Floating stock refers to the number of a company's shares that are publicly available for trading on a stock exchange. These shares are typically owned by individual and institutional investors and are not held by the company's insiders, such as executives and founders. Floating stock is a crucial metric as it determines the liquidity and availability of a company's shares in the market. As the number of shares in a company's floating stock changes, it can significantly influence the stock's price and market capitalization. Investors and market analysts often monitor floating stock to gauge the overall health of the stock market and individual companies. The changes in floating stock can provide insight into the company's financial position, investor sentiment, and market dynamics, which can all influence investment decisions. Insider ownership refers to the proportion of a company's shares held by its executives, founders, and other key personnel. When insiders own a significant percentage of the company's shares, it can reduce the number of shares available for trading on the open market, thus decreasing the floating stock. High insider ownership can signal confidence in the company's future prospects, but it can also limit liquidity and contribute to price volatility. Conversely, low insider ownership can result in a larger floating stock, offering increased liquidity and potentially lower price volatility. However, low insider ownership might also be a cause for concern as it could indicate a lack of confidence in the company's future performance. Institutional ownership is the percentage of a company's shares held by institutional investors, such as mutual funds, pension funds, and hedge funds. High institutional ownership can reduce the floating stock, as these investors often hold large positions in a company's shares. Furthermore, institutional investors tend to have a longer investment horizon, which means they are less likely to trade their shares frequently. On the other hand, low institutional ownership can result in a larger floating stock, providing increased liquidity and potentially more stable stock prices. However, low institutional ownership might also be perceived negatively, as it could suggest that professional investors are not confident in the company's prospects. Companies can influence their floating stock by issuing new shares or buying back existing ones. When a company issues new shares, it increases the number of shares available for trading, thus enlarging the floating stock. However, this can dilute existing shareholders' ownership and may lead to a decline in the stock price. Conversely, when a company buys back its shares, it reduces the number of shares available for trading, leading to a smaller floating stock. Share buybacks can increase the value of remaining shares and signal management's confidence in the company's prospects, but they can also decrease liquidity and contribute to higher price volatility. Various trading restrictions can impact a company's floating stock. For example, lock-up periods prevent insiders and early investors from selling their shares for a specified time after an initial public offering (IPO) or a secondary offering. This can temporarily reduce the floating stock, leading to decreased liquidity and potentially higher price volatility. Additionally, regulatory restrictions can affect the floating stock. For instance, some countries impose limits on foreign ownership of domestic companies, which can limit the number of shares available for trading and reduce the floating stock. Understanding these restrictions is crucial for investors, as they can influence the stock's liquidity and price movements. Market conditions, such as prevailing economic trends and investor sentiment, can also impact a company's floating stock. In a bullish market, investors may be more willing to buy and hold shares, which could lead to a larger floating stock and increased liquidity. Conversely, in a bearish market, investors may be more inclined to sell their shares, potentially decreasing the floating stock and reducing liquidity. Moreover, significant market events, such as mergers and acquisitions, can affect a company's floating stock. For example, when a company acquires another, the number of shares available for trading can change as the two companies' stocks are combined or as shares are exchanged in the transaction. Floating stock has a direct impact on stock prices, as it influences the supply and demand dynamics of a company's shares. When the floating stock is large, there is an abundance of shares available for trading, which can lead to more stable prices due to increased liquidity. Conversely, when the floating stock is small, the limited supply of shares can result in more significant price fluctuations as investors compete for the available shares. Additionally, changes in floating stock can signal changes in investor sentiment, which can also affect stock prices. For example, an increase in floating stock could indicate that insiders or institutional investors are selling their shares, which might be interpreted as a negative signal by the market, leading to a decline in the stock price. Market capitalization is the total value of a company's outstanding shares, calculated by multiplying the stock price by the number of shares outstanding. Floating stock directly impacts market capitalization, as changes in the number of shares available for trading can lead to fluctuations in the stock price and, subsequently, market capitalization. For example, when a company issues new shares, it increases the floating stock, which can dilute existing shareholders' ownership and potentially decrease the stock price. This can result in a decline in the company's market capitalization. Conversely, share buybacks can reduce the floating stock and potentially increase the stock price, leading to a higher market capitalization. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. A larger floating stock can lead to increased liquidity, as there are more shares available for trading, making it easier for investors to buy or sell shares without causing large price movements. On the other hand, a smaller floating stock can result in reduced liquidity, as the limited supply of shares makes it more challenging for investors to execute trades without causing significant price fluctuations. This can be especially problematic for large investors who may struggle to buy or sell large quantities of shares without impacting the stock price. One of the main advantages of floating stock is the enhanced liquidity it provides to the market. A larger floating stock means that more shares are available for trading, which can make it easier for investors to buy or sell shares without significantly affecting the stock price. This improved liquidity can be particularly beneficial for institutional investors who often trade large quantities of shares. Floating stock offers investors increased flexibility, as it allows them to enter or exit positions more easily. With a larger floating stock, investors can execute trades more quickly and with lower transaction costs, as the increased liquidity helps to minimize price fluctuations. This can enable investors to take advantage of market opportunities and better manage their portfolios. A larger floating stock can contribute to increased market efficiency, as the abundant supply of shares available for trading enables prices to more accurately reflect the underlying value of a company. The improved liquidity provided by a larger floating stock allows for more active trading, which can help to ensure that stock prices are more closely aligned with their fundamental value. This increased efficiency can benefit investors by providing more accurate signals for investment decisions and reducing the likelihood of market anomalies. While a larger floating stock can provide increased liquidity, it can also lead to higher price volatility. When there are more shares available for trading, it may be easier for short-term traders and speculators to influence stock prices, causing larger price fluctuations. This increased volatility can be challenging for long-term investors, as it may create uncertainty and make it more difficult to maintain a stable investment strategy. A larger floating stock can also increase the potential for market manipulation, as it may be easier for unscrupulous traders to create artificial price movements. For example, these individuals may engage in practices such as "pump and dump" schemes, where they artificially inflate the stock price before selling their shares for a profit. This can harm unsuspecting investors who may buy into the inflated prices, only to see the value of their investment decline when the manipulators exit their positions. When a company has a large floating stock, it can result in reduced control for company management, as a greater proportion of the company's shares are owned by external investors. This can make it more challenging for management to execute strategic decisions, such as mergers and acquisitions, as they may need to obtain the approval of a larger number of shareholders. Additionally, a large floating stock can make a company more susceptible to hostile takeover attempts, as it may be easier for potential acquirers to accumulate a controlling stake in the company. Floating stock is the number of shares of a company's stock that are available for public trading. Factors that affect floating stock include insider ownership, institutional ownership, share issuance and buybacks, restrictions on trading, and market conditions. Floating stock has significant implications for the stock market, including its impact on stock prices, market capitalization, and liquidity. Advantages of high floating stock include improved liquidity, flexibility for investors, and increased market efficiency. However, there are also disadvantages to high floating stock, including increased volatility, potential for market manipulation, and lower control for company management. Investors should carefully consider the advantages and disadvantages of floating stock when making investment decisions.What Is a Floating Stock?

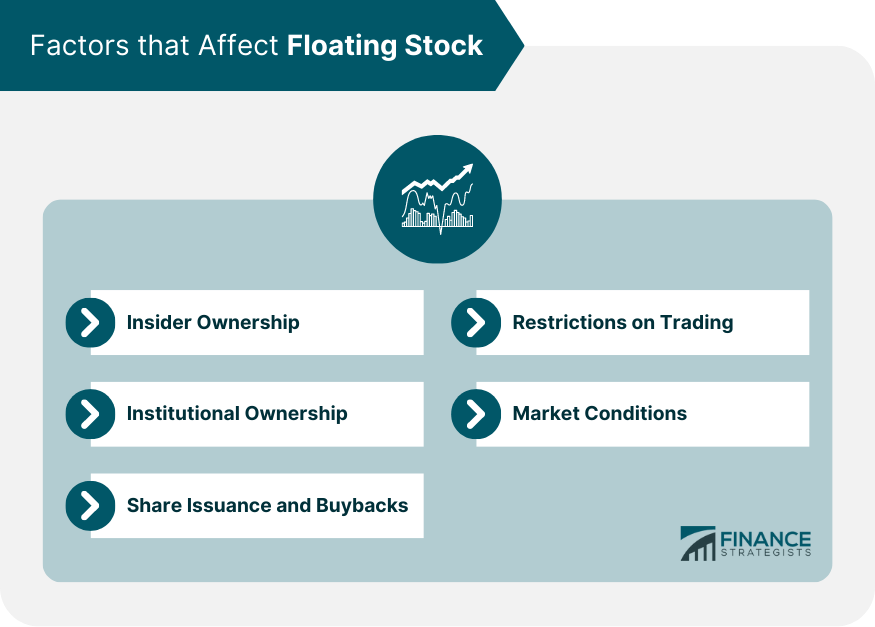

Factors That Affect Floating Stock

Insider Ownership

Institutional Ownership

Share Issuance and Buybacks

Restrictions on Trading

Market Conditions

Significance of Floating Stock

Impact on Stock Prices

Impact on Market Capitalization

Impact on Liquidity

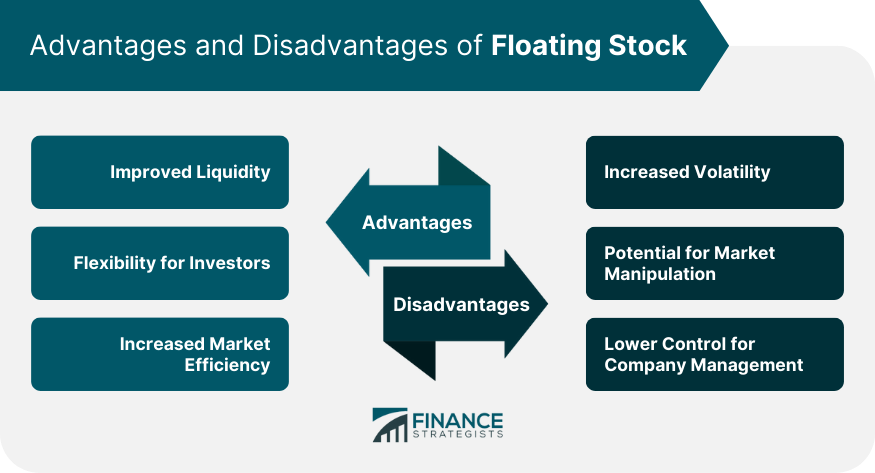

Advantages of Floating Stock

Improved Liquidity

Flexibility for Investors

Increased Market Efficiency

Disadvantages of Floating Stock

Increased Volatility

Potential for Market Manipulation

Lower Control for Company Management

Final Thoughts

Floating Stock FAQs

Floating stock refers to the number of shares of a company's stock that are available for public trading.

Floating stock is calculated by subtracting the number of restricted shares, such as those held by insiders or the company itself, from the total outstanding shares.

High floating stock can improve the liquidity of a stock, make it easier to buy and sell, and increase market efficiency.

High floating stock can increase volatility, reduce the control of company management, and create the potential for market manipulation.

Yes, the floating stock of a company can change over time due to factors such as share issuance, buybacks, insider trading, and changes in market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.