A company's market cap is the first way an investor assesses how "big" a company is. Market Capitalization is the aggregate dollar-value of all outstanding shares of a company's stock. This means, if a company has 15 million shares of stock out in the public markets and each of those shares is valued at $10, then that company has a "market cap" of $150 million. Market cap is the current "total value" of a public company in the eyes of the marketplace. This value provides a snapshot of the company's current market value and is a dynamic metric that fluctuates with changes in stock prices. There are traditionally five categories of market capitalization: Mega-cap Large-cap Mid-cap Small-cap Micro-cap Many mutual funds and institutional investors have specific mandates regarding the size of companies they can invest in, be it large-cap, mid-cap, or small-cap stocks. Generally, larger market caps tend to be associated with established, mature companies that have a significant presence in their industries. These companies often have a broad customer base, diverse product lines, and robust revenue streams. In contrast, smaller market caps might suggest younger, more nimble companies, potentially poised for faster growth but also accompanied by higher risk. Market capitalization also facilitates the comparison of companies across the same industry or sector. While it’s just one of many metrics, it's especially valuable when investors want a quick reference to compare the relative size of companies. For instance, if two tech companies have significantly different market caps, it may indicate differing market perceptions about their future growth potential, profitability, or competitive positioning. Investment strategies often revolve around market capitalization. Some investors are inclined towards large-cap stocks because they perceive them as more stable with consistent dividends. Conversely, others might be attracted to small-cap or mid-cap stocks, seeking higher growth potential. Thus, market capitalization plays a pivotal role in influencing investment decisions by helping investors identify stocks that align with their risk tolerance and investment objectives. Each category of market capitalization has its own characteristics associated with it. Mega-cap companies are very mature companies that have established dominance in their industry. These companies are generally "blue chip" stocks and viewed as "safe, steady" investments for long-term strategies. Mega-cap companies have established themselves as household names, with their products and services resonating across international markets. Large-cap companies typically have a market capitalization of $10 billion or more. They are usually industry leaders and have established a significant presence in the market. These companies tend to have stable earnings, and many of them pay dividends. Investing in large-cap stocks is often considered less risky compared to mid or small-cap stocks. Mid-cap companies have a market capitalization ranging from $2 billion to $10 billion. They often represent businesses that are in the growth phase of their lifecycle. While they offer higher growth potential than large-cap companies, they also come with a higher risk. Mid-cap stocks can provide a balance of growth and stability in a diversified portfolio. Small-cap companies have a market capitalization of under $2 billion. They are usually young businesses and might operate in emerging industries or niche markets. While they offer substantial growth potential, they also possess a higher degree of risk due to their size, limited resources, and market vulnerability. Micro-cap companies typically have a market capitalization of under $300 million. These are much smaller businesses and often include start-ups. Investing in micro-cap stocks can be very risky as these companies can be more susceptible to market volatility, limited liquidity, and less regulatory oversight. Micro-cap companies, on the other hand, are typically young companies with little-to-no track record. Although micro-cap stocks are considered to be volatile of the 5 categories, investors often allocate a percentage of their portfolio to micro-cap stocks because of their potential upside. One of the significant benefits of using market capitalization is its ability to provide a straightforward performance comparison among companies. By looking at changes in market cap over time, investors can gauge the market's perception of a company's growth prospects, profitability, and overall health. It can help differentiate between companies that are genuinely growing in value and those that are not. Companies with a higher market capitalization tend to have more liquid stocks. This liquidity attracts more investors, as they can easily buy or sell large volumes of shares without significantly affecting the stock price. Consequently, these companies often find it easier to raise capital for expansion or other projects. A larger market capitalization often translates to a perception of stability and credibility in the marketplace. Such companies are viewed as safer bets by investors, especially during volatile market conditions, as they believe these firms have the resources and resilience to weather economic downturns. One of the primary limitations of relying solely on market capitalization is that it ignores other vital financial metrics. Factors like a company's debt, cash flows, earnings, and overall financial health are crucial in understanding its true value and potential. Market cap doesn't provide a holistic view of a company's financial standing. Market capitalization is closely tied to a company's stock price, which can be highly volatile and influenced by external factors such as market sentiment, news, and rumors. Moreover, in some cases, stock prices can be manipulated through practices like "pump and dump," which can distort a company's true market capitalization. Companies in certain sectors might naturally have higher market capitalizations than those in other industries, even if they generate similar revenues or profits. For instance, technology companies often have higher market caps compared to firms in traditional sectors like manufacturing. This variation can sometimes make cross-sector comparisons using market cap less meaningful. It is important to remember that a company's market cap may be different than the true economic worth of their assets and ability to generate profits—market cap can be viewed as what the markets perceive a company to be worth. Value investors like Warren Buffet, have built their careers by investing in companies that were more valuable than the market realized. It's for this reason that market cap, as well as any other single data point, should not be viewed in isolation when assessing a company's value. The size and value of a company can affect risk levels and returns when investing in its stocks. The higher the value of market capitalization, the "bigger" companies are perceived. Market capitalization serves as a fundamental metric in evaluating the size and value of a company within the financial landscape. It defines the aggregate value of a company's outstanding shares and provides a snapshot of its market standing. Through categories such as mega-cap, large-cap, mid-cap, small-cap, and micro-cap, investors can assess companies of varying sizes, each category indicative of distinct risk-reward profiles. This metric facilitates performance comparisons, aids in investment attraction due to liquidity and credibility, and guides investment strategies based on perceived stability. However, market capitalization has limitations, including its exclusion of crucial financial metrics, susceptibility to volatility and manipulation, and sector-related variations. Therefore, while market cap offers valuable insights, investors should complement its assessment with a comprehensive understanding of a company's financial health, industry context, and overall investment objectives to make informed decisions.Market Cap Meaning

Significance of Market Capitalization

Indicator of Company Size

Comparison Among Companies

Investment Decisions

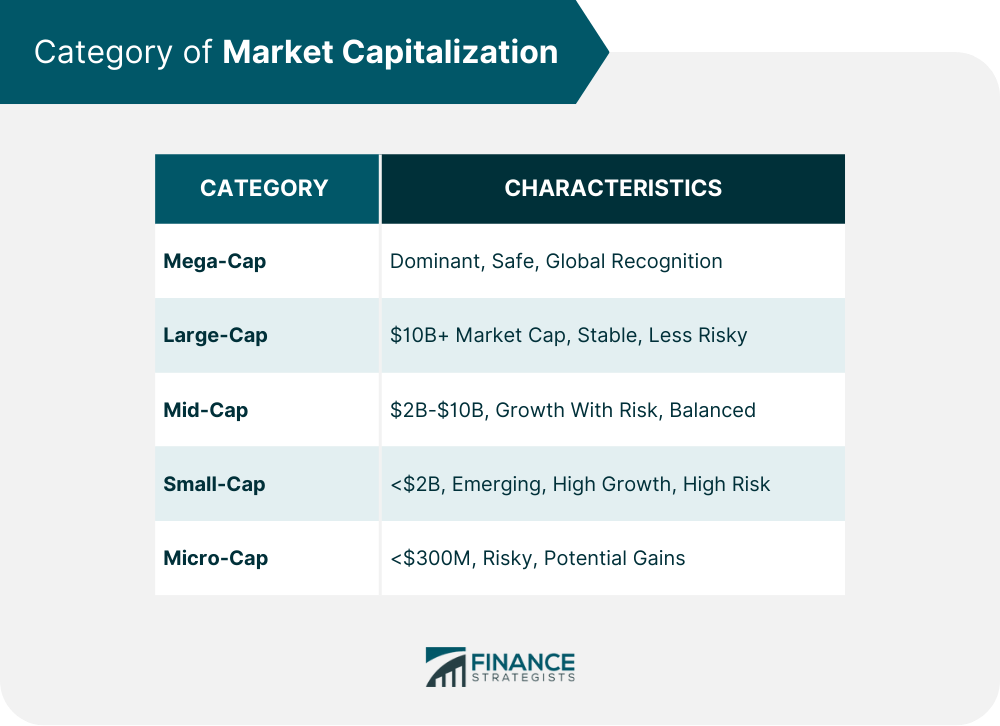

Categories of Market Capitalization

Mega-Cap

Large-Cap

Mid-Cap

Small-Cap

Micro-Cap

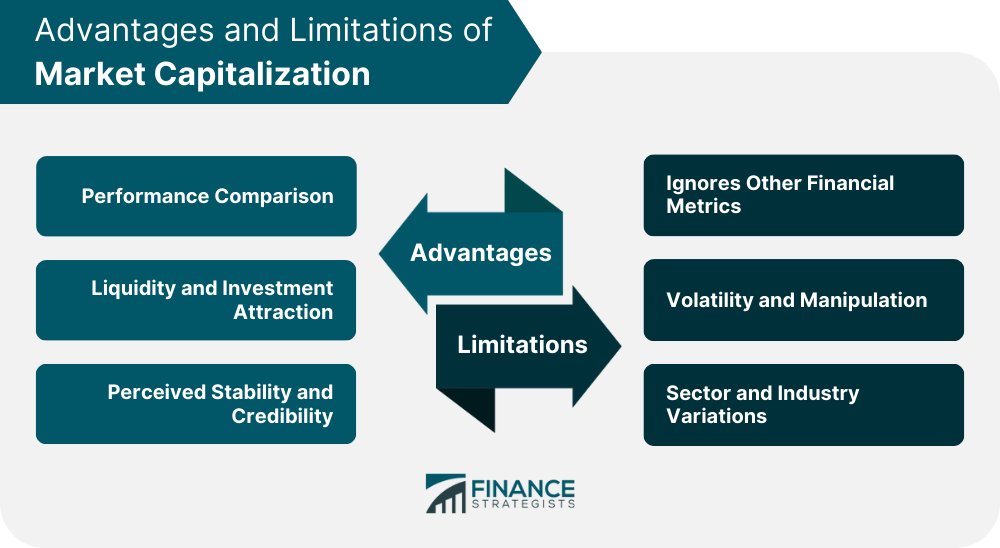

Advantages of Market Capitalization

Performance Comparison

Liquidity and Investment Attraction

Perceived Stability and Credibility

Limitations of Market Capitalization

Ignores Other Financial Metrics

Volatility and Manipulation

Sector and Industry Variations

The Perception of Value

Consider More Data Points

Conclusion

Market Capitalization FAQs

Market cap is short for Market Capitalization.

Market capitalization is the aggregate dollar-value of all outstanding shares of a company’s stock.

A company’s market cap is the first way an investor assesses how “big” a company is.

It is important to remember that a company’s market cap may be different than the true economic worth of their assets and ability to generate profits—market cap can be viewed as what the markets perceive a company to be worth.

The five traditional categories of market capitalization are mega-cap, large-cap, mid-cap, small-cap, micro-cap.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.