Margin is the difference between what money a person has on their own and what that same person owes. Margin represents the difference between the total value of an investment and the loan amount from the broker. This difference acts as collateral or security for the borrowed amount. Buying on margin then refers to money that has been borrowed from a broker whose intended use is to make an investment, such as the purchase of a stock. Using margin amplifies both the potential gains and potential losses of an investment. As it allows for larger positions in the market, even a small percentage change in an investment's value can lead to a significant increase in return on equity. However, this also means that losses can multiply just as quickly. Thus, margin investing can be a powerful tool for experienced investors, but it comes with increased risks that one must understand and manage prudently. When an investor decides to buy on margin, they essentially open a margin account with their brokerage. This is different from a regular trading account. Once the margin account is set up, the investor can borrow up to 50% of the purchase price of a stock. This percentage can vary based on the broker and the type of investment. As the investor's portfolio changes in value, they might be required to deposit more funds into the margin account, known as a margin call. It's crucial to understand that the broker has the right to demand the repayment of the loan at any time. If the investor fails to cover a margin call by depositing more funds or selling assets, the broker can sell the investor's securities without any notification. Additionally, interest is charged on the borrowed amount, and this interest can accumulate rapidly, especially if the investments don't perform well. The primary benefit of buying on margin is that it allows an investor to purchase more stock than they would have been able to on their own. The most prominent benefit of margin trading is the potential for amplified returns. By leveraging borrowed capital, investors can control a larger position in the market than they could using their funds alone. If the investment moves in the favorable direction, the percentage returns on the equity can be significant. For instance, if an investor uses margin to double their position in a stock and that stock rises by 10%, the investor would realize a 20% return on their initial investment, minus any interest and fees. Using margin can also facilitate portfolio diversification. With additional buying power, investors can spread their capital across various assets or sectors, potentially mitigating risks associated with having all funds tied up in one investment. Diversification, often referred to as the only "free lunch" in investing, allows investors to smoothen out returns and potentially achieve a better risk-adjusted performance. By allocating margin funds across different assets, investors can benefit from the upside of multiple investments while hedging against potential downside in any single asset. With additional funds at their disposal, investors can swiftly capitalize on market opportunities without having to liquidate other assets. This can be particularly beneficial in volatile markets where prices can change rapidly, and opportunities may be fleeting. Additionally, margin accounts can be used for short selling, where investors aim to profit from a decrease in a security's price. This adds another dimension to potential investment strategies, allowing for gains even in a bearish market environment. The primary drawback of buying on margin is that it increases the amount of risk that is already present in stock trading. With a loan, comes an interest rate and some form of collateral. In this case, that collateral is the stock purchased with the loan. As a result, the effect of both gains and losses are exaggerated when buying on margin. So even though more stock may be able to be purchased, thus yielding more possible return, if the return ever drops below the interest rate owed to the broker, then the investor will lose money. If after a period of time, the interest rate can no longer be paid, then the broker will liquidate the assets the investor put up as collateral. While margin trading can amplify the gains in a thriving market, it simultaneously heightens the losses in a downturn. Essentially, investors are operating with a leveraged position. So, while a 10% increase on a margin-bought stock can offer a 20% return, a 10% decline can equally result in a 20% loss. What's more daunting is that these losses can exceed the initial investment. For instance, if an investor has used borrowed money to buy shares, and those shares plummet in value, the investor will still owe the brokerage the initial amount borrowed plus interest. Perhaps one of the most intimidating aspects of margin trading is the dreaded 'margin call.' A margin call occurs when the value of the investor's margin account falls below the broker's required amount. In such situations, the broker demands that the investor deposit additional money or securities to cover the deficit. If the investor cannot meet the margin call, the broker has the absolute right to sell the securities in the account at a possible loss to recoup their loan. Often, this forced liquidation occurs without any prior notice and at an inopportune time for the investor. This abrupt sale can cause an irreparable dent in the investment strategy and the overall portfolio value. Margin trading, if not managed meticulously, can wreak havoc on the long-term performance of an investor's portfolio. Borrowing costs, including interest rates on the margin loan and potential fees, can accumulate quickly and eat into the profits. Moreover, in volatile markets, frequent margin calls can force investors into a vicious cycle of selling assets to cover the margin, often leading to the realization of losses. Continuous erosion of the portfolio in this manner can set back the investor's financial goals and substantially diminish the compounded growth over time. In order to begin buying on margin, an investor needs to set up a margin account. An ordinary brokerage account will not do, due to the fact that a portion of the money in the account does not belong to the account holder. Margin accounts are set-up through a brokerage firm and typically require that a minimum of $2,000 be placed in the account. Once a margin account has been opened, the investor may begin to purchase stock. With most margin accounts, there is an initial margin. Which sets the requirement for how much of the investor's own money needs to be put into the account before any stock can be purchased. For instance, if the initial margin is 50% and the investor wants to purchase $10,000 worth of securities then the investor needs $5,000 of their own money. If the investor were to only invest in $5,000 worth however, therefore not exceeding the amount of money personally owned, then no margin has been used to buy. As a result, no official loan has been made and therefore no interest rate is owed and nor are any assets collateralized. Engaging in margin trading necessitates setting clear and stringent risk parameters. Investors should determine in advance the maximum amount they are willing to borrow, which should ideally be well below the broker's limit. Setting a personal borrowing ceiling can help prevent over-leverage. Additionally, one should decide on the maximum loss they are prepared to tolerate before exiting a position. This practice can guard against emotion-driven decisions in volatile market scenarios and maintain a level-headed approach to trading. Margin trading is not a set-it-and-forget-it strategy. Due to its inherent risks, it requires constant vigilance. Regular monitoring of the portfolio's performance is crucial to ensuring its health and to preempt potential margin calls. Efficient management entails reassessing the portfolio's diversification, re-evaluating positions that move against the investment thesis, and consistently ensuring that the leverage level aligns with the risk tolerance. Knowledge is a potent tool in the high-stakes world of margin trading. Before diving into this realm, investors should prioritize educating themselves about the nuances, mechanics, and implications of trading on margin. Many brokerages offer resources, tutorials, and even simulation platforms to practice margin trading without real money on the line. Making the most of these resources can bolster one's confidence and expertise, paving the way for more informed decisions in live trading scenarios. Margin refers to the difference between an individual's personal funds and their outstanding debt. It serves as collateral for borrowed amounts, enabling amplified investment potential. Buying on margin involves borrowing from a broker to invest, offering both increased returns and intensified losses. While margin trading offers benefits such as enhanced returns, diversified opportunities, and increased investment flexibility, it also entails significant risks. Magnified losses, margin calls, and potential negative impacts on portfolio performance highlight the downsides. Effective management is paramount, involving the establishment of risk parameters, regular portfolio monitoring, and prioritized education. Success in margin trading demands meticulous attention to risk and reward, informed decision-making, and continuous learning to navigate its intricate landscape effectively.What Is Margin?

How Does Buying on Margin Work?

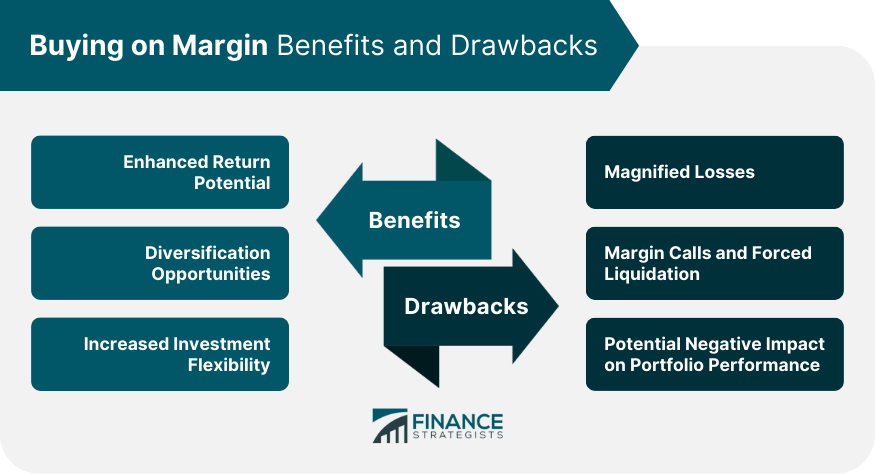

Buying on Margin Benefits

Enhanced Return Potential

Diversification Opportunities

Increased Investment Flexibility

Buying on Margin Drawbacks

Magnified Losses

Margin Calls and Forced Liquidation

Potential Negative Impact on Portfolio Performance

How to Start Buying on Margin

Buying on Margin Example

Best Practices for Margin Trading

Set Appropriate Risk Parameters

Monitor and Manage Portfolio Regularly

Prioritize Education

Conclusion

Margin FAQs

Margin refers to money that has been borrowed from a broker. The intended use is to make an investment, such as the purchase of a stock.

The primary benefit of buying on margin is that it allows an investor to purchase more stock than they would have been able to on their own.

The primary drawback of buying on margin is that it increases the amount of risk that is already present in stock trading.

An ordinary brokerage account will not allow margin trading, due to the fact that a portion of the money in the account does not belong to the account holder. Margin accounts are set-up through a brokerage firm and typically require that a minimum of $2,000 be placed in the account.

If the initial margin is 50% and the investor wants to purchase $10,000 worth of securities, then they need to deposit $5,000 of their own money. If the investor were to only invest in $5,000 worth however, therefore not exceeding the amount of money personally owned, then no margin has been used to buy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.