A margin call is an order from a broker to an investor, that demands that the investor place more money into their margin account. This occurs when the value of the investor's margin account drops below the broker's required amount. Essentially, a margin call ensures that the broker has adequate funds to cover potential losses on trades made with borrowed money. By ensuring that investors maintain a certain level of equity in their accounts, margin calls reduce the potential for significant losses that could impact both the investor and the broker. They also emphasize the importance of investors being aware of their financial commitments and the volatile nature of markets. A margin call is ordered whenever the investor's personal funds within the account falls below the minimum % agreed upon, called the maintenance requirement. The NYSE mandates that investors place at least 25% of their own money in a margin account, but brokerage firms are known to require much more. In simpler terms, think of a margin call as a warning bell. If you were swimming and started to drift too far from the shore, a lifeguard might blow a whistle to alert you. Similarly, a margin call alerts you when your investments are drifting into risky territory. As a quick refresher, margin in a type of stock account that contains both private investor and broker loaned money for the purpose of buying securities. The reason investors open margin accounts, are so that they may be able to purchase more securities than they would have been able to on their own. The purpose of a margin call is to safeguard both the broker and the investor from escalating financial losses in a margin account. When an investor trades on margin, they borrow funds from the broker to amplify their buying power. As the market fluctuates, there's potential for the value of investments to decline. If this decline breaches the maintenance margin—a predetermined equity threshold set by the broker—it could expose the broker to risks if the investor is unable to cover potential losses. The margin call acts as a protective mechanism, ensuring that there are always sufficient funds in the account to cover these potential losses. It prompts the investor to either deposit more money or sell off assets to bring the equity back to an acceptable level. The initial margin requirement is the minimum proportion of the total investment value that an investor must contribute using their own funds. Typically expressed as a percentage, this requirement ensures that investors have some skin in the game and don't rely solely on borrowed funds. For instance, if the initial margin requirement is 50%, and an investor wishes to purchase $10,000 worth of stock, they would need to provide $5,000 of their own money. While the initial margin sets the starting equity threshold, the maintenance margin is the minimum amount of equity an investor must maintain in their margin account. If an account's equity falls below this threshold, typically set as a percentage of the total value of the investment, it triggers a margin call. A margin call is triggered when the equity in a margin account drops below the maintenance margin requirement. Factors such as a declining asset value or market volatility can cause this drop. Once this happens, the broker requires the investor to either deposit more funds or sell assets to restore the account balance. When a margin call occurs, the broker will notify the investor, usually through electronic means such as email or phone call. This notification serves as a warning and gives the investor a timeframe, often very limited, to address the shortfall in their account. To determine at what threshold a margin call would be issued, you may use the equation If your personal funds fall below the MMR, and a margin call is ordered you have a few options. You may either : Pay off the margin call Liquidate some of your stock, and use the capital to reduce the margin loan Ignore the call and see your stock liquidated without your approval by the broker. Let's look at an example. An investor buys $50,000 of Google stock, using $25,000 of his own money and $25,000 of a broker's. The broker's MMR is set at 30% which, is great because at the moment the investor has put up 50% of the cost. However, a week or two goes by and the stock value drops to $35,000. Which means that the investor's equity has fallen to $10,000 or 28% (market value- borrowed funds/market value). Which is less than the 30% MMR. As a result, the broker makes a margin call of $500 in order to be once again eligible for margin. (Market Value x MMR - Investor Equity = Margin Call) One of the best ways to avoid margin calls is to use leverage judiciously. Instead of maximizing borrowing, investors should set realistic leverage levels based on their risk tolerance, investment horizon, and market conditions. Keeping a close eye on market conditions and how they impact the value of investments can help investors anticipate potential margin calls. By staying informed, they can make proactive decisions, such as reducing leverage or depositing additional funds. When faced with a margin call, investors have the option to deposit more funds into their account to meet the maintenance margin requirement. By doing so, they can avoid the forced sale of assets and retain their investment positions. Rapid and significant price fluctuations can lead to sudden decreases in the value of assets held in a margin account, pushing the equity below the maintenance margin level. When the value of securities purchased on margin declines, so does the equity in the margin account. If the decline is sharp and significant, it can easily breach the maintenance margin requirement, prompting a call from the broker. If an investor overextends themselves by borrowing heavily and not maintaining a sufficient equity cushion, even minor market movements can lead to a margin call. This emphasizes the need for prudent borrowing and understanding the risks associated with leveraged investments. If an investor cannot meet the requirements of a margin call by depositing more funds, the broker has the right to sell the assets in the account, even without the investor's consent. This forced liquidation can lead to the sale of assets at inopportune times, potentially locking in losses. Trading on margin amplifies potential gains but also potential losses. When a margin call is triggered, and assets are sold to cover the shortfall, investors may realize significant losses, particularly in volatile markets. Margin calls underscore the significance of risk management in trading. They serve as a stark reminder that while leverage can enhance returns, it also heightens risks. Investors need to adopt strategies to manage and mitigate these risks effectively. A margin call safeguards both investors and brokers from escalating financial losses within margin accounts. It is an order that demands investors to replenish their margin accounts when the account's equity drops below the required amount. This ensures that there's sufficient capital to cover potential losses on leveraged trades. Margin calls exemplify the importance of maintaining a certain level of equity to avoid significant losses, emphasizing the need for investors to remain vigilant about their financial commitments and market volatility. The purpose of margin calls is to mitigate risks associated with margin trading by ensuring adequate equity levels in the account. They act as warning mechanisms, alerting investors to potential dangers of excessive leverage. The process of triggering a margin call involves monitoring equity levels against maintenance margin requirements, with brokers notifying investors when necessary. Managing margin calls involves setting realistic leverage levels, staying informed about market conditions, and adding funds to meet requirements.What Is Margin Call?

Defining Margin Call in Simple Terms

Purpose of a Margin Call

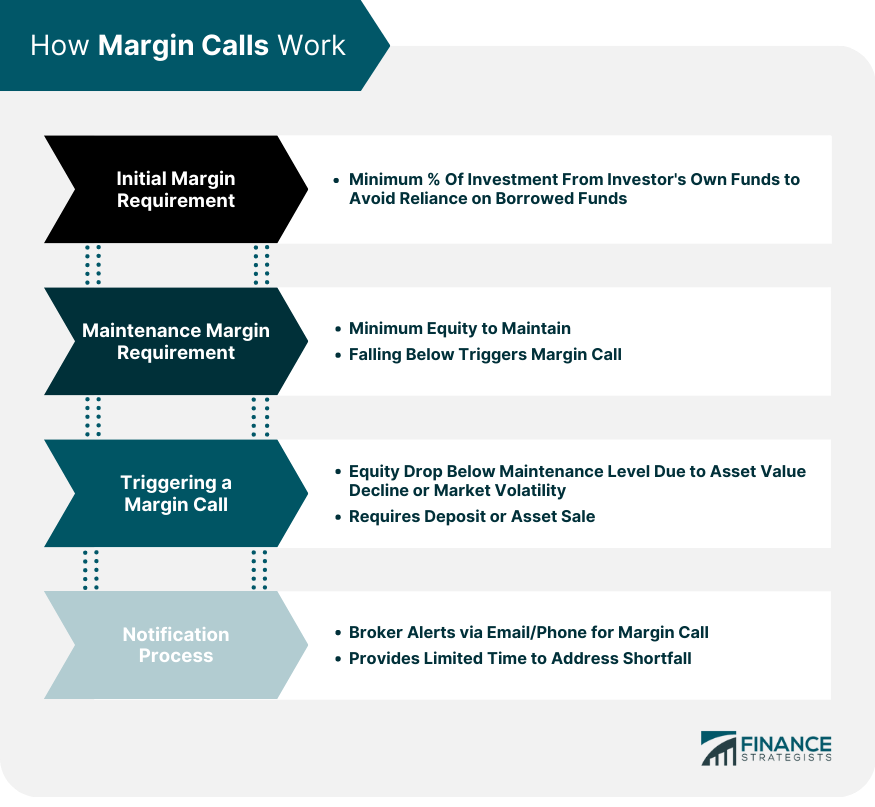

How Margin Calls Work

Initial Margin Requirement

Maintenance Margin Requirement

Triggering a Margin Call

Notification Process

Formula for Determining Margin Call

Minimum Maintenance Requirement

Example of a Margin Call

Managing Margin Calls

Set Realistic Leverage Levels

Monitor Market Conditions

Add Funds to Meet Margin Requirements

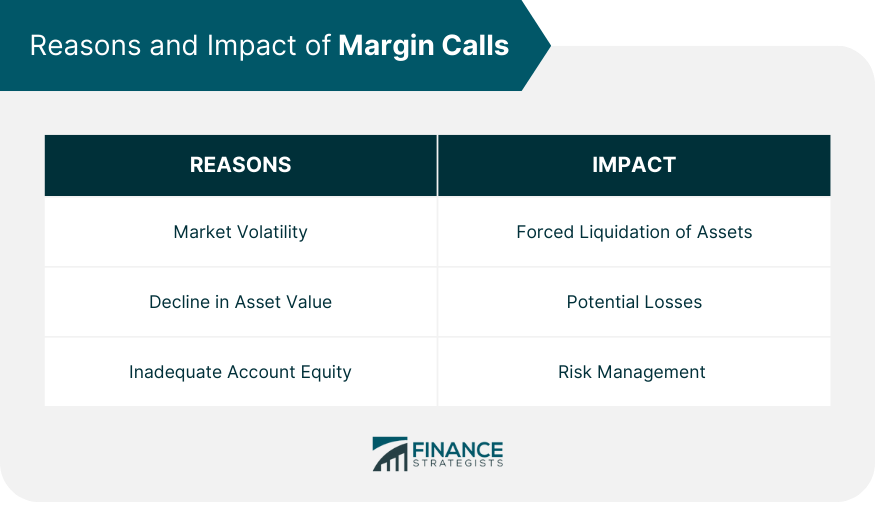

Reasons for Margin Calls

Market Volatility

Decline in Asset Value

Inadequate Account Equity

Impact of Margin Calls

Forced Liquidation of Assets

Potential Losses

Risk Management

Conclusion

Margin Call FAQs

A margin call is an order from a broker to an investor, that demands that the investor place more money into their margin account.

A margin call is ordered whenever the investor’s personal funds within the account fall below the minimum percentage agreed upon, called the maintenance requirement.

To determine at what threshold a margin call would be issued, you may use the equation Account Value = Margin Loan / 1- Minimum Maintenance Requirement (MMR).

The reason investors open margin accounts are so that they may be able to purchase more securities than they would have been able to on their own.

After receiving a margin call, you may either: pay off the margin call; liquidate some of your stock and use the capital to reduce the margin loan; ignore the call and see your stock liquidated without your approval by the broker.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.