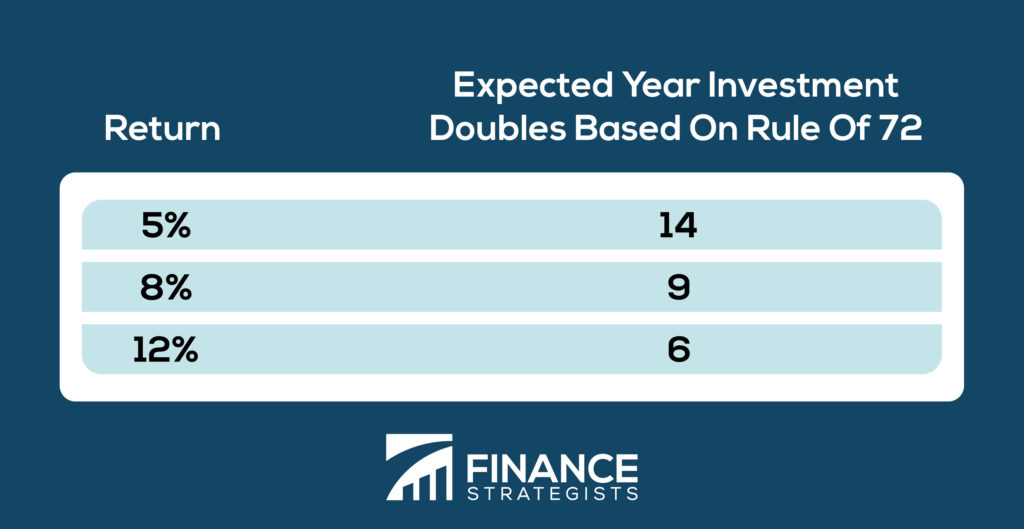

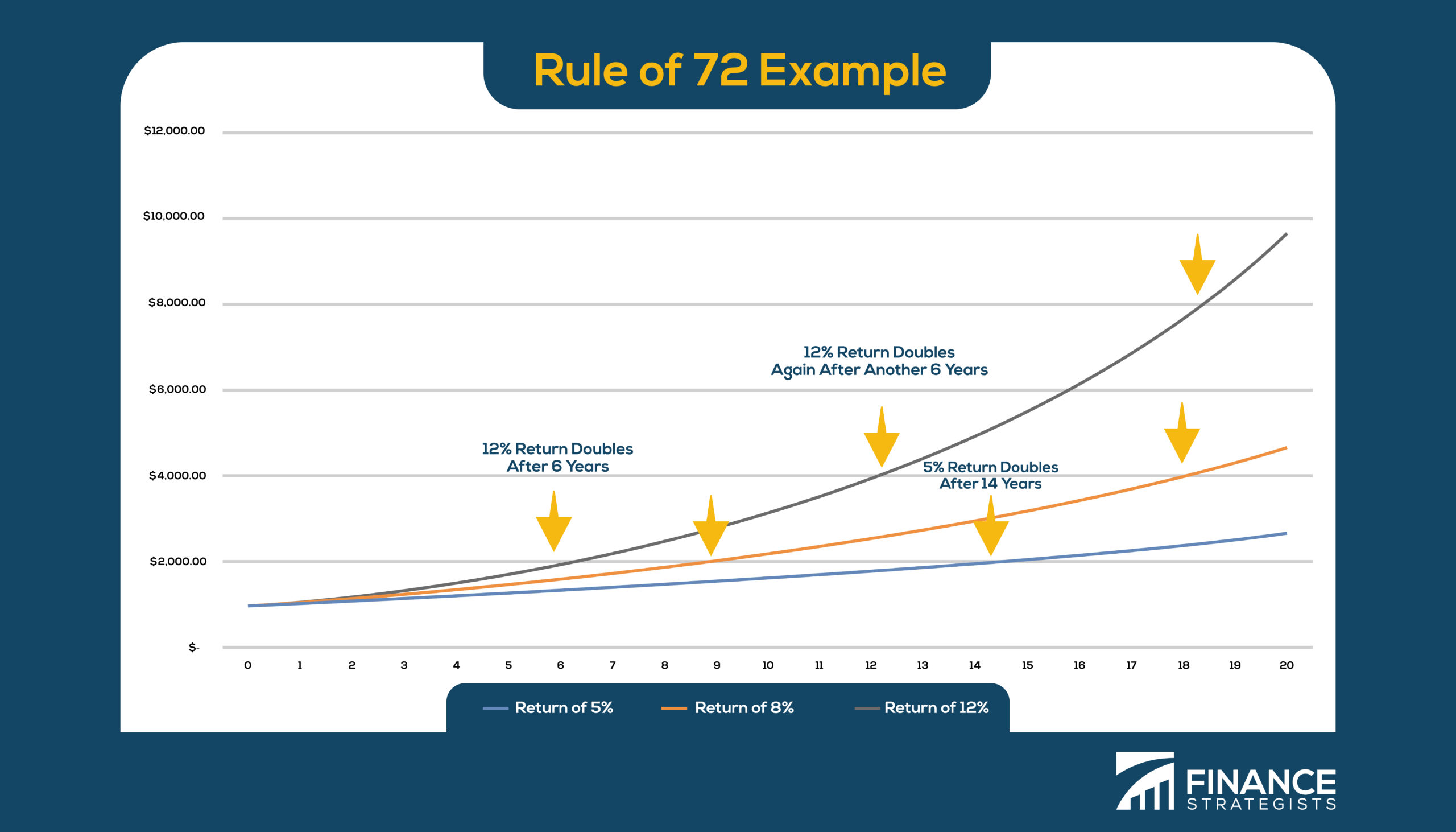

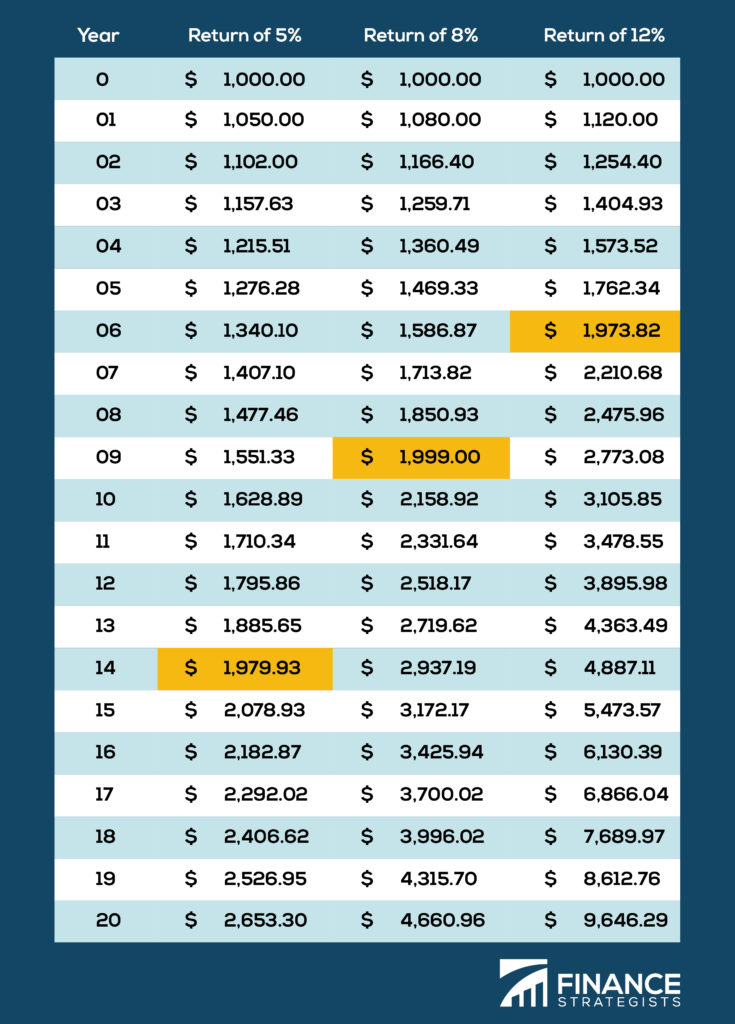

The Rule of 72 is a finance shortcut to quickly estimate how long an investment will take to double. The Rule of 72 definitions can be described as simple as dividing 72 by the rate of return an investment earns. This is the number of periods it will take the investment to double in value. For example, according to the Rule of 72 formula, an investment of $100 that earns 7% annually (compounded) will take 10.3 years to be worth $200 because 72/7 = 10.3. The Rule of 72 can also be used to calculate the cost of debt. A credit card balance of $1,000 at a 25% APR will be a balance of $2,000 in 2.88 years because 72/25 = 2.88. The Rule of 72 can be used in the opposite direction to estimate the rate if the amount of time is known. For example, if you wanted to double $1,000 in 3 years, you would need to earn an interest rate of 24% because 72/3 =24. The "rule" is really a "rule of thumb" or approximation used for quick mental math. In our first example, the Rule of 72 told us the investment would double in 10.3 years. In actuality, the investment would only take 10.24 years to double. Higher interest rates and longer time frames cause the Rule of 72 to become less accurate. The Rule of 69.3 and Rule of 70 work similarly and are used for different scenarios. If the investment is compounding continuously rather than compounding annually, the Rule of 69.3 offers a more accurate estimation. To determine the time it takes for money's buying power to halve due to inflation, financiers divide 70 by the inflation rate, which is the Rule of 70.What Is the Rule of 72?

What’s an Example of the Rule of 72?

When Would You Need to Use the Rule of 72?

Rule of 69.3 and Rule of 70

Rule of 72 Chart

Rule of 72 FAQs

The Rule of 72 is a finance shortcut to quickly estimate how long an investment will take to double.

The Rule of 72 can be calculated by dividing 72 by the rate of return an investment earns.

Whenever you are looking for a back of the napkin estimate of how long it takes for an investment to double, you can use the Rule of 72.

The rule can offer quick insight into whether or not a property is worth investigating further.

The Rule of 72 can also be used to calculate the cost of debt. A credit card balance of $1,000 at a 25% APR will be a balance of $2,000 in 2.88 years because 72/25 = 2.88.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.