The Nasdaq-100 Index is a stock market index composed of 100 of the largest non-financial companies, both domestic and international, listed on the Nasdaq Stock Market. It is a market-capitalization-weighted index, meaning the companies with the highest market value have the most influence on the index's price. Established in January 1985, the Nasdaq-100 Index serves as a benchmark for U.S. technology and growth stocks. Over the years, it has evolved to include companies from various sectors, although technology companies still dominate. The index is a barometer of innovation, reflecting the performance of companies at the forefront of cutting-edge sectors like technology, biotechnology, and modern consumer services. The Nasdaq-100 Index provides a snapshot of the health of the technology and innovative sectors of the market. By tracking the performance of these companies, investors can gauge market trends, make comparisons, and inform their investment decisions. Additionally, it serves as the underlying index for numerous investment products, including options, futures, and Exchange-Traded Funds (ETFs). The Nasdaq-100 Index represents a diverse range of companies from sectors such as technology, healthcare, consumer services, and telecommunications. These include tech giants like Apple, Microsoft, Amazon, and Alphabet (Google's parent company), biotech firms such as Amgen, and consumer service companies like Starbucks. For a company to qualify for inclusion in the Nasdaq-100 Index, it must be listed on the Nasdaq Stock Market and fall under specific sector classifications. Excluded are financial companies, including investment companies. Eligibility is also dependent on the company's market capitalization, liquidity, and other factors. Although the Nasdaq-100 is often associated with technology stocks, it is more diverse, representing various sectors. These include Information Technology, Consumer Discretionary, Communication Services, Health Care, Industrials, Consumer Staples, and Utilities. The Nasdaq-100 Index employs a modified capitalization-weighted methodology. This means that the companies with the largest market capitalization, calculated by multiplying the number of a company's outstanding shares by its stock price, have the most significant impact on the index's price. Nasdaq reviews the composition of the Nasdaq-100 Index annually and adjusts the weights of the companies. This rebalancing process ensures that the index continues to represent the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Market. Additionally, if a company no longer meets the eligibility criteria, it is replaced by a more suitable contender. Stock splits and dividends can affect the price of the index. For example, if a company in the Nasdaq-100 undergoes a stock split, the price of its stock will decrease, but the number of shares will increase, keeping the market capitalization the same. Dividends, on the other hand, reduce a company's retained earnings and therefore its market capitalization, which could impact the index's price. The Nasdaq-100 Index has experienced significant growth since its inception. Key milestones include surpassing the 2000 mark during the dot-com boom of the late 1990s, and later recovery after the dot-com bubble burst. Its recovery was largely fueled by the surge in technology and internet-based businesses. It reached another milestone in 2020, driven by the shift to remote work and increased digital reliance due to the COVID-19 pandemic. The Nasdaq-100 Index is often compared to other significant indices, such as the S&P 500 and the Dow Jones Industrial Average (DJIA). While the S&P 500 encompasses a broader spectrum of the market, the Nasdaq-100 Index is more concentrated on tech and growth-oriented companies. This concentration has led to the Nasdaq-100 outperforming the S&P 500 and Dow Jones during periods of tech-sector strength. Historically, the technology sector has been a significant driver of the Nasdaq-100's performance. Companies such as Apple, Amazon, Microsoft, and Alphabet have consistently been top performers in the index. However, other sectors like consumer services, with companies like Starbucks and Booking Holdings, have also contributed to the index's performance. Direct investment entails purchasing the stocks of individual companies listed on the Nasdaq-100 Index. This method allows for potentially high returns but also comes with its own set of challenges and requirements. By investing directly, investors can potentially reap substantial returns, especially if they pick stocks that outperform the overall market. Investing directly in all the companies of the Nasdaq-100 would require significant capital, given the high stock prices of many companies listed on the index. Picking the right stocks requires extensive research and a deep understanding of each company, its financial health, and its potential for growth. Investors must stay updated on company news, industry trends, and broader economic factors that could impact stock prices. Alternatively, investors can gain exposure to the Nasdaq-100 Index by purchasing shares in index funds or ETFs that track the index, like the Invesco QQQ ETF. This method offers several advantages, including diversification and lower investment thresholds. Index funds and ETFs provide instant diversification as they hold all or a representative sample of the stocks in the index. This can help reduce the risk associated with the poor performance of any single company. Index funds and ETFs generally have lower investment thresholds compared to direct investment, making the Nasdaq-100 Index accessible to a wider range of investors. ETFs like Invesco QQQ can be bought and sold like individual stocks, offering flexibility and ease of trading. They are traded on exchanges, allowing investors to buy and sell shares during market hours and even use advanced trading strategies like short selling or buying on margin. The Nasdaq-100 Index is recognized for its large concentration of innovative, high-growth companies. Many of these companies are leading players in sectors such as technology, biotechnology, and consumer services. By investing in the index, you get exposure to these industry giants, potentially reaping the benefits of their high-growth trajectories. Often, the high-growth nature of the companies in the Nasdaq-100 can lead to attractive returns, especially during periods of tech-sector strength. Tech companies tend to scale quickly and can often generate significant revenues, which can then be reflected in their stock prices. If the tech sector is performing well, the index as a whole often performs well too. Although the Nasdaq-100 is known for its concentration in the tech sector, it's important to note that it still provides a certain level of diversification. The index covers various sub-sectors within the tech industry, including software, hardware, internet services, and semiconductors. Furthermore, the index also includes other innovative sectors, providing a certain degree of balance. While the concentration in the tech sector can be an advantage during periods of tech-sector strength, it can also be a disadvantage. The Nasdaq-100 can be more susceptible to market volatility, especially if it's related to the tech sector. If the tech sector experiences a downturn, it's likely that the index will also suffer losses. The high-growth nature of many of the companies in the Nasdaq-100 also means they may be more susceptible to market volatility. High-growth stocks can be more volatile as they're often valued based on future earnings potential rather than current profitability. As such, changes in market sentiment can have a significant impact on their stock prices. The Nasdaq-100 can be vulnerable to sector-specific downturns due to its heavy concentration in the tech sector. If a downturn occurs in a specific sector that's heavily represented in the index, such as software or semiconductors, the entire index can be negatively affected. As a barometer of the technology and growth sectors, the Nasdaq-100 Index has considerable influence on global markets. Its performance can sway investor sentiment worldwide, impact other stock indices, and inform investment strategies. The Nasdaq-100 can also serve as an economic indicator. For instance, strong performance may signal healthy consumer and business spending, particularly in the technology sector. Conversely, a downturn may indicate a contraction in these areas. Economic crises can significantly impact the Nasdaq-100, as seen during the dot-com bubble and the 2008 financial crisis. However, the index has shown resilience and capacity to recover. Notably, during the COVID-19 pandemic, the Nasdaq-100 outperformed other indices, driven by the acceleration of digital transformation trends. The Nasdaq-100 Index, with its focus on technology and growth companies, plays a critical role in the financial landscape. The Nasdaq-100 Index, established in 1985, is a market-capitalization weighted index comprising 100 of the largest non-financial companies listed on the Nasdaq Stock Market. While technology companies dominate the index, it represents diverse sectors, including healthcare, consumer services, and telecommunications. The index serves as a benchmark for U.S. technology and growth stocks, reflecting the performance of innovative companies at the forefront of cutting-edge sectors. It is used by investors to gauge market trends and inform investment decisions, and also serves as the underlying index for various investment products. Investing in the Nasdaq-100 can offer exposure to high-growth, innovative companies and the potential for attractive returns. However, concentration in the tech sector and susceptibility to market volatility are important risks to consider. The Nasdaq-100 Index plays a significant role in global markets and can serve as an indicator of economic trends and resilience during crises.What Is the Nasdaq-100 Index?

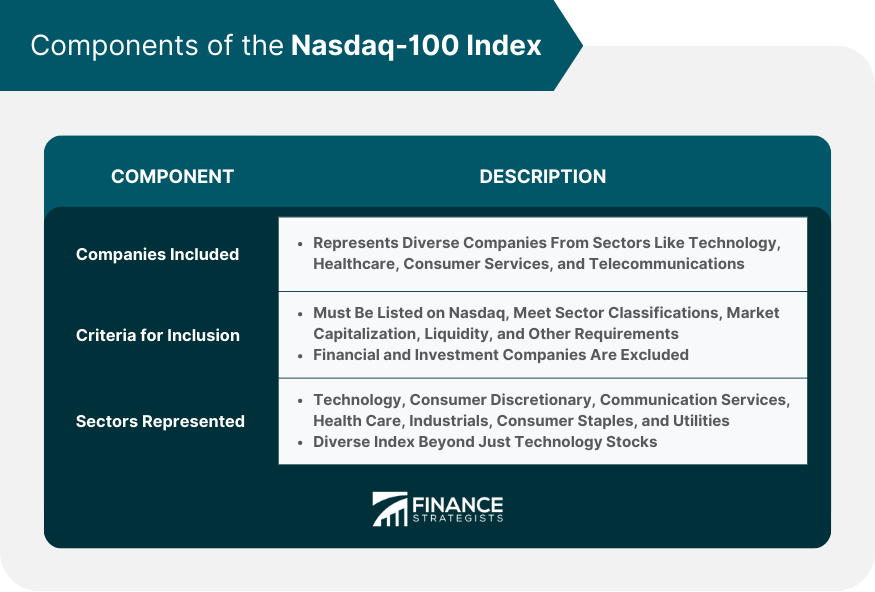

Components of the Nasdaq-100 Index

Companies Included in the Index

Criteria for Inclusion in the Index

Sectors Represented in the Index

Functioning of the Nasdaq-100 Index

Market Capitalization-Weighted Methodology

Rebalancing and Re-Ranking Process

Impacts of Stock Splits and Dividends on the Index

Performance of the Nasdaq-100 Index

Historical Performance and Key Milestones

Comparison With Other Major Indices

Analysis of Top-Performing Companies and Sectors in the Index

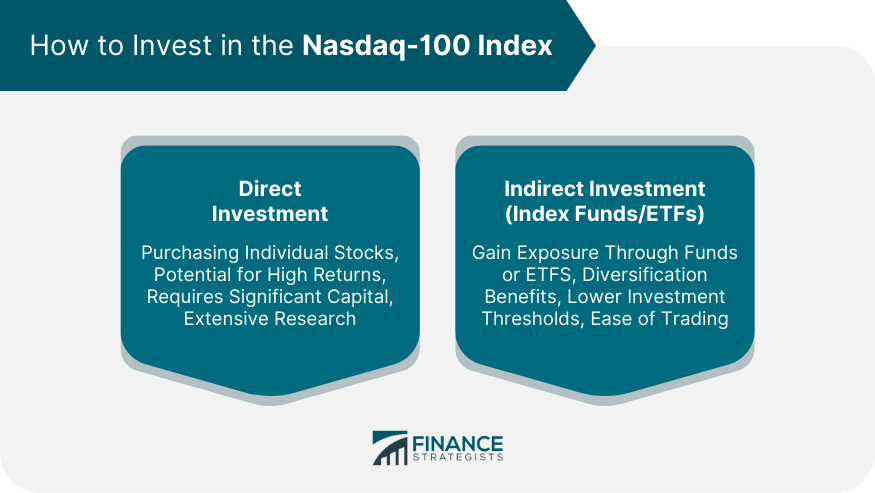

Investing in the Nasdaq-100 Index

Direct Investment in the Nasdaq-100 Index

Potential for High Returns

Requirement of Significant Capital

Need for Extensive Research

Indirect Investment through Index Funds and ETFs

Diversification Benefits

Lower Investment Thresholds

Ease of Trading

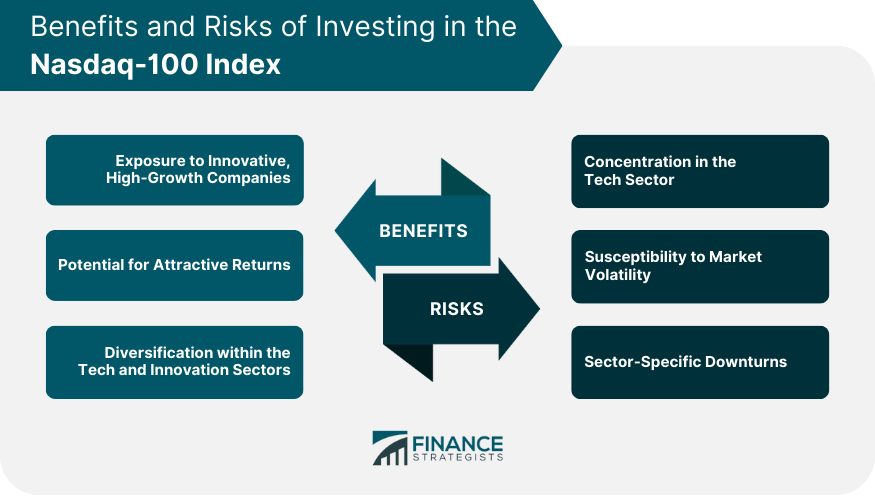

Benefits of Investing in the Nasdaq-100 Index

Exposure to Innovative, High-Growth Companies

Potential for Attractive Returns

Diversification within the Tech and Innovation Sectors

Risks Associated With Investing in the Nasdaq-100 Index

Concentration in the Tech Sector

Susceptibility to Market Volatility

Sector-Specific Downturns

Nasdaq-100 Index in the Global Economy

Influence of the Nasdaq-100 on Global Markets

Role of the Nasdaq-100 in Predicting Economic Trends

Impact of Economic Crises on the Nasdaq-100

Final Thoughts

Nasdaq-100 Index FAQs

The Nasdaq-100 Index is a stock market index that tracks the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Market.

The Nasdaq-100 Index includes a diverse range of companies from sectors such as technology, healthcare, consumer services, and telecommunications, with technology companies being the most dominant.

The Nasdaq-100 Index uses a market capitalization-weighted methodology, meaning companies with the largest market value have the most influence on the index's price.

Investing in the Nasdaq-100 Index offers exposure to high-growth, innovative companies, often leading to attractive returns. However, the index's concentration in the tech sector presents risks, as it can be more susceptible to market volatility and sector-specific downturns.

You can invest directly by buying stocks of individual companies within the index or indirectly through index funds or ETFs that track the Nasdaq-100 Index.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.