strategy in options trading and foreign exchange markets aimed at managing risk and maximizing potential returns. In options trading, it involves selling an out-of-the-money (OTM) put option and buying an OTM call option simultaneously, or vice versa, thereby creating a position that can profit from a significant price shift in the underlying asset without an upfront cost. OTM call options speculate the asset price will rise above the strike price before expiry, while OTM put options predict it will not fall below the strike price. The premium costs of buying and selling these options ideally balance out, incurring no upfront cost to the trader. Despite potential profits, the strategy also carries significant risks if the asset price moves against the predicted direction. Risk reversal plays a significant role in options trading, where it involves simultaneously selling and buying options to create a cost-neutral position. The trader sells an out-of-the-money put option and buys an out-of-the-money call option or vice versa. This strategy allows traders to benefit from potential upside gains while limiting their downside risk. In Forex markets, risk reversal refers to the difference in implied volatility between similar call and put options. It serves as a gauge for market sentiment and helps traders assess the perceived risk of a particular currency pair. Traders can use this information to make informed decisions and capitalize on potential market movements. Risk reversal is based on the fundamental concept of balancing risk and reward. By employing this strategy, traders can minimize potential losses while maximizing potential gains. This balance is crucial in the volatile world of financial markets, where traders must navigate the constant push and pull of risk and reward. The first component of the risk reversal strategy involves the sale of an out-of-the-money option, which could either be a put or a call option. Selling an OTM option entails the seller assuming an obligation to either buy (in the case of a put option) or sell (in the case of a call option) an underlying asset at a predetermined price, widely known as the strike price. This transaction is typically beneficial to the seller, as it generates a premium. This premium is the sum that the buyer pays for the right to exercise the option at a future date, should the market conditions meet their expectations. The second component is the simultaneous purchase of another OTM option. If the option sold was a put, the trader would then purchase an OTM call option and conversely. Buying an OTM option presents the trader with the right, but crucially, not the obligation, to sell (in the case of a put option) or buy (in the case of a call option) the underlying asset at the strike price. This provides the trader with a certain degree of flexibility and potential for profit depending on market movements. To effectively calculate risk reversal numbers, traders are required to compare the implied volatility of the chosen call and put options. This requires an understanding of option pricing models and the inherent uncertainties in market conditions. The numerical difference in implied volatility is insightful as it offers a gauge of the market's perception of the potential directional movement of the asset. A positive risk reversal number suggests a bullish market sentiment, indicating expectations of rising prices. Conversely, a negative risk reversal number points towards a bearish sentiment, indicating expectations of falling prices. Understanding these interpretations enables traders to make more informed decisions and align their strategy with the overall market sentiment. To implement a risk reversal strategy in options trading, a trader will sell an out-of-the-money put option and simultaneously buy an out-of-the-money call option. This creates a position that profits from an upward move in the underlying asset's price. Conversely, a trader can sell a call option and buy a put option to profit from a downward move. There are three potential outcomes when using a risk reversal strategy in options trading In the Forex market, risk reversal involves assessing the implied volatility difference between similar call and put options. Traders use this information to gauge market sentiment and make trading decisions. A positive risk reversal number suggests that the market expects the base currency to appreciate, while a negative number indicates an expectation of depreciation. While the concept of risk reversal is the same in both Forex and options trading, the implementation differs. In options trading, risk reversal is a strategy that involves selling and buying options to create a cost-neutral position. In Forex markets, risk reversal is a metric used to measure market sentiment and the perceived risk of a currency pair. Risk reversal can significantly impact currency valuation and trading decisions. For instance, a positive risk reversal number might motivate traders to go long on a currency pair, expecting it to appreciate. Conversely, a negative number might signal potential depreciation, prompting traders to go short. This knowledge allows traders to make informed decisions and manage risk more effectively. Risk reversal can be an effective risk management and mitigation strategy. By selling and buying options simultaneously, traders can create a position that profits from the anticipated direction of an asset's price movement while limiting potential losses. This strategy can serve as a hedge against adverse market movements, protecting traders' portfolios from substantial losses. Consider a company that expects to receive payment in a foreign currency in the future. The company might use a risk reversal strategy to hedge against potential currency fluctuations. It could sell a put option on the currency, allowing it to profit if the currency depreciates, and simultaneously buy a call option, providing protection if the currency appreciates. Risk reversal has a close relationship with implied volatility. Implied volatility reflects the market's expectation of future price fluctuations of an underlying asset. The difference in implied volatility between a call option and a put option—what's known as risk reversal—helps traders gauge market sentiment and anticipate potential price movements. Volatility skew, also known as the "smile," refers to the pattern formed when graphing the implied volatility of options across various strike prices. This pattern can impact risk reversal. For example, a steep volatility skew might suggest a higher implied volatility for out-of-the-money options, influencing a trader's risk reversal strategy. Risk reversal can be a valuable tool for portfolio management. By creating a position that profits from a specific direction of an asset price movement while limiting potential losses, portfolio managers can better manage risk and enhance returns. Risk reversal can also be used for speculation and profit-making strategies. Traders with a strong market view can use risk reversal to potentially profit from their market predictions while managing their risk exposure. Risk reversal's cost neutrality is its primary limitation. Ideally, the sold option's premium should cover the purchased one's cost. However, if market conditions or option specifics lead to a significant premium difference, the strategy may not be cost-neutral. If the underlying asset's price doesn't behave as expected, this could dent potential profits or even cause losses. Risk reversal does not fully eliminate risk. Should the underlying asset's price deviate from the trader's prediction, they could suffer losses. This happens when the sold option ends up in the money, necessitating the trader to meet their obligations under the option contract, potentially leading to financial losses. By closely monitoring market conditions, traders can gain insights into the potential price movements of the underlying assets. These insights can help them choose the right options to buy and sell, making the risk reversal strategy more likely to be successful. A risk reversal strategy requires making several key decisions, such as which options to buy and sell, when to enter and exit the positions, and how much risk to take. Making these decisions based on solid research and analysis can help mitigate the risks associated with risk reversal. Finally, risk reversal doesn't have to be used in isolation. It can be combined with other risk management strategies to further reduce the potential risks. For example, a trader could use stop-loss orders to limit potential losses, or they could diversify their portfolio to spread the risk across multiple investments. Combining these strategies can provide a more comprehensive risk management approach, increasing the chances of successful trading. Risk reversal stands as a pivotal strategy for managing potential hazards while maximizing returns. At its core, this approach involves simultaneously transacting with out-of-the-money put and call options, constructing a position set to capitalize on the directional movement of an underlying asset, thereby offsetting any upfront cost. This methodology finds extensive use in options trading. Moreover, in the Forex market, it serves as a measure of market sentiment, gauging perceived risk by analyzing the difference in implied volatility between similar call and put options. The comprehension of this concept equips traders with an effective tool to navigate the intricate and often unpredictable financial markets, fostering informed decision-making and risk mitigation. In essence, risk reversal transcends the traditional dichotomy of risk and reward, creating a strategic balance beneficial to traders and investors.Definition of Risk Reversal

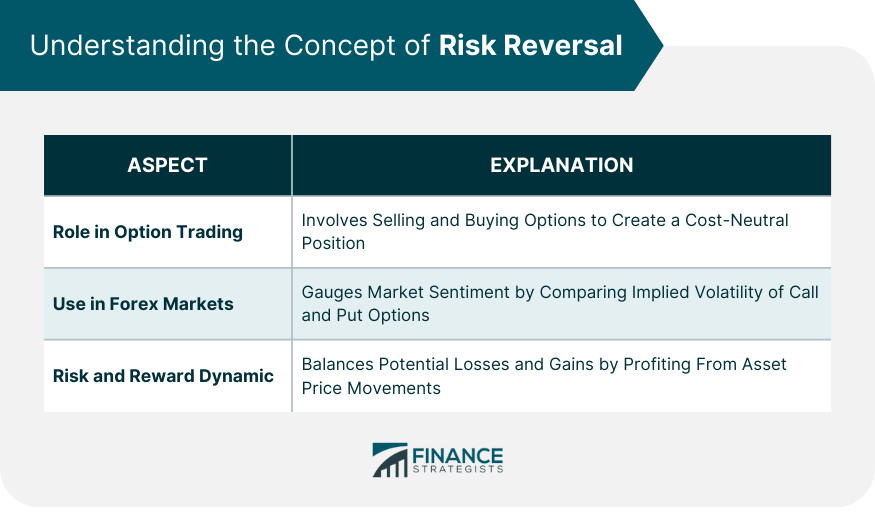

Understanding the Concept of Risk Reversal

Role in Option Trading

Use in Foreign Exchange (Forex) Markets

Risk and Reward Dynamic

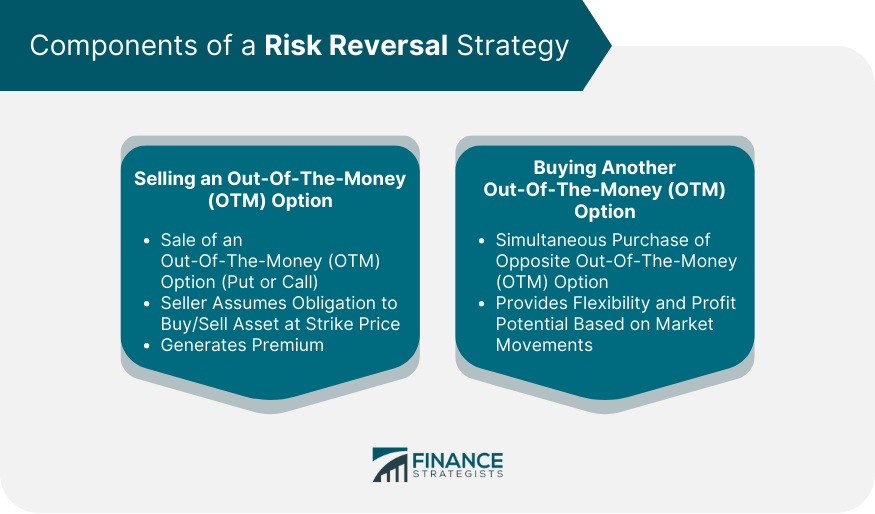

Components of a Risk Reversal Strategy

Selling an Out-Of-The-Money Option

Buying Another Out-Of-The-Money Option Simultaneously

Calculating and Interpreting Risk Reversal Numbers

Calculation of Risk Reversal Numbers

Interpreting Risk Reversal Numbers

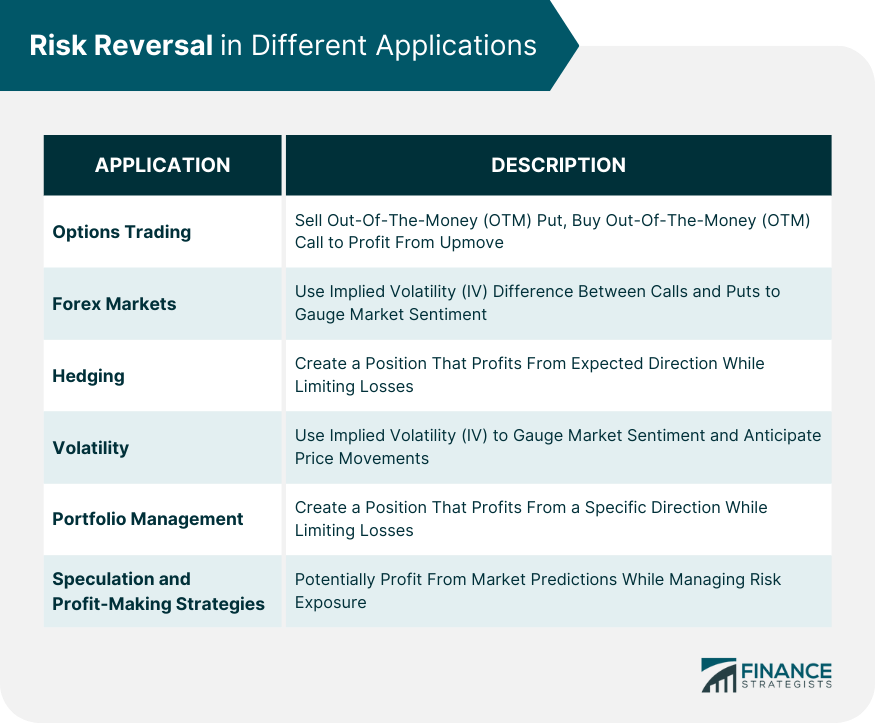

Risk Reversal in Options Trading

Implementing the Strategy: Selling and Buying Options

Potential Outcomes and Scenarios

1. The underlying asset's price moves in the anticipated direction, resulting in a profit from the purchased option. The sold option expires worthless, and the trader retains the premium received.

2. The price moves in the opposite direction, causing the sold option to be exercised. The trader may incur a loss, but the purchased option provides some protection by limiting potential losses.

3. The asset's price remains unchanged or moves within a narrow range. Both options expire worthless, and the trader neither profits nor loses.

Risk Reversal in Forex Markets

Understanding Currency Risk Reversal

Key Differences Between Forex and Options Risk Reversal

Impact on Currency Valuation and Trading Decisions

Role of Risk Reversal in Hedging

Risk Management and Mitigation Strategies

Examples of Hedging With Risk Reversal

Risk Reversal and Volatility

Relationship With Implied Volatility (IV)

Volatility Skew and Its Implication on Risk Reversal

Risk Reversal: Practical Applications

Use in Portfolio Management

Usage in Speculation and Profit-Making Strategies

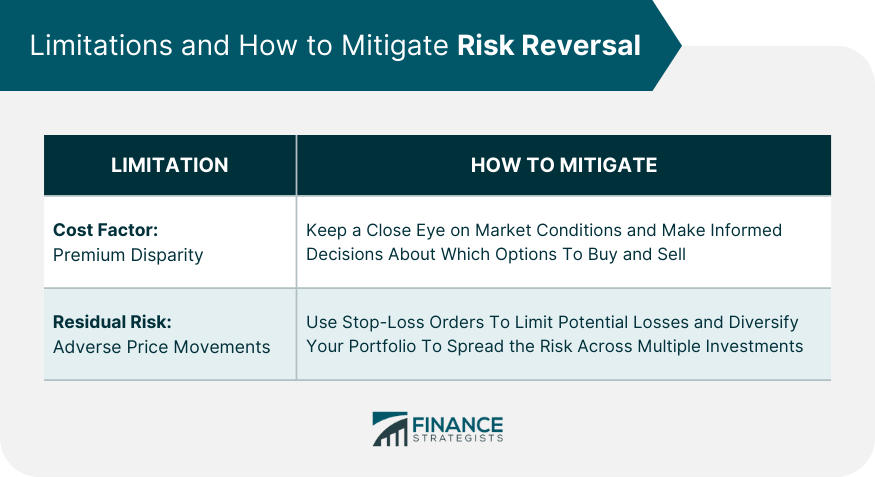

Limitations of Risk Reversal

Cost Factor: Premium Disparity in Risk Reversal

Residual Risk: Adverse Price Movements

Mitigating Risk Reversal

Keeping a Close Eye on Market Conditions

Making Informed Decisions

Combining Risk Reversal With Other Risk Management Strategies

Final Thoughts

Risk Reversal FAQs

Risk reversal is a financial strategy used in options trading and Forex markets to mitigate risks and enhance potential returns.

In options trading, risk reversal involves selling an out-of-the-money put option and simultaneously buying an out-of-the-money call option, or vice versa, to create a position that can profit from a directional move in the underlying asset.

In the Forex market, risk reversal is the difference in implied volatility between similar call and put options. Traders use this information to gauge market sentiment and make trading decisions.

The potential outcomes of a risk reversal strategy include profiting from the anticipated direction of an asset's price movement, incurring a loss if the price moves in the opposite direction, or breaking even if the price remains unchanged or moves within a narrow range.

Risk reversal does not completely eliminate risk, and there's the potential for losses if the underlying asset's price moves in the opposite direction of the trader's prediction. The strategy might also not be cost-neutral if there's a significant difference in premiums between the sold and purchased options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.