The Fed Model is a market timing tool that compares the earnings yield of the S&P 500 with the yield on 10-year U.S. Treasury bonds to determine whether the U.S. stock market is fairly valued. If the earnings yield of the S&P 500 is higher than the yield on 10-year U.S. Treasury bonds, the market is considered bullish, and investors may choose to buy stocks. Conversely, if the earnings yield of the S&P 500 falls below the yield of 10-year U.S. Treasury bonds, the market is considered bearish, and investors may choose to sell stocks and invest in bonds. The Fed Model was developed by economist Ed Yardeni in its current form in 1999 and has been used by investors for several decades. However, the model's track record is not compelling, as it has failed to predict several significant market downturns, including the Great Recession of 2008. The Fed Model works by comparing the earnings yield of the S&P 500 with the yield on 10-year U.S. Treasury bonds. The earnings yield of the S&P 500 is calculated by dividing the annual earnings per share of the index by its current market price per share. The yield on 10-year U.S. Treasury bonds is the annual return an investor can expect to receive by holding a 10-year bond issued by the U.S. government. The Fed Model assumes that investors will choose to invest in whichever security offers the highest yield. If the earnings yield of the S&P 500 is higher than the yield on 10-year U.S. Treasury bonds, the model predicts a bullish market sentiment, indicating that investors are optimistic about the economy and the prospects of companies within the S&P 500. Conversely, if the earnings yield of the S&P 500 falls below the yield of 10-year U.S. Treasury bonds, the model predicts a bearish market sentiment, indicating that investors are pessimistic about the economy and the prospects of companies within the S&P 500. Investors use the Fed Model to make investment decisions and time the market, but it is important to use the model in conjunction with other market timing and valuation models and seek the advice of a financial advisor to make well-informed investment decisions. The Fed Model is a popular tool used by traders to determine whether the stock market is overvalued or undervalued by comparing the earnings yield of the stock market to the 12-month yield of the 10-year Treasury bond. Here are the steps involved in applying the fed model: The first step in applying the Fed Model is to gather data on the earnings yield of the stock market and the 12-month yield of the 10-year Treasury bond. The earnings yield is the inverse of the P/E ratio and represents the amount of earnings generated by a company for every dollar invested in its stock. The 12-month yield of the 10-year Treasury bond represents the interest rate paid on the bond over the past year. Once you have gathered the necessary data, the next step is to compare the earnings yield of the stock market to the 12-month yield of the 10-year Treasury bond. If the earnings yield of the stock market is lower than the 12-month yield of the bond, this indicates that the market may be overvalued. Conversely, if the earnings yield of the stock market is higher than the 12-month yield of the bond, this suggests that the market may be undervalued. Based on the comparison of the two figures, you can then consider your investment strategy. If the market is overvalued, you may want to consider selling equity investments to protect yourself from potential losses. If the market is undervalued, you may want to consider buying more equity investments to take advantage of potential gains. It is important to remember that the Fed Model is just one tool in your investment analysis toolkit. Other factors, such as economic indicators, company performance, and market trends, should also be considered when making investment decisions. Additionally, the Fed Model is not foolproof and may not always accurately predict market movements. Therefore, it is important to use the Fed Model as just one tool in your analysis and not rely on it exclusively. Although the Fed Model is a popular tool used by traders to determine whether the stock market is overvalued or undervalued, several limitations should be considered when using it to make investment decisions. This includes its failure to predict significant economic events like the Great Recession of 2008 and its failure to account for inflation. One major limitation of the Fed Model is that it failed to predict the Great Recession of 2008. While the model has been largely accurate in tracking market values from approximately 1960 until 2008, its failure to predict one of the most significant economic events of the past few decades has caused many people to question its reliability. It is worth noting that the Fed Model is just one tool in a trader's toolkit, and it is important to consider a variety of factors when making investment decisions. Another limitation of the Fed Model is that it does not account for inflation. While inflation is priced into the earnings yield of the stock market, it is not factored into the yield of Treasury bonds. This is known as the "money illusion," and it can lead to flawed predictions by the Fed Model. Analysts have suggested that the central flaw in the Fed Model lies in its failure to account for inflation and that this flaw undermines its usefulness as a predictive tool. While some investors still rely on the Fed Model as a predictive tool despite its limitations, there are alternative financial ratios, market timing, and valuation models with better-proven track records in predicting market direction. These include: One alternative to the Fed Model is the price-to-earnings (P/E) ratio, which compares a stock's price to its earnings per share. The P/E ratio is a widely used valuation metric that can help investors determine whether a stock is overvalued or undervalued. A high P/E ratio may suggest that a stock is overvalued, while a low P/E ratio may indicate that a stock is undervalued. Another alternative to the Fed Model is the price-to-sales (P/S) ratio, which compares a company's market capitalization to its revenue. The P/S ratio can be used as a valuation metric to determine whether a company's stock is overvalued or undervalued. A high P/S ratio may suggest that a company's stock is overvalued, while a low P/S ratio may indicate that a stock is undervalued. A third alternative to the Fed Model is examining household equity as a percentage of total financial assets. This metric can help investors gauge market sentiment and determine whether investors are bullish or bearish on the stock market. If household equity as a percentage of total financial assets is high, it may suggest that investors are bullish on the stock market, while a low percentage may indicate that investors are bearish. It is worth noting that each alternative model has its limitations. The P/E ratio, for example, may not be an accurate valuation metric for companies in certain industries, and the P/S ratio may be less effective for companies with profit margins that are low. Additionally, while examining household equity as a percentage of total financial assets can provide insight into market sentiment, it may not accurately predict market movements. The Fed Model is a market timing tool used to determine whether the US stock market is fairly valued by comparing the earnings yield of the S&P 500 with the yield on 10-year US Treasury bonds. However, the model's track record is not compelling, as it has failed to predict significant market downturns, including the Great Recession of 2008. It is crucial to use the Fed Model in conjunction with other market timing and valuation models and seek the advice of a financial advisor to make well-informed investment decisions. While some investors still rely on the Fed Model, alternative models such as the price-to-earnings ratio, the price-to-sales ratio, and examining household equity as a percentage of total financial assets have better-proven track records in predicting market direction. It is important to note that each alternative model has its limitations, and investors should consider various factors when making investment decisions. Seeking the help of wealth management services can provide guidance and expertise on making well-informed investment decisions.What Is the Fed Model?

How the Fed Model works

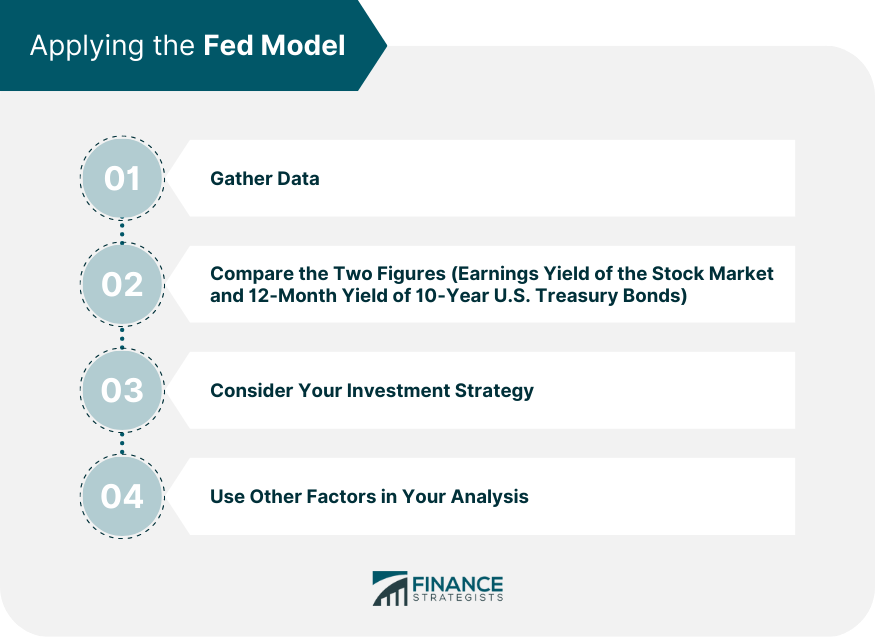

Applying the Fed Model

Step 1: Gather Data

Step 2: Compare the Two Figures

Step 3: Consider Your Investment Strategy

Step 4: Use Other Factors in Your Analysis

Limitations and Criticisms of the Fed Model

Failed to Predict the Great Recession of 2008

Does Not Account For Inflation

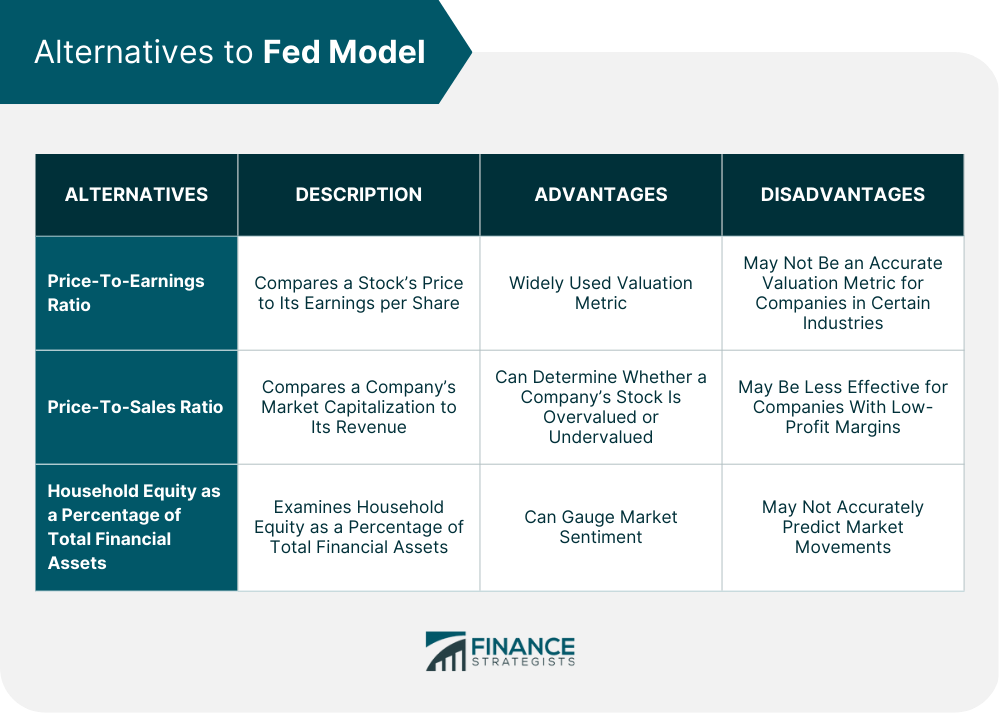

Alternatives to the Fed Model

Price-To-Earnings Ratio

Price-To-Sales Ratio

Household Equity as a Percentage of Total Financial Assets

Limitations of Alternatives

Final Thoughts

Fed Model FAQs

The Fed Model is a market timing tool that compares the earnings yield of the S&P 500 with the yield on 10-year U.S. Treasury bonds to determine whether the U.S. stock market is fairly valued.

The Fed Model works by comparing the earnings yield of the S&P 500 with the yield on 10-year U.S. Treasury bonds. If the earnings yield of the S&P 500 is higher than the yield on 10-year U.S. Treasury bonds, the market is considered bullish, and investors may choose to buy stocks. Conversely, if the earnings yield of the S&P 500 falls below the yield of 10-year U.S. Treasury bonds, the market is considered bearish, and investors may choose to sell stocks and invest in bonds.

The Fed Model has several limitations, including its failure to predict significant economic events like the Great Recession of 2008 and its failure to account for inflation. It is crucial to use the Fed Model in conjunction with other market timing and valuation models and seek the advice of a financial advisor to make well-informed investment decisions.

Alternative models to the Fed Model include the price-to-earnings ratio, the price-to-sales ratio, and examining household equity as a percentage of total financial assets. Each alternative model has its limitations, and investors should consider a variety of factors when making investment decisions.

Yes, it is recommended to consult a financial advisor when using the Fed Model or alternative models. Financial advisors can provide guidance and expertise to help investors make well-informed investment decisions based on their individual financial goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.