SEC Regulation Best Interest is a rule implemented by the US Securities and Exchange Commission (SEC) in 2019 that requires brokers and financial advisors to act in the best interest of their clients when making investment recommendations. The rule requires brokers and financial advisors to provide advice that is in the best interest of their clients and prohibits them from putting their own interests ahead of their clients. Brokers and financial advisors are also required to disclose any potential conflicts of interest that may arise when making investment recommendations. SEC Regulation BI applies to brokers and financial advisors who make recommendations to retail clients regarding securities transactions, investment strategies, account types, and rollovers. The rule aims to protect investors by ensuring that brokers and financial advisors act in their best interest and provide them with the information they need to make informed investment decisions. Reg BI establishes a series of obligations to ensure that broker-dealers and investment advisers act in the best interest of their retail customers. The disclosure obligation requires broker-dealers and investment advisers to provide retail customers with detailed information about the nature of their relationship, services offered, and any associated fees and costs. This includes: 1. Material Facts About Relationships and Services: Advisers must disclose the scope and terms of their services, as well as any material limitations or conditions. 2. Fees, Costs, and Conflicts of Interest: Advisers must clearly communicate all fees and costs associated with their services, as well as any potential conflicts of interest that could compromise their objectivity. 3. Standard of Conduct and Legal Obligations: Advisers must disclose their standard of conduct and any legal or regulatory obligations they must adhere to. The care obligation ensures that broker-dealers and investment advisers: 1. Understand the Investment Strategies and Products They Recommend: Advisers must have a thorough understanding of the investment products and strategies they recommend to their clients. 2. Have a Reasonable Basis to Believe the Recommendation Is in the Client’s Best Interest: Advisers must ensure that their recommendations are based on a thorough analysis of the client's financial situation, investment objectives, and risk tolerance. 3. Consider the Cost, Risk, and Potential Benefits of the Recommendation: Advisers must weigh the potential benefits of a recommendation against its costs and associated risks. The conflict of interest obligation requires broker-dealers and investment advisers to: 1. Identify and Mitigate Conflicts of Interest: Advisers must establish policies and procedures to identify, disclose, and mitigate any conflicts of interest that could compromise their objectivity. 2. Disclose Conflicts to Clients: Advisers must inform their clients about any conflicts of interest that could potentially impact their recommendations. 3. Eliminate Certain Conflicts: In some cases, advisers must eliminate specific conflicts of interest that cannot be adequately mitigated or disclosed. The compliance obligation necessitates broker-dealers and investment advisers to: 1. Establish and Maintain Written Policies and Procedures: Advisers must create and implement written policies and procedures that ensure compliance with Reg BI's requirements. 2. Periodically Review and Update Policies and Procedures: Advisers must review and update their policies and procedures regularly to address any changes in the regulatory landscape. 3. Periodically Review and Update Policies and Procedures: Advisers must maintain accurate records and documentation to demonstrate their compliance with Reg BI. Reg BI has had several significant effects on the financial industry, including: Reg BI has raised the standard of care for broker-dealers and investment advisers by requiring them to prioritize their client's best interests when providing recommendations. By mandating comprehensive disclosure of fees, costs, and conflicts of interest, Reg BI has increased transparency and facilitated more informed decision-making by retail customers. Reg BI has brought the standards for broker-dealers and investment advisers closer to the fiduciary duty, which requires advisers to act in their client's best interests. Reg BI has helped to harmonize the regulatory landscape by aligning with the Department of Labors Fiduciary Rule, which governs retirement investment advice. The SEC has established a phased implementation timeline for Reg BI, with key milestones allowing broker-dealers and investment advisers to gradually adopt the new requirements. The SEC is responsible for enforcing Reg BI and conducting examinations to ensure that broker-dealers and investment advisers are in compliance with the regulation. Non-compliance with Reg BI can result in various penalties, including fines, sanctions, and reputational damage for broker-dealers and investment advisers. Reg BI has been the subject of several criticisms and debates, including: Some critics argue that Reg BI does not go far enough in protecting retail investors, as it falls short of imposing a full fiduciary duty on broker-dealers and investment advisers. Reg BI has presented several challenges for industry stakeholders, including increased compliance costs and the need to navigate a complex regulatory landscape. There has been an ongoing debate about the relationship between Reg BI and the Department of Labor's Fiduciary Rule, with some arguing that the two regulations should be more closely aligned to ensure consistent standards across the financial industry. SEC Regulation Best Interest (Reg BI) is a significant regulatory change that aims to protect retail investors by requiring broker-dealers and investment advisers to act in their clients' best interest when making investment recommendations. The regulation establishes a series of obligations, including the disclosure obligation, care obligation, conflict of interest obligation, and compliance obligation, to ensure that advisers prioritize their clients' interests, disclose material facts, and mitigate conflicts of interest. Reg BI has had a significant impact on the financial industry by raising the standard of care for broker-dealers and investment advisers, increasing transparency, and aligning regulatory standards with the fiduciary duty. The SEC is responsible for enforcing Reg BI and conducting examinations to ensure compliance, with potential penalties for non-compliance. However, the regulation has also been subject to criticisms and debates, including its effectiveness in protecting retail investors and challenges for industry stakeholders. Reg BI may undergo further developments and amendments in response to industry feedback, legal challenges, and changing market conditions, as well as international harmonization and cooperation. Overall, Reg BI is an essential regulatory development that promotes investor protection and transparency in the financial industry.What Is SEC Regulation Best Interest (Reg BI)?

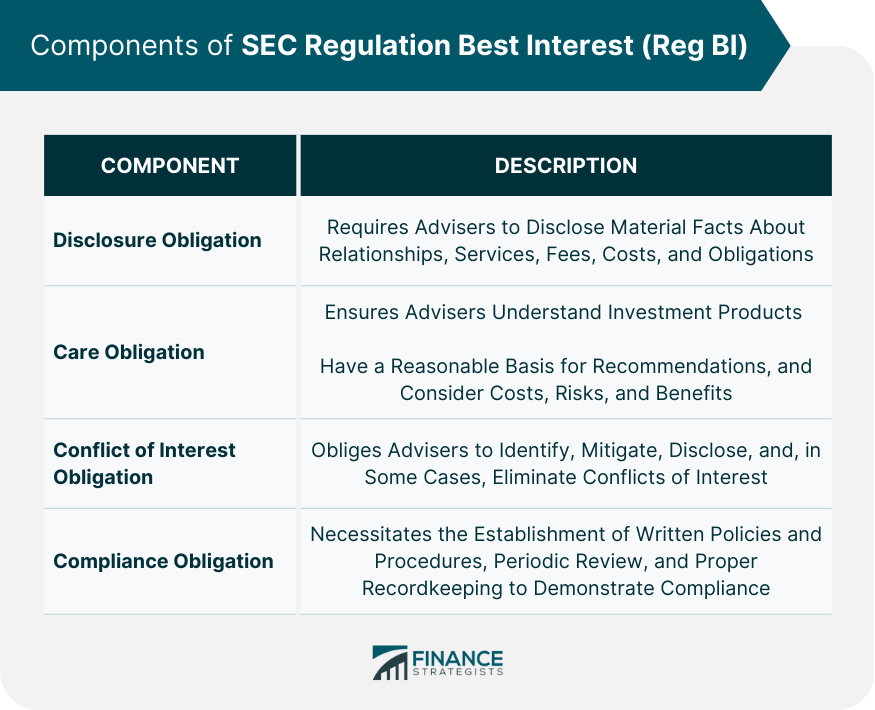

Components of Regulation Best Interest

Disclosure Obligation

Care Obligation

Conflict of Interest Obligation

Compliance Obligation

Reg BI's Impact on Broker-Dealers and Investment Advisers

Enhanced Standard of Care

Increased Transparency

Greater Alignment With Fiduciary Duty

Harmonization With the Fiduciary Rule

Implementation and Enforcement

Implementation Timeline and Milestones

SEC's Role in Enforcement and Examination

Potential Penalties for Non-compliance

Criticisms and Debates Surrounding Reg BI

Effectiveness in Protecting Retail Investors

Challenges for Industry Stakeholders

Comparison to the Department of Labor's Fiduciary Rule

Conclusion

SEC Regulation Best Interest (Reg BI) FAQs

The purpose of the SEC Regulation Best Interest (Reg BI) is to enhance the standard of conduct for broker-dealers and investment advisers when providing recommendations to retail customers. It aims to ensure that financial professionals act in their clients' best interests, increase transparency, and promote greater alignment with fiduciary duty.

The main components of the SEC Regulation Best Interest (Reg BI) include the Disclosure Obligation, the Care Obligation, the Conflict of Interest Obligation, and the Compliance Obligation. These components establish a series of requirements for broker-dealers and investment advisers to act in their clients' best interests, disclose pertinent information, and maintain proper compliance policies and procedures.

The SEC Regulation Best Interest (Reg BI) impacts broker-dealers and investment advisers by enhancing the standard of care they must provide, increasing transparency through mandatory disclosures, aligning their standards more closely with fiduciary duty, and harmonizing regulatory requirements with the Department of Labor's Fiduciary Rule.

The SEC is responsible for enforcing the Regulation Best Interest (Reg BI) by conducting examinations to ensure compliance by broker-dealers and investment advisers. The SEC also has the authority to impose penalties, such as fines and sanctions, on financial professionals who fail to comply with the regulation.

Some criticisms and debates surrounding the SEC Regulation Best Interest (Reg BI) include concerns about its effectiveness in protecting retail investors, challenges faced by industry stakeholders in navigating the complex regulatory landscape, and debates about the relationship between Reg BI and the Department of Labor's Fiduciary Rule.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.