Rule 144A, established by the U.S. Securities and Exchange Commission (SEC), is a regulation that creates a safe harbor for the resale of privately placed securities to qualified institutional buyers (QIBs). This regulation has had a significant impact on the financial market by enhancing liquidity and facilitating capital raising for issuers. The primary purpose of Rule 144A is to provide a mechanism for the resale of restricted securities in a more efficient and streamlined manner. By allowing the participation of QIBs, Rule 144A expands the investor base for privately placed securities, improving their tradability and attractiveness. The Securities Act of 1933, commonly referred to as the Securities Act, is a federal law that governs the issuance and sale of securities in the United States. The primary goal of the Securities Act is to protect investors by requiring companies to provide full and fair disclosure of material information when offering securities to the public. Under the Securities Act, companies that offer or sell securities to the public must register the securities with the SEC. The registration process involves preparing and filing a registration statement, which includes detailed financial and non-financial information about the issuer and the securities being offered. The Securities Act provides certain exemptions from registration for private placements, which are securities offerings made to a limited number of sophisticated investors. These exemptions allow issuers to raise capital without the cost and time associated with a public offering. Prior to the implementation of Rule 144A, the resale of privately placed securities was subject to significant restrictions, which limited liquidity and hindered the ability of issuers to raise capital. To address these challenges, the SEC introduced Rule 144A in 1990. Rule 144A was designed to improve the liquidity of privately placed securities by allowing their resale to QIBs without registration. This facilitated secondary market trading and increased the attractiveness of private placements to investors. By providing a streamlined process for privately placed securities resale, Rule 144A reduced the regulatory burden on issuers and enabled them to access capital more efficiently. Restricted securities are securities that are acquired in a private placement and are subject to restrictions on resale under the Securities Act. These securities cannot be freely traded on the public market without registration or an applicable exemption. Examples of restricted securities include privately placed stocks, bonds, and other debt instruments. QIBs are institutional investors that meet certain criteria established by the SEC. Under Rule 144A, QIBs can purchase and trade restricted securities without registration. To qualify as a QIB, an institution must own and invest at least $100 million in securities of unaffiliated issuers. Certain types of institutions, such as banks and savings and loan associations, must also have a net worth of at least $25 million. Examples of QIBs include mutual funds, pension funds, insurance companies, and investment firms. Rule 144A allows the resale of restricted securities to QIBs without registration, provided that certain conditions are met. These conditions include the availability of certain information about the issuer and the absence of general solicitation or advertising. Issuers must make certain information available to potential buyers, including financial statements and information about the issuer's business and operations. Rule 144A expands the investor base for privately placed securities by allowing QIBs to participate in the market. This increased demand enhances liquidity and facilitates secondary market trading. The ability to resell restricted securities to QIBs under Rule 144A creates a more active secondary market, which benefits both issuers and investors. Issuers can raise capital more efficiently, while investors can manage their portfolios more flexibly. Rule 144A provides a streamlined process for the resale of restricted securities, reducing the time and effort required to complete transactions. This allows issuers to access capital more quickly and efficiently. By providing a safe harbor for the resale of restricted securities, Rule 144A reduces the regulatory burden on issuers. This eliminates the need for a full registration process, saving issuers time and money. Rule 144A provides issuers with additional funding options by allowing them to raise capital through private placements and resell securities to QIBs. This flexibility is particularly valuable for companies that may need to meet the requirements for a public offering. Rule 144A allows QIBs to access a broader range of investment opportunities, including securities that are not available on the public market. This diversification can enhance portfolio performance and reduce risk. Because Rule 144A offerings are exempt from registration, they do not require the same level of public disclosure as registered offerings. This can limit the information available to investors and increase the risk of fraud or misrepresentation. Rule 144A is designed to protect sophisticated institutional investors who are presumed to have the knowledge and resources to evaluate investment risks. However, non-QIB investors may have a different level of expertise and may be exposed to greater risk. The limited disclosure requirements and private nature of Rule 144A offerings can create insider trading and market manipulation opportunities. This can undermine market integrity and harm investors. Monitoring and enforcing compliance with Rule 144A can be challenging for regulators due to the private nature of the transactions. This can make it difficult to detect and address violations. Rule 144A limits participation in private placements to QIBs, excluding retail investors from these investment opportunities. This can create concerns about fairness and equal access to the market. By restricting access to QIBs, Rule 144A can contribute to the concentration of investment power among large institutional investors. This can have implications for market dynamics and competition. Rule 144A has had a significant impact on the financial market by enhancing liquidity and facilitating capital raising for issuers. This regulation provides a safe harbor for the resale of privately placed securities to qualified institutional buyers (QIBs), expanding the investor base and improving the tradability of restricted securities. The benefits of Rule 144A include improved liquidity, a broader investor base, cost and time savings, reduced regulatory burden for issuers, and increased access to capital. However, there are limitations and criticisms associated with Rule 144A. These include limited investor protection due to reduced public disclosure, increased risk for non-QIB investors, concerns about potential market manipulation and insider trading, regulatory challenges in monitoring compliance, unequal access to investment opportunities excluding retail investors, and the concentration of investment power among large institutional investors. Rule 144A has been instrumental in improving liquidity and facilitating capital raising in the financial market. Balancing the advantages and disadvantages of Rule 144A is essential for ensuring a fair and efficient marketplace for all participants.What Is Rule 144A?

Background and Origin of Rule 144A

The Securities Act of 1933

Registration Requirements

Private Placement Exemptions

The Need for Rule 144A

Enhancing Liquidity for Private Placements

Reducing Cost and Time for Issuers

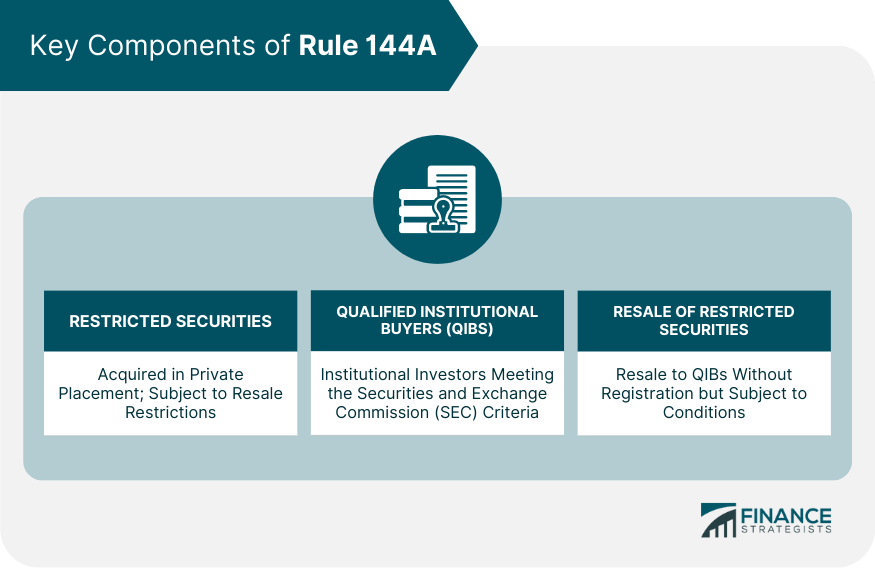

Key Components of Rule 144A

Restricted Securities

Definition

Examples

Qualified Institutional Buyers (QIBs)

Definition

Requirements and Criteria

Examples

Resale of Restricted Securities

Conditions Under Rule 144A

Information Requirements

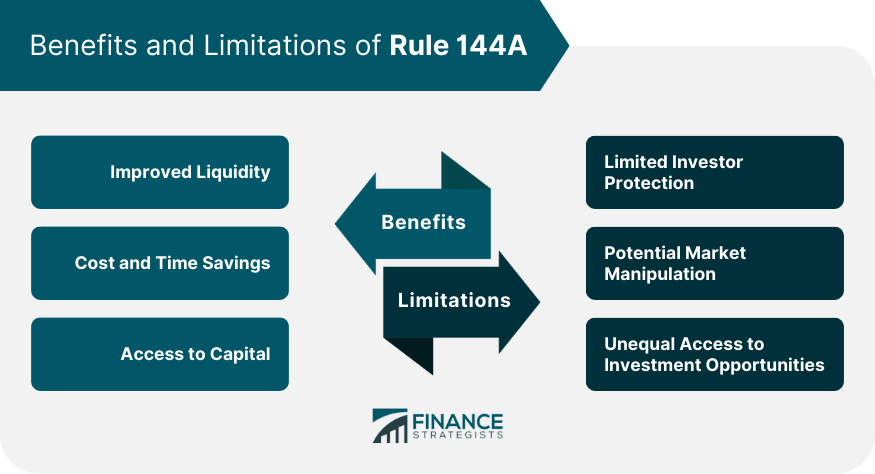

Benefits of Rule 144A

Improved Liquidity

Broader Investor Base

Secondary Market Trading

Cost and Time Savings

Expedited Process

Reduced Regulatory Burden

Access to Capital

Increased Funding Options for Issuers

Diversification of Investment Opportunities for QIBs

Limitations and Criticisms of Rule 144A

Limited Investor Protection

Lack of Public Disclosure

Increased Risk for Non-QIB Investors

Potential Market Manipulation

Insider Trading Concerns

Regulatory Challenges

Unequal Access to Investment Opportunities

Exclusion of Retail Investors

The Concentration of Investment Power

Conclusion

Rule 144A FAQs

Rule 144A is a provision under the Securities Act of 1933 that allows for the private resale of restricted securities to qualified institutional buyers (QIBs) without the need for registration with the U.S. Securities and Exchange Commission (SEC). It is designed to facilitate the liquidity of privately placed securities.

Under Rule 144A, only qualified institutional buyers (QIBs) are eligible to purchase securities. QIBs are typically large institutional investors, such as investment companies, pension funds, and insurance companies, with at least $100 million in securities owned and invested.

Issuing securities under Rule 144A provides several benefits, including faster access to capital, lower issuance costs, and increased liquidity for privately placed securities. It allows issuers to bypass the lengthy and costly registration process with the SEC while still reaching a broad base of sophisticated institutional investors.

No, individual investors are not eligible to purchase securities under Rule 144A. Only qualified institutional buyers (QIBs) with at least $100 million in securities owned and invested can participate in Rule 144A offerings.

No, Rule 144A securities are not publicly traded on a securities exchange. They have privately placed securities that are traded in private transactions between qualified institutional buyers (QIBs). However, Rule 144A facilitates the liquidity of these securities by allowing for their resale to QIBs without SEC registration.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.