The Securities and Exchange Commission (SEC) is an independent U.S. federal agency charged with protecting investors, maintaining orderly, fair, and efficient markets, and facilitating capital formation. Founded in 1934 following the Great Depression, it regulates public securities trading - stocks, bonds, and other investments. Its mission is to promote capital formation while ensuring that competition is preserved in the marketplace. It seeks to do this by deliberately applying stringent rules and consistent enforcement against those who violate them. By providing transparency in the industry, the SEC helps ensure fairness between buyers and sellers in pursuit of maximum investor protection – something essential to a thriving economy. The SEC is in charge of regulating the securities industry. It protects investors and ensures that markets are fair, orderly, and run well. It meets these goals by ensuring that certain rules, laws, and regulations about buying and selling securities in the U.S. are followed. The SEC also ensures that companies disclose to investors the truth about their activities through registration statements, periodic reports, proxy statements, short-term borrowing forms, and other documents. This is to protect investors from false or misleading information. When its rules are broken, the SEC has strong enforcement powers to promote market integrity, investor confidence, and economic growth. Before the establishment of the SEC, there was essentially no control of the trade in stocks, bonds, and other securities, which resulted in widespread fraud, insider trading, and other abuses. The stock market plummeted in 1929, and investors and banks lost billions of dollars in a single day, triggering the Great Depression. Many financial organizations had misled investors, acted recklessly and engaged in rampant insider trading. Securities Act of 1933. Its goal was to prevent securities fraud by requiring investors to get accurate financial information regarding publicly traded securities for sale. It also empowered the Federal Trade Commission to halt securities sales. Glass-Steagall Act. Still, in 1933, an act separating investment banking from commercial banking helped to restore the economy and public confidence. It also established the Federal Deposit Insurance Corporation (FDIC) to supervise banks and defend the interests of consumers. Securities Exchange Act of 1934. The act, signed by President Franklin D. Roosevelt, established the SEC. This provided the SEC broad authority to regulate the securities business. It empowered them to file civil lawsuits against those who broke securities laws. Public Utility Holding Company Act (PUHCA) of 1935. This reduces utility costs and weakens the grip of a few utilities conglomerates over the sector. It requires interstate utility holding firms to register with the SEC and to give operational and financial information. SEC Restores Public Trust. The Glass-Steagall Act, the SEC formation, and the PUHCA all contributed to the restoration of investor trust by eliminating deceptive trading, increasing investing transparency, and limiting the use of margins to acquire stocks. The SEC prioritized the requirements of investors over the needs of brokers, traders, and companies, which helped attract individuals back to the stock market. The SEC is led by a five-member commission. The president appoints, and the senate confirms the commissioners. Further, the president designates one of the commissioners to serve as chair. Each commissioner serves a term of five years and can be re-appointed once. The SEC’s organizational structure consists of six divisions and 23 offices. This division keeps an eye on public companies and other U.S. organizations selling securities. Similarly, it includes keeping track of their disclosure requirements, registration statements, and regular reports. This division is responsible for investigating and prosecuting violations of federal securities laws. Similarly, it includes civil injunctions, criminal charges, and administrative proceedings against those who have violated the law. This division regulates and examines registered investment companies and investment advisors that manage assets for individuals or institutions. The division also sets rules for disclosure, trading practices, advertising requirements, and other aspects of fund management. The division provides economic advice on rulemaking, market surveillance initiatives, investigations, and industry trends. This division also works to identify emerging financial risks and develop policies that protect investors while promoting economic growth. This division oversees broker-dealers, exchanges, clearing agencies, self-regulatory organizations, transfer agents, and other participants in the financial markets. Similarly, it ensures that trading practices are fair and orderly and pricing information is transparent. This division actively monitors registered entities such as broker-dealers, investment advisors, and mutual funds to ensure compliance with federal securities laws. Similarly, it plays a role in preventing fraud and other illegal activities. Since its creation in 1934, the U.S. Securities and Exchange Commission has operated with two founding principles. The first is the protection of investors, which is accomplished by ensuring that they understand the risks and rewards associated with any investments they choose to make. The second principle is maintaining a fair market system and preventing fraud, manipulation, and other deceptive practices from occurring within securities transactions. Over its long history, the SEC has kept these goals in mind when developing new regulations to enforce investor protection and market efficiency. These two founding principles are jointly responsible for laying the foundation on which U.S. financial markets rely today. The U.S. Securities and Exchange Commission is responsible for helping protect investors, ensure market integrity, and promote capital formation. To fulfill its mission, the SEC has established two primary founding principles: protecting investors and maintaining a fair market system. By adhering to these principles, the SEC has created a secure foundation from which financial markets can thrive in the United States. It is led by a five-member commission where each serves a five-year term. Its organizational structure consists of six divisions and 23 offices. The SEC's commitment to upholding its founding principles continues to benefit American investors and businesses.What Is the Securities and Exchange Commission (SEC)?

What Does the SEC Do?

History of the SEC

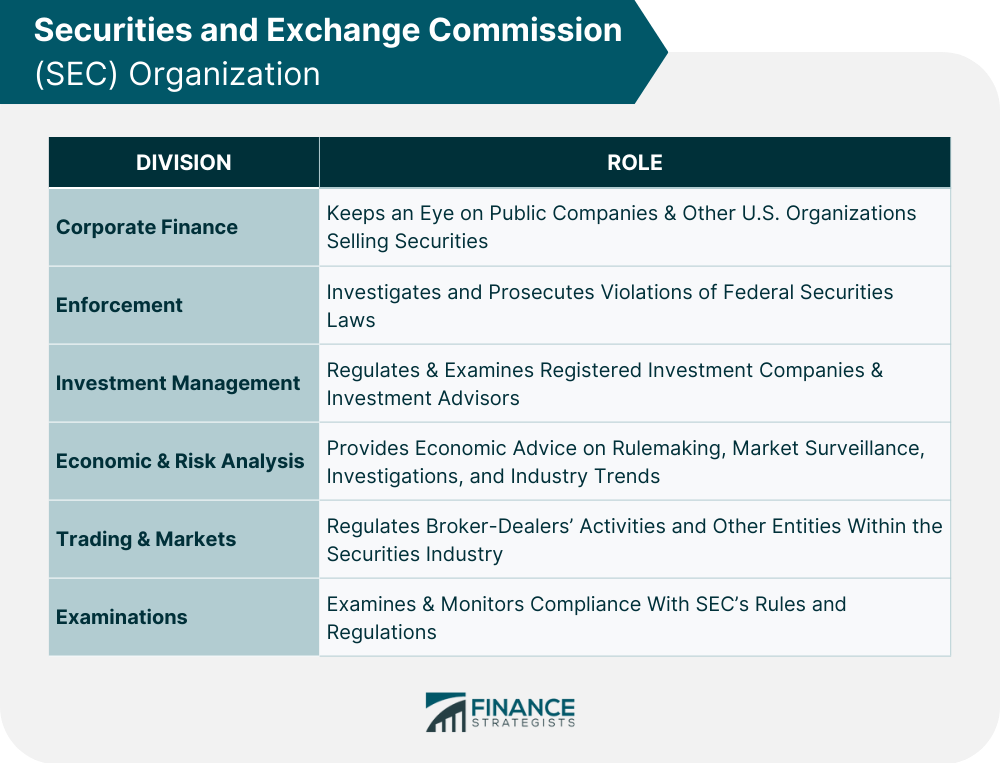

The SEC Organization

Division of Corporate Finance

Division of Enforcement

Division of Investment Management

Division of Economic and Risk Analysis

Division of Trading and Markets

Division of Examinations

The Founding Principles of the SEC

Final Thoughts

Securities and Exchange Commission (SEC) FAQs

The SEC protects investors because they are integral to the stability of U.S. financial markets. It helps ensure that investors understand the risks and rewards associated with their investments and maintain a fair market system free from fraud or manipulation.

The SEC's primary goal is to protect investors and maintain market integrity by enforcing federal securities laws and promoting capital formation.

By registering with the SEC, businesses can benefit from increased transparency in activities such as disclosure, trading practices, advertising requirements, and fund management. Additionally, registration allows companies access to a larger pool of prospective investors and customers.

The SEC is an independent federal agency led by a five-member commission appointed by the President of the United States. The SEC is also subject to oversight from Congress and other government agencies, such as the Department of Justice.

Generally, publicly traded businesses in U.S. markets must register with the SEC. Depending on their activities, other entities, such as investment advisors and broker-dealers, may also be required to register. Nonprofit organizations can avoid registering with the SEC if they meet specific criteria. In all cases, companies should consult an attorney to determine whether or not they need to register with the SEC.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.