A fractional share is a portion of a full share of a stock, ETF, or other financial instrument that is less than one whole share. These shares allow investors to buy and sell assets in smaller increments, making it possible for individuals to invest in expensive stocks or create more diversified portfolios without needing large amounts of capital. Fractional shares can be acquired through stock splits, dividend reinvestment plans (DRIPs), or through investment platforms that offer fractional share trading. Fractional share ownership has been around for decades, with its origins in dividend reinvestment plans, which allowed investors to reinvest their dividends into additional shares, even if the dividend amount was not enough to purchase a whole share. Over time, the concept of fractional shares has evolved and expanded, becoming more accessible to individual investors. The rise of online brokerages and investment platforms in the 21st century has contributed significantly to the growth and popularity of fractional share investing. This has made it easier for retail investors to participate in the stock market and build diversified portfolios with relatively small amounts of money. Fractional shares have become an important tool in the financial world, as they provide greater accessibility and flexibility for individual investors. By allowing investors to buy and sell stocks in smaller increments, fractional shares have democratized investing, making it possible for more people to participate in the stock market and build wealth over time. Additionally, fractional shares have made it easier for investors to diversify their portfolios and implement various investment strategies, such as dollar-cost averaging or long-term investing, which can help to manage risk and potentially enhance returns. One of the primary benefits of fractional shares is the lower entry cost for investors. Because investors can purchase a fraction of a share, they do not need to have the full share price available to invest in a particular stock or ETF. This makes it possible for individuals with limited resources to start investing in the stock market and gradually build their portfolios over time. Fractional shares also enable investors to diversify their portfolios more easily. With the ability to buy small portions of multiple stocks or ETFs, investors can spread their investments across a wider range of assets, reducing the impact of a single stock's performance on their overall portfolio. Fractional shares offer increased flexibility for investors when purchasing shares. Instead of having to buy whole shares, investors can allocate their funds more precisely, investing the exact amount they want in a particular stock or ETF. This can be especially beneficial for those with limited funds who want to make the most of their investment dollars. Investing in fractional shares may also provide the potential for higher returns. By allowing investors to participate in the stock market with smaller amounts of money, fractional shares can help individuals start building wealth sooner and take advantage of compounding returns over time. Additionally, the ability to invest in high-priced stocks through fractional shares can give investors access to companies with strong growth potential that might otherwise be out of reach. One of the risks associated with fractional shares is the limited control investors have over their share ownership. Because they own less than a full share, investors may not have the same voting rights or access to shareholder benefits as those who own whole shares. This can potentially limit an investor's influence on corporate decisions and their ability to participate in certain shareholder events. While fractional shares are generally considered to be highly liquid, there is still the potential for liquidity issues in some cases. For example, if a particular stock is thinly traded or the investment platform handling the fractional shares experiences technical difficulties, it may be challenging for investors to buy or sell their fractional shares at their desired price or time. However, these situations are relatively rare and do not typically pose a significant risk for most investors. Owning fractional shares can also limit an investor's access to certain shareholder benefits. For example, some companies offer perks to their shareholders, such as discounts on products or services, invitations to exclusive events, or the ability to participate in shareholder meetings. Investors who own only fractional shares may not be eligible for these benefits, as they do not hold full shares of the company's stock. Investing in fractional shares can also result in increased exposure to market volatility. Because investors can buy and sell fractional shares with smaller amounts of money, they may be more likely to make frequent trades or attempt to time the market, which can lead to higher transaction costs and greater potential for losses due to market fluctuations. To mitigate this risk, investors should consider adopting a long-term investment strategy and avoid making impulsive trading decisions. Robinhood is a popular online brokerage that offers commission-free trading of stocks, ETFs, and options. In addition to whole shares, Robinhood also allows its users to buy and sell fractional shares of most U.S. stocks and ETFs, making it an attractive option for investors looking to build diversified portfolios with limited funds. Charles Schwab is a well-established brokerage firm that offers a wide range of investment products and services, including fractional share investing. Through its Stock Slices program, investors can purchase fractional shares of S&P 500 companies, allowing them to gain exposure to some of the largest and most successful companies in the U.S. market. Fidelity Investments is another major brokerage firm that offers fractional share investing. Through its Fidelity Mobile app, investors can buy and sell fractional shares of stocks and ETFs, as well as participate in dividend reinvestment plans. Fidelity's platform is known for its user-friendly interface and extensive educational resources, making it a suitable option for both new and experienced investors. In addition to the platforms mentioned above, there are several other investment apps and online brokerages that offer fractional share investing. Some popular options include M1 Finance, SoFi Invest, and Public. Each platform has its unique features and fee structures, so investors should carefully compare their options to find the best fit for their needs and investment goals. Dollar-cost averaging is an investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can be particularly effective when investing in fractional shares, as it allows investors to gradually build their positions over time and reduce the impact of market fluctuations on their overall portfolio. Fractional shares make it easier for investors to diversify their portfolios, as they can invest in a wide range of assets with smaller amounts of money. To build a well-diversified portfolio, investors should consider allocating their funds across different asset classes, sectors, and geographic regions, as well as maintaining a mix of stocks, bonds, and other investment vehicles. Long-term investing is another effective strategy for those looking to invest in fractional shares. By focusing on the long-term growth potential of their investments and avoiding short-term market fluctuations, investors can potentially achieve higher returns and benefit from the power of compounding. While not suitable for everyone, active trading is a strategy that some investors may choose to employ when investing in fractional shares. This approach involves frequently buying and selling stocks or ETFs in an attempt to profit from short-term price movements. Investors who choose to engage in active trading should be aware of the risks involved, including higher transaction costs and the potential for significant losses due to market volatility. Additionally, active trading requires a significant amount of time, knowledge, and dedication to market analysis and research. When investors sell fractional shares at a profit, they are subject to capital gains tax on the earnings. The tax rate depends on the holding period of the investment and the investor's income level. Short-term capital gains, which are realized on investments held for one year or less, are taxed at the investor's ordinary income tax rate. Long-term capital gains, which are realized on investments held for more than one year, are generally taxed at a lower rate. Investors who receive dividends from their fractional shares are also subject to taxes on these earnings. Qualified dividends, which are typically paid by U.S. corporations and some foreign corporations, are taxed at the long-term capital gains rate. Non-qualified dividends, on the other hand, are taxed at the investor's ordinary income tax rate. Tax-loss harvesting is a strategy that involves selling an investment at a loss to offset capital gains from other investments, potentially reducing an investor's overall tax liability. Fractional shares can be used for tax-loss harvesting purposes, just like whole shares. However, investors should be aware of the "wash sale" rule, which disallows the tax benefits of a loss if the same or substantially identical security is purchased within 30 days before or after the sale. A fractional share is a portion of a company's stock that represents less than one whole share. Fractional shares are typically purchased through a brokerage and allow investors to own a fraction of a share of expensive stocks with a lower entry cost. Fractional shares represent a portion of a full share of a stock, ETF, or other financial instrument and have become an important tool in the financial world, providing greater accessibility and flexibility for individual investors. They have helped democratize investing and allowed more people to participate in the stock market and build wealth over time. Fractional shares offer numerous benefits, such as lower entry costs, increased portfolio diversification, flexibility in purchasing shares, and the potential for higher returns. However, they also come with certain risks, including limited control over share ownership, potential liquidity issues, limited access to shareholder benefits, and increased exposure to volatility. Investors should carefully consider these benefits and risks when deciding whether to invest in fractional shares. Additionally, investors should be aware of the tax implications of fractional share investing, including capital gains tax, dividend tax, and tax-loss harvesting, to optimize their tax efficiency and overall investment returns.What Is a Fractional Share?

Historical Background of Fractional Share Ownership

Significance of Fractional Shares in the Financial World

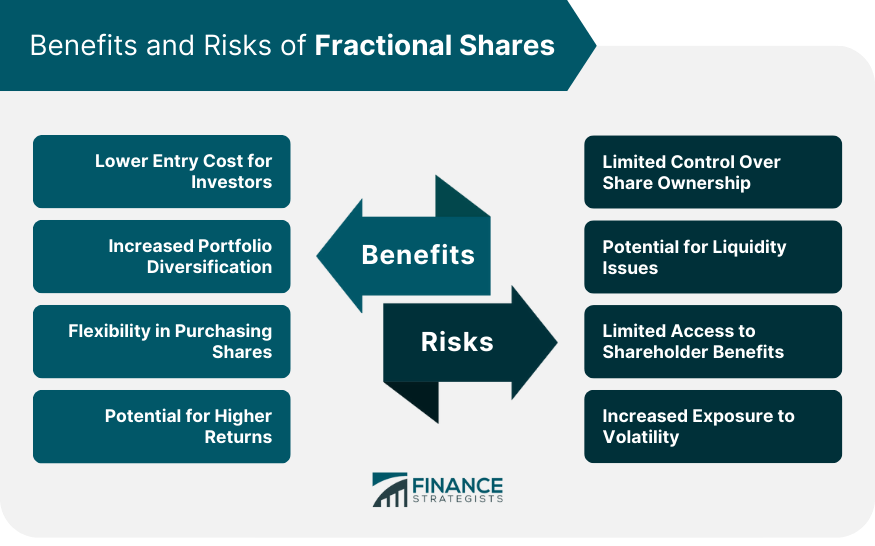

Benefits of Fractional Shares

Lower Entry Cost for Investors

Increased Portfolio Diversification

Flexibility in Purchasing Shares

Potential for Higher Returns

Risks of Fractional Shares

Limited Control Over Share Ownership

Potential for Liquidity Issues

Limited Access to Shareholder Benefits

Increased Exposure to Volatility

Fractional Share Investing Platforms

Robinhood

Charles Schwab

Fidelity Investments

Other Investment Apps

Strategies for Investing in Fractional Shares

Dollar-Cost Averaging

Portfolio Diversification

Long-Term Investing

Active Trading

Tax Implications of Fractional Shares

Capital Gains Tax

Dividend Tax

Tax-Loss Harvesting

Final Thoughts

Fractional Share FAQs

Fractional shares are a portion of a company's stock that represents less than one whole share, typically purchased through a brokerage.

Fractional shares allow investors to own a portion of expensive stocks with a lower entry cost, increase diversification, and potentially earn higher returns.

Investors may face limited control over share ownership, liquidity issues, limited access to shareholder benefits, and increased exposure to volatility.

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

Popular fractional share investing platforms include Robinhood, Charles Schwab, Fidelity Investments, and other investment apps.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.