Secondary offerings refers to the sale of additional shares of a company's stock by existing shareholders, rather than the company itself issuing new shares. These offerings typically occur after the company has already gone through an initial public offering (IPO) and the shares have started trading publicly. In a secondary offering, the company does not receive any proceeds from the sale of shares, as the shares are being sold by existing shareholders, such as founders, early investors, or employees. The purpose of a secondary offering is usually to provide liquidity for existing shareholders or to raise additional capital for the selling shareholders. An FPO is a type of secondary offering where a company issues additional shares to the public after its initial public offering (IPO). FPOs can be classified into two types: In a dilutive offering, the company issues new shares, increasing the number of outstanding shares and potentially diluting the ownership stake of existing shareholders. In a non-dilutive offering, existing shareholders sell their shares to the public without the company issuing any new shares. This type of offering does not dilute ownership but provides liquidity to the selling shareholders. An ATM is a type of secondary offering in which a company sells its shares directly into the open market at prevailing market prices. This type of offering provides flexibility for the issuer to raise capital over a period of time. In an RDO, a company sells its shares directly to a select group of investors, typically institutional investors, without a public offering. This type of offer often has lower costs and faster execution compared to traditional public offerings. A CMPO is a type of secondary offering where a company privately markets its shares to institutional investors before publicly disclosing the offering. This approach allows the company to gauge investor interest and determine the appropriate pricing for the offering. A PIPE is a type of secondary offering where a company raises capital by selling its shares privately to a select group of investors, often at a discount to the current market price. This type of offering is common among smaller companies and those with limited access to public capital markets. Conducting a secondary offering typically involves several steps: Companies choose investment banks and other financial advisors to help manage the secondary offering process, including conducting due diligence, pricing the shares, and marketing the offering to potential investors. The company and its advisors conduct a thorough review of the company's financials, operations, and legal matters. They then prepare to offer documents, such as a prospectus or private placement memorandum, which provide investors with essential information about the offering. Companies must file the necessary documents with relevant regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States. These authorities review the filings and must approve the offering before it can proceed. The company and its advisors determine the appropriate pricing for the offering based on factors such as market conditions, investor demand, and the company's financial performance. They then market the offering to potential investors through presentations, roadshows, and other promotional efforts. Once the offering is priced and fully subscribed, the shares are distributed to investors. The company receives the proceeds from the offering, and the shares are listed and traded on the relevant stock exchange. Secondary offerings are subject to various regulations and legal requirements to protect investors and maintain market integrity: In the United States, the Securities and Exchange Commission (SEC) oversees secondary offerings and requires companies to comply with various disclosure and reporting requirements. FINRA, a self-regulatory organization in the U.S., enforces rules related to secondary offerings, such as ensuring fair and transparent pricing and marketing practices. Insider trading laws and regulations apply to secondary offerings, prohibiting company insiders from trading shares based on material non-public information. Companies must provide investors with accurate and complete information about the offering, including risks and financial performance, through offering documents such as a prospectus or private placement memorandum. Several parties play essential roles in secondary offerings: Companies looking to raise capital or provide liquidity to existing shareholders initiate secondary offerings. Existing shareholders, such as founders, executives, or early investors, may sell their shares through secondary offerings to monetize their investments. Investment banks and financial advisors guide companies through the secondary offering process, providing essential services such as due diligence, pricing, and marketing. Investors, including institutional investors like mutual funds and hedge funds, as well as individual retail investors, participate in secondary offerings by purchasing the offered shares. Secondary offerings provide numerous benefits to companies and investors, including: Liquidity for Existing Shareholders: A secondary offering allows existing shareholders to sell their shares, creating liquidity and potentially realizing gains on their investments. Raising Capital Without Diluting Ownership: In the case of non-dilutive secondary offerings, companies can raise capital without diluting the ownership stake of existing shareholders. Lower Costs and Faster Execution: Certain types of secondary offerings, such as RDOs and ATMs, often have lower costs and faster execution compared to traditional public offerings. Price Stabilization: Secondary offerings can help stabilize the price of a company's shares by increasing the supply of shares available for trading in the market. Expanding Investor Base: By offering additional shares to the public, companies can expand their investor base, potentially attracting new investors and improving the liquidity of their shares. Despite the advantages, secondary offerings also have potential drawbacks: Potential Share Price Dilution: Dilutive secondary offerings can lead to a decrease in earnings per share and potentially lower share prices, affecting the value of existing shareholders' investments. Negative Market Perception: Investors may perceive secondary offerings as a sign of financial distress or desperation, which can negatively impact the company's reputation and share price. Increased Regulatory Scrutiny: Companies conducting secondary offerings must comply with additional regulatory requirements, increasing the potential for scrutiny from regulators and investors. Underpricing Risk: If a secondary offering is not priced appropriately, the company may not raise the desired amount of capital or may inadvertently undervalue its shares. Increased Volatility: Secondary offerings can lead to increased volatility in the company's share price, particularly in the short term, as the market absorbs the additional shares and adjusts to the new supply. Secondary offerings are an essential tool for companies seeking to raise capital, provide liquidity to shareholders, and expand their investor base. While they offer numerous advantages, they also come with potential drawbacks and risks. Companies considering secondary offerings must carefully weigh these factors and work closely with experienced advisors to ensure a successful outcome. As the financial markets continue to evolve, secondary offerings will likely remain an important component of the capital-raising landscape. By understanding the intricacies of secondary offerings and staying abreast of regulatory changes and market trends, companies and investors can better position themselves to take advantage of these opportunities and contribute to the overall health and growth of the global economy.Definition of Secondary Offerings

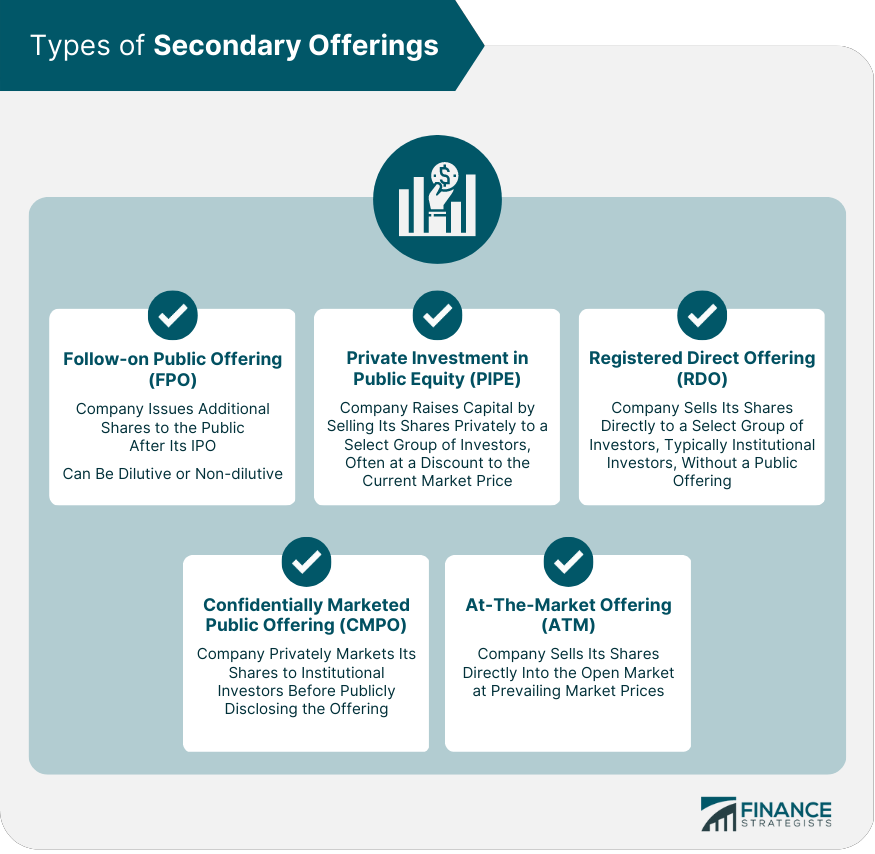

Types of Secondary Offerings

Follow-on Public Offering (FPO)

Dilutive Offering

Non-dilutive Offering

At-The-Market Offering (ATM)

Registered Direct Offering (RDO)

Confidentially Marketed Public Offering (CMPO)

Private Investment in Public Equity (PIPE)

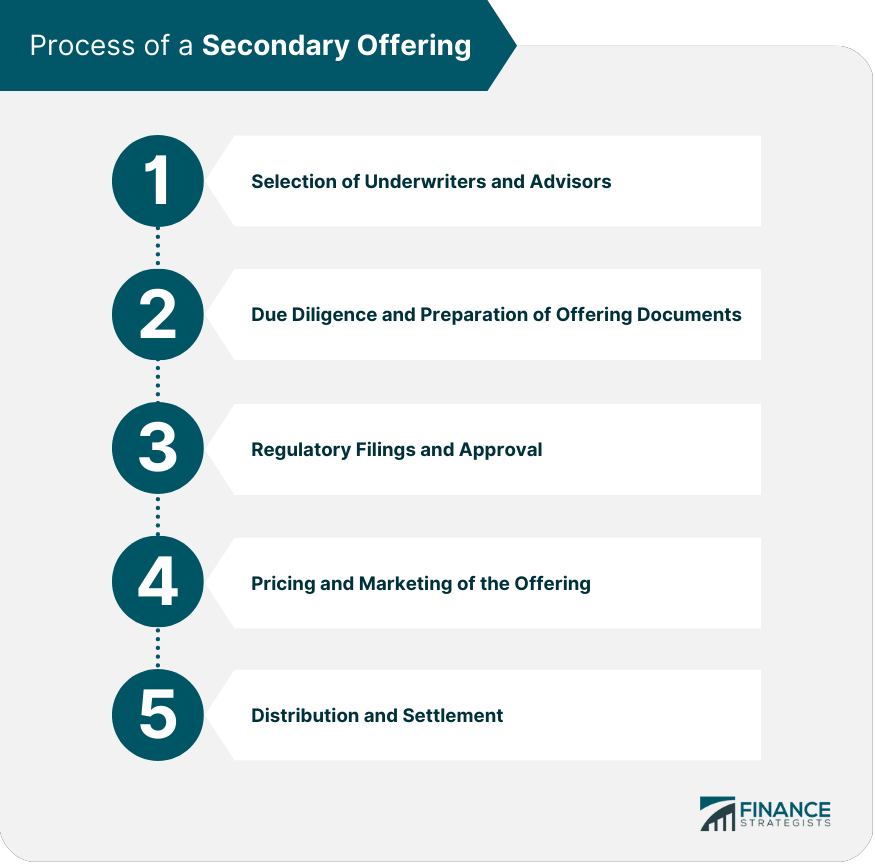

Process of a Secondary Offering

Selection of Underwriters and Advisors

Due Diligence and Preparation of Offering Documents

Regulatory Filings and Approval

Pricing and Marketing of the Offering

Distribution and Settlement

Regulatory and Legal Aspects of Secondary Offerings

Securities and Exchange Commission (SEC) Regulations

Financial Industry Regulatory Authority (FINRA) Rules

Insider Trading Considerations

Disclosure Requirements

Key Market Participants in Secondary Offerings

Issuing Companies

Selling Shareholders

Underwriters and Advisors

Institutional and Retail Investors

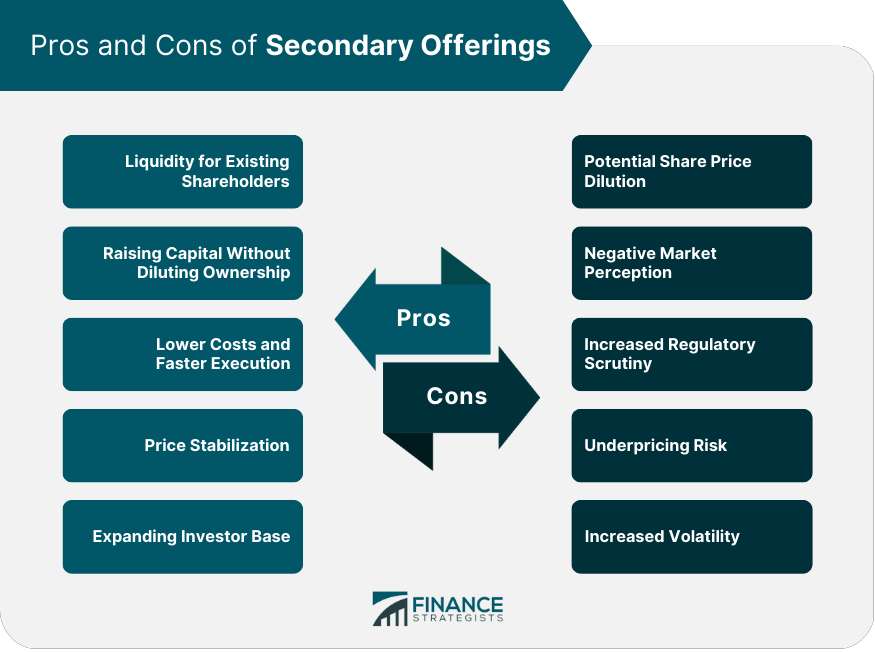

Pros of Secondary Offerings

Cons of Secondary Offerings

Conclusion

Secondary Offerings FAQs

Secondary offerings are the sale of additional shares by a company after its initial public offering (IPO). They can be used to raise capital, provide liquidity to shareholders, or expand the investor base. Unlike primary offerings, where companies issue new shares to raise capital for the first time, secondary offerings involve the issuance of new shares or the sale of existing shares by the company or its shareholders.

There are several types of secondary offerings, including follow-on public offerings (FPOs), at-the-market offerings (ATMs), registered direct offerings (RDOs), confidentially marketed public offerings (CMPOs), and private investments in public equity (PIPEs). Each type has its unique characteristics, advantages, and disadvantages, depending on the company's goals and market conditions.

Secondary offerings offer advantages such as liquidity for existing shareholders, raising capital without diluting ownership, lower costs and faster execution, price stabilization, and expanding the investor base. However, they also have potential drawbacks, including share price dilution, negative market perception, increased regulatory scrutiny, underpricing risk, and increased volatility.

The process of conducting a secondary offering typically involves selecting underwriters and advisors, performing due diligence and preparing offering documents, obtaining regulatory approvals, pricing and marketing the offering, and distributing and settling the shares.

Companies must comply with various regulations and legal requirements when conducting secondary offerings. These may include Securities and Exchange Commission (SEC) regulations, Financial Industry Regulatory Authority (FINRA) rules, insider trading considerations, and disclosure requirements to ensure transparency and protect investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.