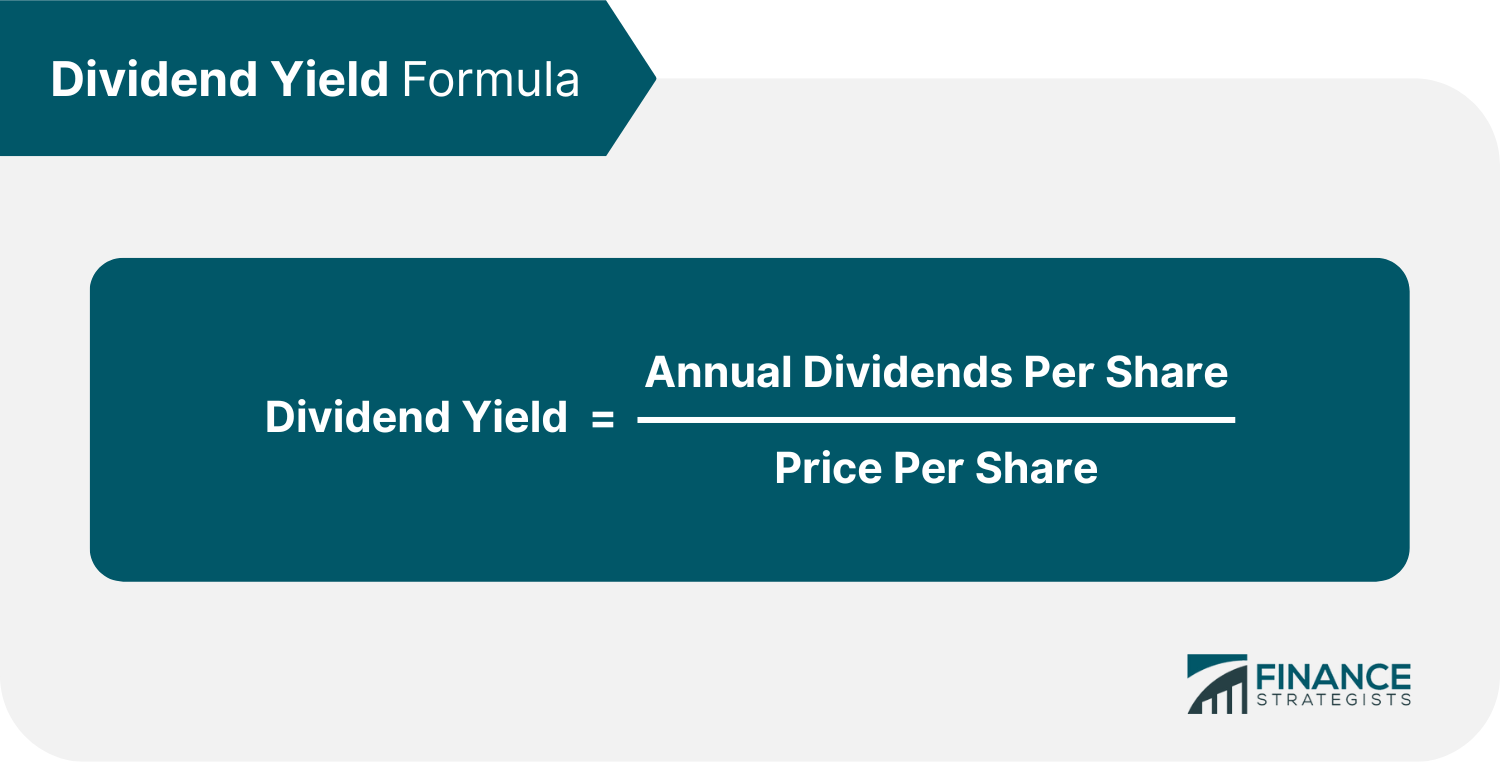

A dividend is a distribution of a company's earnings to its shareholders. Dividends are typically paid out quarterly, and they can be in the form of cash or stock. Dividends are one way that companies can share their profitability with their shareholders. When a company earns profits, the board of directors has the discretion to decide whether to distribute those earnings to shareholders in the form of dividends. Some investors prefer companies that pay dividends because they provide a source of regular income. Additionally, dividend payments can signal that a company is doing well financially. However, it is important to remember that not all companies pay dividends. Some companies may reinvest their profits back into the business instead of paying them out to shareholders. And, even if a company does pay dividends, the amount can fluctuate from year to year. To calculate the total dividend for a company, divide the per-share dividend by the market share price. In this example, the share price is $32, and the firm distributes $1.75 per share. The payout ratio is 0.054 percent or 5.4%. Because the dividend yield is based on the share price when you buy plays a crucial role in dividend investing. Let us say the stock price drops from $32 to $27; if that happens, the yield will jump to 6.4%. And remember: as long as you own that stock, its original owner will keep paying the same amount for it regardless of any changes. This is a reasonable concern. When a firm makes money, it can utilize it in various ways. One choice is to reinvest profits into the company's growth by acquiring better equipment, marketing, and research and development. If a firm decides to save its earnings, they are referred to as retained earnings. Retained earnings are an excellent indicator of a company's health in the same way that dividends are. In essence, they are identical. The payout ratio is the proportion of earnings that a firm distributes in dividends. For example, suppose a business makes $100,000 in net income and pays out $70,000 in dividends, yielding a payout ratio of 70%. That is relatively high. To figure out the proportion, divide the total dividend paid for the year by the total net income (70k/100k). Pro Tip: The payout ratio is included in most financial reports. Payout ratios are significant because they symbolize a number of crucial aspects for investors, including: You are in good shape if you get a high yield (above 5%) and the payout ratio is low. Those figures suggest that the company will be able to continue to pay decent returns while remaining competitive by having enough cash (50% of retained earnings) to invest in future income generation. It's also less likely that such a firm would cut dividends (even during severe economic downturns). At the same time, as sales grow, it becomes more likely that firms with a lower payout ratio will increase their dividends. Pro Tip: A 100 percent payout ratio is typical for a Ponzi scheme. Dividends are divided into shares. As a result, the more shares you own, the greater your return. On the other hand, all investors receive the exact yield for each share. Of course, big money players like Warren Buffett may buy $5 billion in Goldman Sachs with a 10% yield and warrants to acquire a few billion more at an even lower rate. Most retail investors, on the other hand, receive exactly what is advertised. You will not receive a dividend payment if you buy a stock after the ex-dividend date. That is all there is to it. Before that date, you must be sure to purchase stock. The ex-dividend date is one business day before the date of record. Companies pay out their dividends in different ways depending on their business model or board of directors' decision. The four most common methods are cash dividends, stock dividends, stock splits, and property dividends. Cash Dividends - dividends are paid in cash. To pay, a company must have cash on hand. This could possibly mean that the firm is healthy and ready to face any emergency. Most investors would obviously want to be paid in cash instead of stock. Stock Dividends - dividends paid out of stock—instead of cash—are known as stock dividends. In this scenario, corporations can keep their money. If a firm decides to switch from paying in cash to paying in stock, it might be a sign of trouble. That decision indicates that a company's free cash flow may be restricted. Stock Split - A stock split is when a company divides its existing shares into multiple new ones. This has the effect of reducing the value of each share, but it also makes it more affordable for investors to buy more significant numbers of shares. Splits are usually undertaken when a company's share price gets too high and becomes unwieldy or unsustainable. Property Dividends - dividends paid out as shares of a subsidiary firm or actual assets such as real estate, inventory, or anything tangible. The corporation's dividend value is based on the fair market value of the underlying asset. If a business does not have adequate cash on hand or does not want to dilute the parent company's stock, it can choose to do this. Dividend income has a number of advantages that make it an attractive investment option, especially in comparison to other types of investments. These advantages include: Lowering Risk: Companies with high yields are less likely to be damaged by economic fluctuations because they can temporarily lower dividend payouts to maintain their operations. Growth stocks, however, often collapse during recessions because they tend to be leveraged when these months occur. Without a buffer, these companies cannot absorb the blow. Moreover, during economic contractions, these companies continue to pay high yields. This gives investors income even in the weakest market conditions. The primary reason dividend stocks can keep giving returns during recessions is that consumers have a list of necessities they are willing to cut back on last. These include items like utilities, gas, groceries, and phone service, all sectors with excellent yields. Tax Advantages: This is one of the two advantages of owning dividend stocks. In 2012, when Republican presidential candidate Mitt Romney released his tax returns, there was widespread controversy and disbelief. Although Romney earned over $44 million in just two years, he only paid an effective rate of $14%. Comparatively, the average middle-class worker pays between 25-35%. The reason for this discrepancy is that Romney's income largely came from dividends, interest, and capital gains--all of which are taxed at a much lower rate. Investors need to know if the tax break will continue due to the significant disparity. Pursuing an investment strategy is only advantageous if one of the major advantages would not be taken away. The measures proposed by the White House state: Those making over a million dollars a year must pay a minimum effective tax rate of 30%. The Buffett Rule is similar to the Alternative Minimum Tax (AMT). The Buffett Rule is a policy that would equitably implement reasonable rules and would not disadvantage people who give large amounts of money to charity. The Alternate Minimum Tax (AMT) is comparable to the Buffett Rule. It is hard enough to pay taxes once, but paying twice is just cruel. As a result, double taxation of dividend income might be frightening if you consider a portfolio of foreign equities. However, there is no cause for worry yet. If you are subject to a 15% foreign dividend income tax in Brazil, you can usually claim a credit for the entire amount when you submit your tax return in the United States. So, perhaps some research or consultation with a tax professional would be helpful. For example, though the income you gain from dividends qualifies for a credit, your labor does not. The United States is alone in this sense among industrialized countries- it taxes the money you make overseas even if you already paid income tax there. This rule again preferential treatment of dividend/interest income under the law. Yield-seeking investors might be attracted to dividend stocks regardless of the sector or industry. Still, it is essential to remember that the same due diligence is required when assessing these companies. Dividends are simply distributions of profits, so prospective dividend stock investors should get to know a sector or industry before investing. This will increase your chances of making good bets on future prospects. Consider an area of expertise in the investing universe. If you are a dividend investor, there are many ways to maximize income from your investments, but you still have to be able to judge the current and future prospects of any stock you wish to buy. You have advantages in picking stocks. For example, Coltene Holdings would be an excellent investment for dentists because they are in the best position to assess which companies in their industry are cutting-edge and well-managed. If you work in the gas industry, you have a unique perspective on how close we are to pass a natural gas bill by Congress. You also know about the cycles that gas prices go through. In March 2012, natural gas prices were at their lowest in 10 years. Why is this? If you follow the industry closely, you would know that it is because of something called fracking - a new technology that allows producers to drill deeper into the Earth and tap into previously unreachable reserves of natural gas. Peter Lynch argues in his book, One Up on Wall Street that we as individuals have the upper hand over Wall Street because we see things from the bottom up rather than from the top down. He stated that by the time trends reach analysts on Wall Street, they would have missed out on most small-cap growth stocks. For example, countless people knew about fracking when it was still only a concept. Gas stock prices would have been wise to short once fracking became an actual technology. Dividend investment strategies are as diverse as the investors who use them. This is beneficial because it allows each dividend investor to tailor their strategy to fit their unique needs and goals. Offsetting Trading Losses: Investors frequently seek dividends-paying assets during expected sluggish stock development periods. The idea is that the dividends will compensate even if the market fails to advance. This is why electricity stocks with high payout rates are bid up during economic uncertainty. For example, the value of one share (CLP Holdings), which pays a 6% yield, rose from $8 to $9.17 as money managers rushed into utility companies seeking safety. When volatility decreased, it returned to $8/share. Return on Capital: Ideally, you should concentrate on firms with a track record of increasing dividends located in fast-growing industries. You want to keep these stocks long-term and reinvest the dividends. The rate of return on your original investment to acquire the underlying asset will rise with time as dividends rise over time. For example, if you purchase Natural Gas Inc. at $10 per share that pays $1 per share yearly, your ROI is 10%. But let us look at what happens to your return when dividends increase. If Natural Gas Inc. increases dividend payments to $1.50 in the next five years, your ROI will be 15%. In other words, if you invest $10/share today, that is a fixed cost while the return from the investment (dividends) continues to grow. Currency Strategies: It is easy to get caught up in percentage points when discussing yields, but we must remember that percentages do not always indicate value. A 7% yield sounds excellent, but how much is it actually worth? With a global economy, it becomes increasingly important to understand the currency we will be paid in and whether that currency will appreciate or depreciate over time. Most investment books do not discuss this topic extensively, but it is crucial to understanding the market. We should not think that all dividend yields are the same, just like we would not assume that salt water and spring water are equally desirable simply because they are both liquids. The notion that "a share has a certain value" is a myth. The percentage might be correct, but what good does it do? If the Dow rises 15 percent, but the dollar falls 15% simultaneously, no real money has been made. Intelligent investing can be described as understanding and keeping track of how conditions change over time. A good investment is not only based on the current market but also on how other investments are doing (including currencies). Any investment process that does not take into account currency strategy is likely to fail. Ask your investment advisor or financial planner what their current strategy is this week--you might be surprised by the response. Low or no fee investing: Many firms provide a dividend reinvestment plan. DRIPs, for short, are programs that enable investors to buy stock directly from the company without paying a broker fee. The dividends are automatically spent on more of the stock. These fees make a significant difference in your portfolio's overall performance. According to a study published in the August 27, 2010 edition of The Wall Street Journal, high-cost vs. low-cost mutual funds have differing rates of return. According to the research, low-cost mutual funds outperformed higher-cost counterparts by approximately 1.3 percent. So not only would you be paying a more significant fee, but your portfolio would also underperform by 1.3%. The majority of management fees range between 1 and 2 percent. DRIPS save you at least 1.3% each year on average. So what is the big deal? Here is where it gets interesting: If we invest and compound our money at a rate of 10%, we end up with $33,033 after 25 years (1 + 0). Within 50 years, our portfolio would be 80% more valuable if we save annually! A DRIP plan saves your money and grows it over time. Pro Tip: Most companies have information about their DRIP plans on their websites, usually in the investor center. Most investors miscalculate two key ideas: the effects of inflation on total returns and the power of dividends. An article by Morgan Housel of the Motley Fool emphasizes the importance of dividends and their substantial influence on total returns. (a) Pfizer: If you had invested in this company in the 1960s, your investment would have returned 4200%. However, if you reinvest dividends, your return could be as high as 13,200%. (b) Johnson and Johnson: Since the 1960s, it has repaid 9700 percent. If dividends were reinvested, the return would increase to 21,400 percent. (c) Reynolds: Over the last two decades, its value has nearly tripled. The appreciation is 840% when dividends are reinvested. In another article, Housel compared the return of Public Storage stock with and without dividends reinvested. He found that over twenty years, the difference was significant. In the last four decades, the stock has jumped 700%. And if dividends were reinvested, it would have come back with 4500% interest. The difference is astounding. Here are all the files you need to get started with Proof: Please Note: The following are not investment recommendations. They are merely examples of the processes and details involved in dividend investing. (1) Coltene Holdings AG - the Swiss Franc will almost certainly continue its long-term appreciation against the dollar. In 2004, one franc was worth $0.82. Today one franc is worth $1.01. Investors who sold dollars for francs in 2004 may acquire more dollars today (as well as anything else denominated in dollars, such as food, automobiles, or property). A second benefit of holding Franc-denominated assets is that it has long been a safe haven for investors. So even if the Swiss stock you own falls alongside the rest of the market during recessions or periods of uncertainty, you are still making money since the franc will also rise. The third consideration is that it was paying a decent return of 4.44%. The current dividend rate of Coltene is $.083 quarterly or $3.32 annually. The current share price is $74. (2) Telstra is an excellent choice for investors looking to bet on large-cap communication companies. Telstra trades at $3.74 and pays out 6.68%. In addition, Telstra has 3.793 billion dollars of free cash flow which helps to reduce risk. Free cash flow is the money companies have after paying for the cost of doing business. Owning Telstra also provides exposure to the Australian dollar, which can be beneficial in diversifying one's portfolio. The examples presented should demonstrate that there are many bargains out there if we seek them. Furthermore, safety and yield are not mutually exclusive, as evidenced by these instances. You may have your cake and eat it, too; companies that pay strong dividends clearly have the financial wherewithal to do so. You do not want to be concerned with yields when developing a portfolio. Instead of focusing on a losing company, focus on a company with a competitive advantage that can withstand the competition. To achieve diversification, you should select a class of cyclical dividend-paying assets and compare it to its counterpart. Its commonly believed that counter-cyclical stocks are difficult to find because businesses usually struggle when others around them are doing poorly. However, as CLP Holdings and utilities demonstrated earlier, that is not always the case. While finding stocks that grow during economic depressions can be challenging, there are some companies whose stock prices increase during those times. In other words, the movement of large amounts of money can cause a company's stock to increase even if the underlying business is not growing. Utility stocks gain during depressions and fall during booms. It is all about the flow of funds. Finally, you want a diverse currency portfolio. You want to be exposed to currencies from Asia, Australia, New Zealand, and Canada. All of these countries have government debt and robust economies. As the United States and Europe continue to deal with high debt levels, their currencies will fall in value. The following is a list of resources for dividend investing. This list includes books, websites, and podcasts. Atlantic Power Corporation looks stellar on paper at the top of the list. It has a yield of 8% and a low payout ratio. That is an incredible find. It could be a great investment. And it is all available for free. Over time, you will grasp how the stock market works by adding stocks you are interested in into your Yahoo app portfolio. This way, you can follow current news related to those businesses without searching for them. In addition, You will learn more about the company's issues and opportunities and find out information about its competitors. Remember to keep an eye on things like nominal return rates; they may be deceptive in some cases. The money used to pay dividends comes directly from the income of a company. There are many reasons why a company might choose to pay out this money to investors instead of spending it elsewhere. Primarily, dividends are paid when a company is earning a significant income and has no reasonable use for the funds remaining after paying other dues. This occurrence is rare in smaller businesses or businesses that are investing in rapid growth, but common in corporations with good cash flow that have reached a titanic size, such as Walmart. With nowhere left to open new stores and a production rate that more than meets demand, Walmart uses some of its excess cash to pay dividends as a reward to its many investors. Some companies have grown their dividend payments for over 25 consecutive years, and are called dividend aristocrats. A company's dividend sustainably is of paramount importance to investors. Dividend sustainably is how likely it is that a company will be able to maintain or increase its dividend payments. There are two metrics used to calculate this: dividend yield and dividend payout ratio. Dividend yield refers to the percentage of the share price that gets paid back as a dividend. For example, if shares sell for $10 each and pay a $0.20 annual dividend, then the dividend yield is 2%. Dividend payout ratio is the proportion of a company's earnings that is used to pay dividends to investors. For example, if a company earns an estimated $1 per share and pays the same $0.20 per share, then the payout ratio is 20%. The higher the percentage, the more likely it is that it will be reduced down the line. Smaller ratios are less taxing on a company and reducing them has diminishing returns, so they are more likely to remain stable and sustainable. Dividends are primarily paid to investors as cash, but some companies allow the dividend payment to be reinvested as additional partial stock in the company. This is called a Dividend ReInvestment Plan, or DRIP. This can be especially appealing for investors looking to maximize their returns over time rather than benefit from short-term gains. There are four important dates that dividend payments have: The declaration date is simply when a company declares that it will be making dividend payments, and the payment date is when the company sends the payment out. The record date determines a recent share-buyers eligibility to receive a dividend payment for that period. Stock market rules say that the buyers must have purchased the share at least two days before the record date to receive payment. The ex-dividend date is the date after which the traded share will not pay a dividend to its new owner. After this date, the next payment will be made to the original owner. A Dividend is a distribution of a company's earnings to its shareholders. It is paid out quarterly and is often reinvested in the company. It also provides income for investors, which can be helpful in retirement planning. With a little bit of research, you can start receiving dividend payments from the companies in which you invest. The key is to find good, solid companies that have a history of paying and increasing their dividends. Also, keep an eye on the payout ratio; anything above 60% is cause for concern. Dividend stocks can provide you with a source of income that can help you reach your financial goals. Dividend-paying stocks have outperformed the rest of the market for a reason: There are dependable investments that will continue to provide you with earnings even when other aspects of your portfolio might dip in value momentarily. By following the steps outlined in this article, you will be well on your way to growing your wealth and begin receiving payments from the companies in which you invest. Most importantly, have fun and take your time learning.What Is a Dividend?

What Is the Dividend Yield?

You want to buy during moments of irrational volatility, like when stock prices may drop lower than they should be– this creates an incredible opportunity.

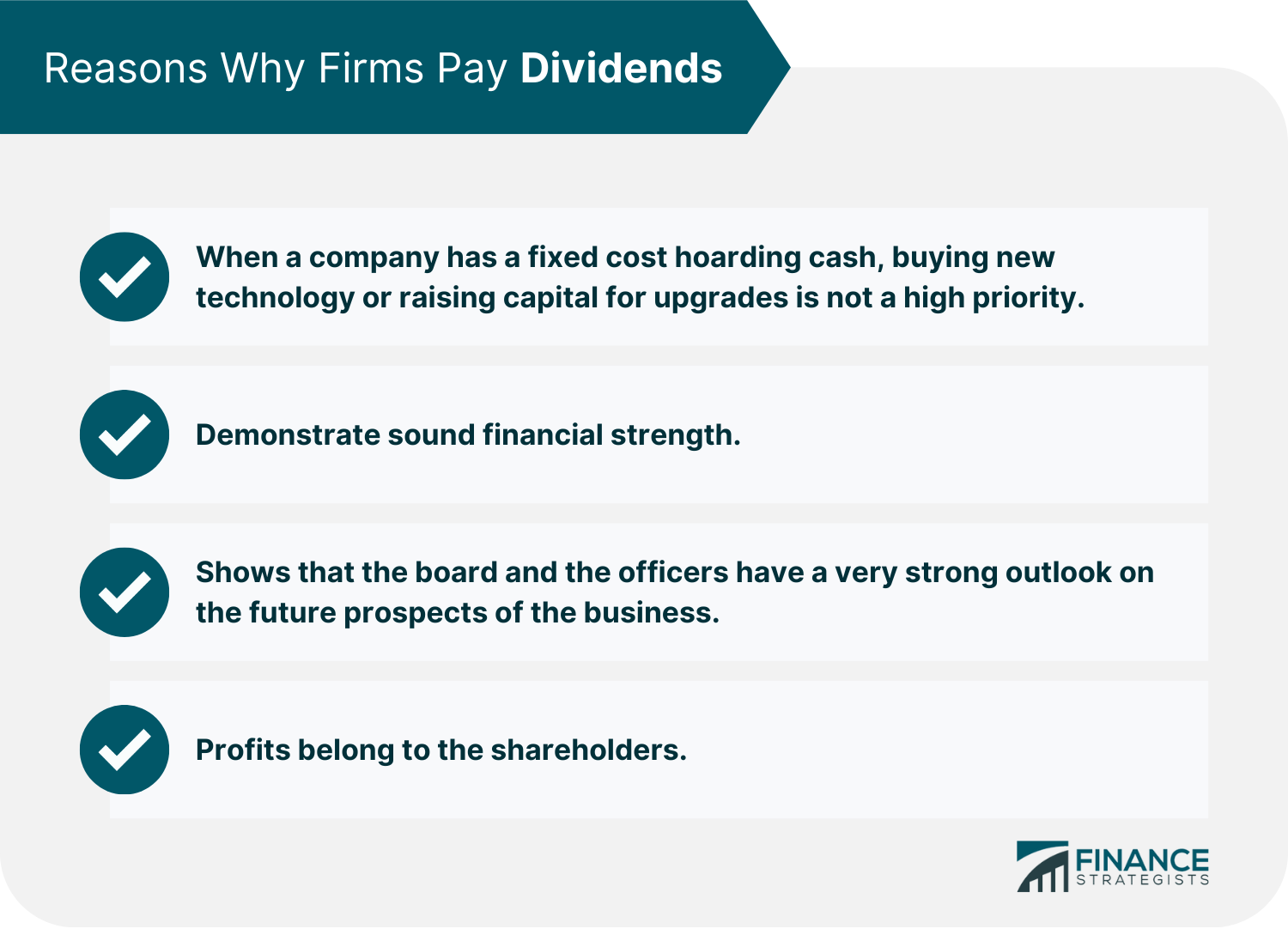

Why Do Firms Pay Dividends?

For example, once the capital has been spent to lay a pipeline or create infrastructure, a natural gas transmission company's future profits can be paid out to investors since their return from the transmission business only increases with time.

Additionally, there were no other companies on the horizon to acquire. Instead, he hopes the board will hand out a special dividend--a non-recurring bonus paid to shareholders when profits are booming.

On the other hand, companies never want to cut dividends because it looks terrible and makes management look incompetent.The Payout Ratio: Why It Matters

Why are Payout Ratios So Important?

The Ideal Configuration for a Dividend Investor

What is the Procedure for Dividend Payment?

What is the Definition of an Ex-Dividend Date?

Different Types of Dividend Payments

Dividend Income's Advantages

However, even if congress passes the Buffett Rule (which is very likely), it would not affect most investors.What Are the Tax Implications of Foreign Income?

Of course, credit availability depends on the investment vehicle used to invest in foreign assets. What Kinds of Assets Pay Dividends?

The Different Types of Dividend Investments Strategies

The following are some popular dividend investment strategies:

Inflation, Dividends, and Total Returns

To make this point more precise, he compares the return on investment for stocks when dividends are reinvested and when they are not.Quick Start Files

Because a firm has money on hand to retool itself for future growth, dividends act as a safeguard against the stock's full devaluation.Asset Allocation for Dividends

List of Resources

1. Discount Brokerages: If you are a member of a trading platform like Fidelity, TD Ameritrade, or Schwab, you have access to great research tools that can help you screen stocks from all over the world.

Get a broker to work for you on a low-cost basis: If you want to get information about these platforms, you can call their brokers. Many of them offer free classes on topics like stocks and options at local offices.

2. Also, broker-assisted trades are affordable, often costing a flat $150 per trade. Brokers are still valuable. Do not believe that everyone has access to the same information simultaneously.

3. Utilize the Power of Crowdsourcing: With countless investors sharing their investment insights, advice, and investigation on a single platform, all that information is crowdsourced (thus the name).

In the past, Warren Buffett would spend hours paging through Moody's manuals to find suitable investments. However, now bargain shopping is much simpler.

Therefore, crowdsourcing has become a favorite preliminary research method. Listed below are some websites to assist you in beginning your research process.

Go to the main webpage; on the right-hand side, you will see a search box near the top.

Type in "yield" and press enter, which will direct you to an article discussing high-yield utility stocks. Then, click that link which takes you to different stocks that meet a certain set of criteria established by the author.

From there, you will find a website with a slide show that discusses Southern Copper-- which yielded 8.1% when the article was published. Simply branch out to create a list and open up the company's financials afterward.

You can access financials, news reports, charts, key developments, price data, and purchase analyst reports (usually costing between $10-$100).

This knowledge is key to making an informed investment decision.

The app filters financial information, so you only see what is relevant to your portfolio. And sometimes, you find answers to questions you did not even know you should have been asking.

Though some of their pieces may be somewhat political in nature, there are several free economics audiobooks, ebooks, and lectures available. You may read these ebooks on your Kindle for free if you have one.

The audio files and movies are ideal for students who do not have a lot of time on their hands.

Most people are unaware that true inflation (which used to be measured before) is a little over 8%.

Given that inflation plays a part in why someone would own dividend-paying stocks, it behooves investors to understand how it is calculated.

Their list of high-yield dividend stocks has 1,627 firms starting with a yield of 24 percent at the moment.

Find out what is causing it to be so big. What is the payout ratio? Anything above 60% implies that dividends are at risk of being reduced sooner or later.

It is not guaranteed, but your security decreases dramatically as the payout ratio rises.What Is a Dividend in Finance?

How Are Dividends Paid?

Important Dates with Regard to Dividend Payments

Final Thoughts

Dividend FAQs

A dividend is an amount of money paid by a company to its shareholders.

Quarterly is the most common frequency of payment, but a company can also choose to pay monthly, semi-annually, or annually. Dividends can alternatively be “special,” meaning that they are a one-time payment that won’t repeat (or won’t repeat at the same amount), but more often dividends are paid on a schedule.

Primarily, dividends are paid when a company is earning a significant income and has no reasonable use for the funds remaining after paying other dues.

The money used to pay dividends comes directly from the income of a company.

Dividends are primarily paid to investors as cash, but some companies allow for the dividend payment to be reinvested as additional partial stock in the company.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.