Non-assessable stock refers to shares of a company that have been fully paid for, absolving the shareholder from any additional financial obligation to the company. This is in contrast to assessable stock, where shareholders might be required to pay more than the initial purchase price. Non-assessable stocks are the standard type of stock issued by corporations in many jurisdictions, including the United States. The primary purpose of issuing non-assessable stock is to protect investors from future claims by the corporation. When an investor buys a non-assessable stock, they can rest assured that their liability is limited to the amount they initially invested, providing stability and predictability to their investment. This security and assurance help to foster a broad and active market for the purchase and sale of corporate stock. A critical feature of non-assessable stock is the requirement for full payment at the time of purchase. Once bought, shareholders owe nothing more to the company, regardless of its financial circumstances. Non-assessable stocks come with the guarantee that the issuing company will not demand additional payment. Hence, shareholders are not liable for the company's debts or other financial burdens. Non-assessable stock shareholders enjoy the same rights as other shareholders, including voting rights and dividends, without the risk of additional assessments. Non-assessable stocks offer significant protection to investors. As no additional payments can be levied, investors have a clear understanding of their maximum potential loss: the initial investment. Non-assessable stocks provides stability to an investor's portfolio. The absence of further financial obligations makes them a steady, predictable investment choice. Non-assessable stocks are widely accepted and more common in the market, which increases their liquidity and potential marketability. Companies issuing non-assessable stock may lack financial flexibility. In case of financial distress, they cannot call upon shareholders for additional capital. Relying solely on non-assessable stock for capital raising might limit a company's financial capacity, especially when substantial funding is needed. The board of directors of a company plays a critical role in the decision to issue non-assessable stock. They must balance the potential benefits against the possible financial limitations this type of stock might pose. Laws and regulations often govern the issuance of non-assessable stock. Companies must adhere to these rules, which vary between jurisdictions, during the issuance process. In the United States, when companies issue stocks, they are usually non-assessable. This means that shareholders are not obligated to pay any additional money beyond the initial purchase price of the shares. Both federal and state laws in the US strongly support non-assessable stocks and aim to protect investors. In the United Kingdom, most companies also issue non-assessable stocks, which are referred to as "fully paid" shares. The Companies Act of 2006 establishes the guidelines for issuing these shares. In simple terms, when investors buy fully paid shares, they do not have any further financial obligations to the company. In different countries, the laws and regulations related to non-assessable stocks can vary significantly. It is crucial for investors to be aware of these differences before investing in foreign markets. Understanding the specific rules governing non-assessable stocks in each jurisdiction is important for making informed investment decisions and avoiding potential financial risks. Non-assessable stocks provides a significant means for companies to raise capital. By issuing these stocks, companies receive immediate funding without incurring debt. The non-assessable stock allows a company to raise capital while distributing ownership. However, control remains with the existing management, given that voting rights are proportionate to shares held. Investors consider non-assessable stocks a lower-risk investment. However, they must still carefully evaluate the company's financial position and future prospects. Despite no risk of assessment, non-assessable stockholders face other risks, such as market and business risks. On the other hand, the rewards include potential dividends and capital appreciation. As business environments evolve, non-assessable stocks are likely to remain a staple in capital markets due to their benefits to both companies and investors. Predict a continued preference for non-assessable stocks, primarily driven by investor protection regulations. Innovations in financial technology and changing business landscapes might influence the issuance and trading of non-assessable stocks. However, their core value proposition of stability and investor protection will likely continue to drive their popularity. Non-assessable stock, a secure investment option, assures investors by eliminating further financial obligations beyond the initial investment. Though it may limit a company's financial flexibility, the benefit of immediate capital infusion typically outweighs this drawback. Despite varying regulations in different jurisdictions, non-assessable stocks are standard issuances in many regions, including the US and UK. They play a vital role in a company's capital structure, distributing ownership without diluting control. Amid evolving business environments and financial technology innovations, non-assessable stocks remain a reliable and robust choice, offering both investor protection and an efficient capital-raising method for companies. Therefore, investors should be aware of the benefits and risks of non-assessable stocks, considering not only a company's current financial status but also its future prospects.What Is a Non-Assessable Stock?

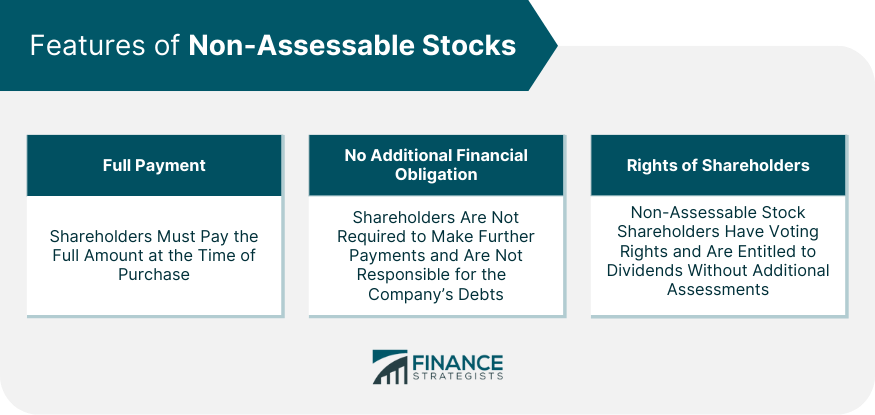

Features of Non-Assessable Stocks

Full Payment

No Additional Financial Obligation

Rights of Shareholders

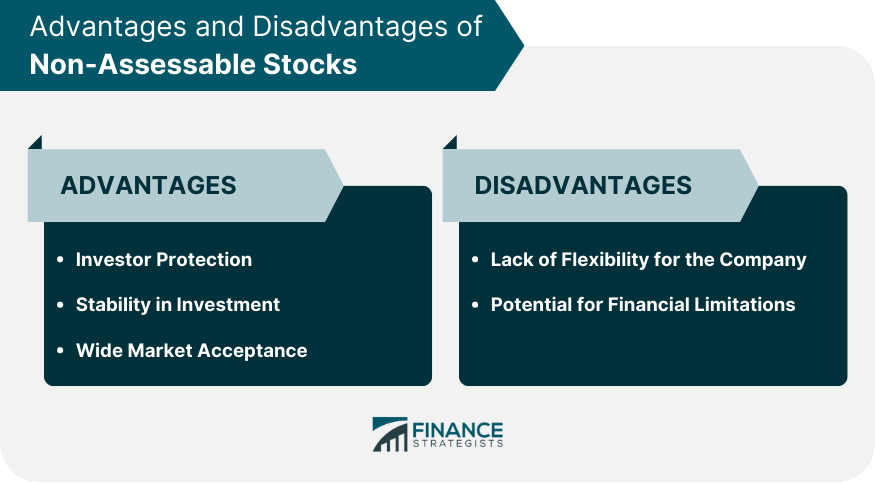

Advantages of Non-Assessable Stocks

Investor Protection

Stability in Investment

Wide Market Acceptance

Disadvantages of Non-Assessable Stocks

Lack of Flexibility for the Company

Potential for Financial Limitations

Creation and Issuance of Non-Assessable Stocks

Role of the Company's Board of Directors

Laws and Regulations

Non-Assessable Stock in Different Jurisdictions

US Perspective

UK Perspective

Other Jurisdictions

Role of Non-Assessable Stock in a Company’s Capital Structure

Raising Capital

Control of the Company

Non-Assessable Stock and Investors

Investor Considerations

Risks and Rewards

Future of Non-Assessable Stocks

Predictions and Trends

Impact of Changes on the Business Environment

Final Thoughts

Non-Assessable Stock FAQs

Non-assessable stock refers to shares of a company's capital stock that do not require additional payments or assessments from shareholders beyond the initial purchase price. The shareholders are not liable for any further financial obligations or debts of the company.

Non-assessable stock has a few key features. Firstly, it limits the liability of shareholders to the amount they have initially invested in the stock. Secondly, it provides shareholders with a sense of financial security, as they are not obligated to contribute additional funds to the company. Lastly, non-assessable stock allows for greater flexibility in attracting investors, as it eliminates the risk of unexpected financial obligations.

There are several advantages associated with non-assessable stock. Firstly, it provides investors with a clear understanding of their financial liability, as they are only responsible for the initial investment. Secondly, it can attract investors who are risk-averse or prefer a more predictable investment scenario. Thirdly, non-assessable stock can enhance the company's reputation and credibility among potential investors, as it demonstrates a commitment to transparency and financial stability.

While non-assessable stock offers certain advantages, it also has limitations. One limitation is that companies issuing non-assessable stock may face challenges in raising additional capital through assessments on existing shareholders if the need arises. Additionally, the company's ability to respond to unexpected financial crises or liquidity challenges may be limited, as shareholders are not obligated to provide additional funding.

No, not all companies can issue non-assessable stock. The ability to issue non-assessable stock is usually granted by the company's articles of incorporation or bylaws. Certain jurisdictions or regulatory bodies may have specific rules or limitations on the issuance of non-assessable stock. It is essential for companies to consult legal and financial professionals to understand the specific regulations and requirements applicable to their jurisdiction before issuing non-assessable stock.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.