Cumulative Preferred Stock is a type of preferred stock that guarantees the payment of any missed dividends to shareholders. If a company fails to pay a dividend on its CPS, the amount accumulates and becomes an obligation that must be paid before any dividend payments can be made to common stockholders. CPS is typically issued by companies that need to raise capital but do not want to dilute the value of their common stock or do not qualify for traditional bank loans. The purpose of CPS is to provide companies with a flexible and cost-effective way to raise capital. CPS can be issued with different dividend rates, which allows companies to tailor their financing needs to the prevailing market conditions. CPS can also be structured with different features, such as callability, convertibility, or participation rights, which provide additional flexibility and benefits to both the issuer and the investor. CPS is an important source of capital for many companies, particularly those in the financial, energy, and utility sectors. CPS provides a stable income stream to investors and priority in dividend payments and liquidation preference. This makes it an attractive investment option for income-seeking investors who are looking for higher yields than traditional fixed-income securities, such as bonds or CDs, but are unwilling to take on the risks associated with common stock. CPS pays a fixed dividend rate to shareholders, which is usually higher than the dividend rate paid on common stock but lower than the interest rate paid on bonds. The dividend rate is determined at the time of issuance and is typically expressed as a percentage of the par value of the stock. The dividend is paid to shareholders before any dividends are paid to common stockholders. CPS provides priority in liquidation over common stock but is subordinate to bonds and other debt securities. In the event of a company's liquidation, CPS holders have the right to receive their par value plus any accrued and unpaid dividends before any distribution is made to common stockholders. If there are any remaining assets after the payment of CPS holders, they will be distributed to common stockholders. CPS can be structured to be convertible into common stock at a predetermined price and time. This allows investors to participate in the potential capital appreciation of the company's common stock while still receiving a fixed dividend rate. Convertible CPS is typically issued with a lower dividend rate than non-convertible CPS. Callable CPS is a type of CPS that can be redeemed by the issuer at a predetermined price and time. Callable CPS allows the issuer to redeem the stock if interest rates fall, which would allow the issuer to issue new CPS with a lower dividend rate. Callable CPS is typically issued with a higher dividend rate than non-callable CPS. Convertible CPS is a type of CPS that can be converted into common stock at a predetermined price and time. Convertible CPS allows investors to participate in the potential capital appreciation of the company's common stock while still receiving a fixed dividend rate. Participating CPS is a type of CPS that provides the holder with the right to participate in any dividends paid to common stockholders above a predetermined amount. CPS provides investors with a stable income stream in the form of fixed dividend payments. This makes it an attractive investment option for income-seeking investors who are looking for higher yields than traditional fixed-income securities but are unwilling to take on the risks associated with common stock. CPS provides priority in dividend payments and liquidation preference over common stock. This makes it a less risky investment option than common stock, particularly in times of financial distress when the company's ability to pay dividends and meet its obligations may be in question. Convertible CPS provides investors with the potential for capital appreciation in the company's common stock while still receiving a fixed dividend rate. This allows investors to participate in the upside potential of the company's growth prospects without taking on the risks associated with common stock. CPS pays a lower dividend rate than common stock, which reduces its appeal to investors who are looking for higher returns. CPS is also subject to interest rate risk, which means that the value of CPS may decline if interest rates rise. CPS typically does not provide voting rights to shareholders. This means that CPS holders have limited or no say in the company's management decisions, which may be a disadvantage to investors who are looking for more control over their investments. CPS is subject to interest rate risk, which means that the value of CPS may decline if interest rates rise. This is because higher interest rates make the fixed dividend payments less attractive to investors, which may reduce the demand for CPS and cause its value to decline. CPS pays a fixed dividend rate to shareholders, while common stock pays a variable dividend rate or no dividend at all. This makes CPS a more predictable investment option than common stock. CPS typically does not provide voting rights to shareholders, while common stock provides voting rights to shareholders. This means that common stockholders have more say in the company's management decisions than CPS holders. CPS is less risky than common stock but offers lower returns. Common stock is riskier but offers higher potential returns. This means that investors must choose between a higher risk/higher reward investment option (common stock) or a lower risk/lower reward investment option (CPS). Cumulative Preferred Stock is a type of security that offers a fixed dividend rate, priority in dividend payments and liquidation preference, and potential for capital appreciation. CPS is an important source of capital for many companies and an attractive investment option for income-seeking investors who are looking for higher yields than traditional fixed-income securities but are unwilling to take on the risks associated with common stock. However, CPS pays a lower dividend rate than common stock and is subject to interest rate risk, which may reduce its appeal to investors. Furthermore, investors should carefully consider the type of CPS they are investing in and the features it offers, such as callability, convertibility, or participation rights, as these features can significantly impact the return and risk profile of the investment. Investors should also be aware of the potential drawbacks of CPS, such as limited voting rights and interest rate risk, and weigh them against the potential benefits of the investment. While CPS pays a lower dividend rate than common stock, it offers priority in dividend payments and liquidation preference, and potential for capital appreciation. Investors should carefully consider the features and risks of CPS before making an investment decision and consult with a financial advisor if needed.What Is Cumulative Preferred Stock?

Characteristics of Cumulative Preferred Stock

Dividend Payments

Liquidation Preference

Convertibility

Types of Cumulative Preferred Stock

Callable Cumulative Preferred Stock

Convertible Cumulative Preferred Stock

Participating Cumulative Preferred Stock

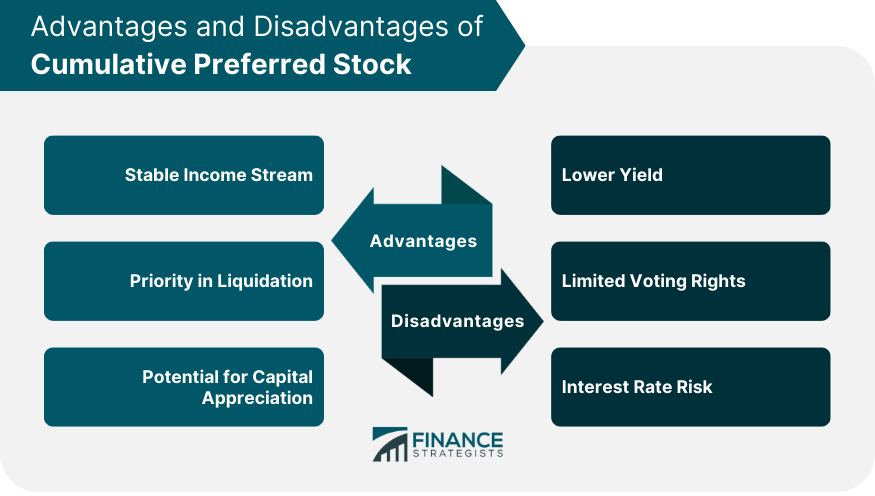

Advantages of Cumulative Preferred Stock

Stable Income Stream

Priority in Liquidation

Potential for Capital Appreciation

Disadvantages of Cumulative Preferred Stock

Lower Yield

Limited Voting Rights

Interest Rate Risk

Comparison With Common Stock

Dividend Payments

Voting Rights

Risk and Return Profile

Conclusion

Cumulative Preferred Stock FAQs

Cumulative Preferred Stock is a type of preferred stock that guarantees the payment of any missed dividends to shareholders.

Cumulative Preferred Stock offers a stable income stream, priority in liquidation, and potential for capital appreciation.

Cumulative Preferred Stock has lower yields, limited voting rights, and is subject to interest rate risk.

The types of Cumulative Preferred Stock include Callable Cumulative Preferred Stock, Convertible Cumulative Preferred Stock, and Participating Cumulative Preferred Stock.

Cumulative Preferred Stock differs from Common Stock in terms of dividend payments, voting rights, and risk and return profile.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.