The Securities Exchange Act of 1934 (the '34 Act) is a federal law enacted to regulate the secondary trading of securities, such as stocks and bonds, in the United States. The primary aim of the '34 Act is to protect investors and maintain fair, orderly, and efficient markets by establishing a regulatory framework for securities exchanges, brokers, and public companies. The '34 Act contains various provisions, including the regulation of securities exchanges and brokers, reporting requirements for public companies, regulation of tender offers and corporate control transactions, enforcement and sanctions, and key exemptions and exceptions. The '34 Act requires securities exchanges, such as the New York Stock Exchange and NASDAQ, to register with the Securities and Exchange Commission (SEC) and comply with its rules and regulations. Broker-dealers, which include investment banks and brokerage firms that facilitate securities transactions, must also register with the SEC and adhere to financial responsibility, recordkeeping, and reporting rules. Two important aspects of the Exchange Act are its standards of conduct and anti-manipulation rules, which are designed to promote fair and transparent markets and to prevent fraudulent and manipulative practices. Below is an overview of these aspects: The Exchange Act establishes certain standards of conduct for market participants, including brokers, dealers, and investment advisers. These standards are intended to ensure that market participants act in the best interests of their clients and that they provide full and fair disclosure of material information. Key provisions related to standards of conduct include: Fiduciary Duty: Certain market participants, such as investment advisers, are considered fiduciaries and owe a duty of loyalty and care to their clients. They must act in the best interests of their clients and avoid conflicts of interest. Disclosure Requirements: Market participants are required to provide investors with important information about securities, including the risks and potential returns associated with an investment. This information must be accurate, complete, and not misleading. Fair Dealing: Brokers and dealers are required to deal fairly with their customers. This includes providing best execution (i.e., obtaining the most favorable terms for their customers' orders) and disclosing any material conflicts of interest. The Exchange Act contains several provisions aimed at preventing market manipulation, which refers to practices that artificially affect the price or trading volume of a security. Some of the key anti-manipulation rules include: This section of the Exchange Act prohibits various manipulative practices, including wash sales (transactions that involve no change in beneficial ownership), matched orders (coordinated buy and sell orders designed to create the appearance of trading activity), and pool operations (schemes to manipulate the price of a security through coordinated trading). Section 10(b) of the Exchange Act broadly prohibits the use of any manipulative or deceptive device or contrivance in connection with the purchase or sale of any security. Rule 10b-5, promulgated by the Securities and Exchange Commission (SEC) under Section 10(b), makes it unlawful to make any untrue statement of a material fact or to omit a material fact necessary to make statements not misleading. It is also unlawful to engage in any act, practice, or course of business that operates as a fraud or deceit upon any person in connection with the purchase or sale of any security. This regulation is designed to prevent market manipulation during securities offerings. It restricts certain activities by issuers, underwriters, and other participants that could artificially influence the market for the offered security. This regulation addresses issues related to short selling and aims to prevent abusive naked short selling and other manipulative practices. Violations of the standards of conduct and anti-manipulation rules under the Exchange Act can result in civil and criminal penalties, including fines, disgorgement of profits, and imprisonment. The SEC is responsible for enforcing these rules and may bring enforcement actions against individuals and entities that violate the provisions of the Exchange Act. It's important to note that securities laws and regulations are subject to change, and it is advisable to consult with legal or financial professionals for the most current information and guidance. Public companies must submit periodic financial reports to the SEC, including: Companies are required to file an annual report containing audited financial statements, a management discussion and analysis, and information about the company's business, management, and risk factors. Companies must also file quarterly reports containing unaudited financial statements and a management discussion and analysis of the company's financial condition and results of operations. Companies are required to report significant events, such as mergers, acquisitions, and changes in management, on a current report. The '34 Act regulates the proxy solicitation process, ensuring that shareholders receive accurate and complete information to make informed voting decisions at shareholder meetings. The '34 Act imposes reporting requirements and trading restrictions on corporate insiders, including: Corporate insiders, such as officers, directors, and major shareholders, must report their transactions in company securities to the SEC. Insider trading, which involves trading on material nonpublic information, is prohibited under the '34 Act and can result in civil and criminal penalties. The Williams Act, an amendment to the '34 Act, regulates tender offers and corporate control transactions, requiring: Parties making tender offers must disclose their identity, the terms of the offer, and their plans for the target company. The Williams Act contains anti-fraud provisions that prohibit manipulative and deceptive practices in connection with tender offers. The '34 Act also governs proxy contests and mergers, ensuring that shareholders have the necessary information to make informed decisions regarding corporate control transactions. The '34 Act provides shareholders with various rights and protections, such as the ability to sue for violations of the Act and to participate in shareholder meetings. The SEC is the federal agency responsible for enforcing the '34 Act and its provisions. The SEC has the authority to investigate potential violations, bring civil enforcement actions against violators, and impose a range of penalties, including fines, injunctions, and disgorgement of ill-gotten gains. In addition to the civil enforcement powers of the SEC, criminal enforcement of the '34 Act is carried out by the Department of Justice (DOJ). Criminal violations of the '34 Act can result in severe penalties, including imprisonment, fines, and asset forfeiture. The '34 Act provides various exemptions and exceptions for certain types of securities and transactions, such as: Government and municipal securities, as well as certain other types of securities, are exempt from many provisions of the '34 Act. Regulation A+ provides an exemption from registration for certain smaller securities offerings, subject to specific disclosure and offering requirements. Rule 144A provides a safe harbor for the private resale of restricted securities to qualified institutional buyers, subject to certain conditions. The Securities Exchange Act of 1934 plays a crucial role in regulating the secondary trading of securities in the United States. By establishing a comprehensive regulatory framework for securities exchanges, brokers, and public companies, the '34 Act seeks to protect investors and maintain the integrity of the financial markets. As a result, the '34 Act remains a cornerstone of federal securities law, ensuring transparency, fairness, and investor confidence in the U.S. financial system.What Is the Securities Exchange Act of 1934?

Main Provisions and Regulatory Framework

Regulation of Securities Exchanges and Brokers

Registration of Securities Exchanges

Registration of Broker-Dealers

Standards of Conduct and Anti-manipulation Rules

Standards of Conduct

Anti-manipulation Rules

Section 9

Section 10(b) and Rule 10b-5

Regulation M

Regulation SHO

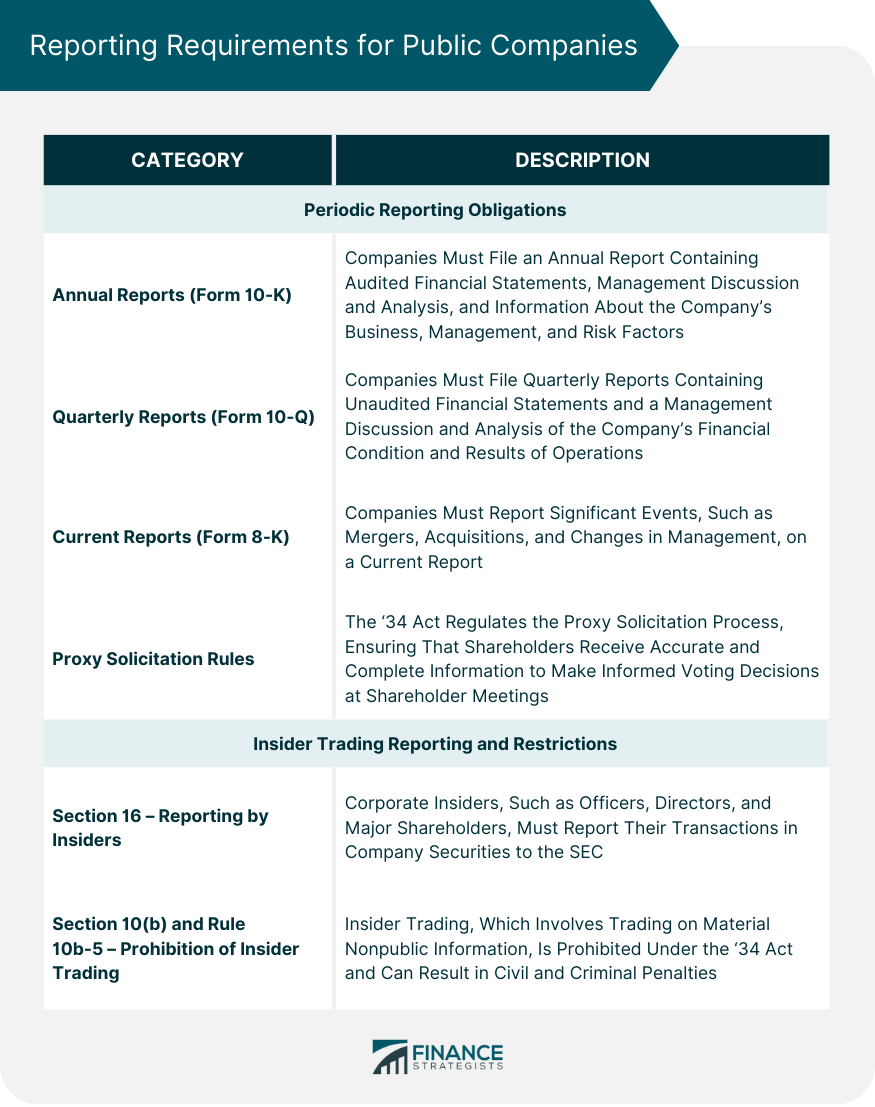

Reporting Requirements for Public Companies

Periodic Reporting Obligations

Annual Reports (Form 10-K)

Quarterly Reports (Form 10-Q)

Current Reports (Form 8-K)

Proxy Solicitation Rules

Insider Trading Reporting and Restrictions

Section 16 – Reporting by Insiders

Section 10(b) and Rule 10b-5 – Prohibition of Insider Trading

Regulation of Tender Offers and Corporate Control Transactions

Williams Act Amendments

Disclosure Requirements for Tender Offers

Anti-fraud Provisions

Regulation of Proxy Contests and Mergers

Shareholder Rights and Protections

Enforcement and Sanctions

Role of the Securities and Exchange Commission

Criminal Enforcement and Sanctions

Key Exemptions and Exceptions

Exemptions for Certain Securities and Transactions

Exempted Securities

Regulation A+ Offerings

Rule 144A – Private Resales of Securities

Conclusion

Securities Exchange Act of 1934 FAQs

The Securities Exchange Act of 1934 is a federal law that regulates the secondary market trading of securities in the United States.

The Securities Exchange Act of 1934 requires companies to register with the Securities and Exchange Commission (SEC) and file periodic reports, including annual and quarterly reports.

The purpose of the Securities Exchange Act of 1934 is to protect investors and maintain fair and orderly markets by requiring transparency and disclosure from companies, brokers, and other market participants.

Key provisions of the Securities Exchange Act of 1934 include the creation of the SEC, the regulation of securities exchanges and brokers, and the prohibition of insider trading.

While the Securities Act of 1933 primarily regulates the initial offering of securities, the Securities Exchange Act of 1934 focuses on the secondary market trading of securities and the ongoing reporting and disclosure requirements for companies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.