Non-cumulative preferred stock is a type of preferred stock issued by companies to raise capital. It differs from cumulative preferred stock in terms of the dividend payment structure and the rights it provides to shareholders. Also known as straight preferred stock, non-cumulative stock does not carry a provision for the accumulation of unpaid dividends. This means that if a company fails to pay dividends in a particular period, the missed dividends are not required to be paid to shareholders in the future. The right to receive dividends is limited to the current period, and any unpaid dividends do not accumulate or carry forward to subsequent periods. The purpose of non-cumulative preferred stock is to provide flexibility to the issuing company in managing its dividend payments. By not accumulating unpaid dividends, the company has the option to skip dividend payments during periods of financial strain without incurring a significant future financial obligation. This can help the company preserve its cash flow and financial stability. Non-cumulative preferred stock offers several distinct features that investors should be aware of before considering investing in it. Non-cumulative preferred stock holders have a priority claim on dividend payments over common stockholders, but their dividends are not cumulative. This means that if the issuing company decides not to pay a dividend for a specific period, the missed dividend is not carried forward or accumulated. Instead, the right to receive the dividend expires, and the company is not obligated to make up for missed payments in the future. In the event of the company's liquidation or bankruptcy, non-cumulative preferred stockholders have a higher priority claim on the company's assets than common stockholders. They have a greater likelihood of receiving their initial investment back before common stockholders. However, they are typically lower in priority compared to bondholders and other debt holders. Some non-cumulative preferred stocks may come with a conversion option, allowing the holder to convert their preferred shares into a specified number of common shares. This feature provides investors with the opportunity to participate in potential capital appreciation if the common stock's value increases. Non-cumulative preferred stock gives companies the flexibility to adjust dividend payments based on their financial situation. During periods of financial strain, the company can choose not to pay dividends without creating a future financial obligation. This flexibility can help companies maintain financial stability and avoid defaulting on their dividend payments. By not accumulating unpaid dividends, non-cumulative preferred stock reduces the company's financial obligation. This can be beneficial for the issuing company, as it avoids the burden of accumulating unpaid dividends and potentially needing to make significant payments in the future. It allows companies to manage their cash flow more effectively and allocate funds to other areas of the business. Non-cumulative preferred stock carries a lower risk for investors compared to cumulative preferred stock. With non-cumulative preferred stock, investors understand that missed dividends are not recoverable, and there is no accumulation of unpaid dividends. This reduced risk can be attractive to investors who prioritize steady income and are comfortable with the potential for missed dividend payments. The primary disadvantage of non-cumulative preferred stock is the potential loss of missed dividends. If the issuing company chooses not to pay a dividend for a specific period, the right to receive that dividend expires, and investors will not receive the missed dividend in the future. This can be a significant drawback for income-focused investors who rely on consistent dividend payments. Compared to cumulative preferred stock, non-cumulative preferred stock offers limited protection for investors. In the claim on the company's assets than bondholders and other debt holders. This means that there is a higher risk of losing a portion or all of the investment in the event of a company's insolvency. While non-cumulative preferred stockholders have a higher priority claim on the company's assets than common stockholders, they are typically lower in priority compared to bondholders and other debt holders. This means that non-cumulative preferred stockholders may receive less in the event of a company's liquidation or bankruptcy. When considering non-cumulative preferred stock, it's important to understand how it compares to cumulative preferred stock, a similar investment type that does accumulate unpaid dividends. The primary difference between non-cumulative and cumulative preferred stock is in their dividend payments. Cumulative preferred stock allows missed dividends to accumulate, creating a future financial obligation for the company to pay the missed dividends before any dividends can be paid to common stockholders. Non-cumulative preferred stock does not have this feature, and missed dividends are not carried forward. Cumulative preferred stock offers more investor protection compared to non-cumulative preferred stock. In the event of financial strain or bankruptcy, cumulative preferred stockholders have a higher priority claim on the company's assets and are more likely to receive their investment back before non-cumulative preferred stockholders. Cumulative preferred stock carries a higher risk for investors compared to non-cumulative preferred stock due to its higher financial obligation for the issuing company. However, it also offers a higher return potential due to the accumulation of unpaid dividends. Investors should review the issuing company's dividend history and payout ratio to evaluate the reliability and consistency of its dividend payments. Companies with a strong track record of paying dividends and a low payout ratio may be more attractive investments. Investors should also evaluate the financial strength of the issuing company. Companies with a stable financial position and low debt-to-equity ratios may be more reliable in meeting their dividend obligations. Market conditions and interest rates can also affect the performance of non-cumulative preferred stock. Investors should monitor these factors to assess the potential impact on their investment and make informed decisions. Non-cumulative preferred stock is a type of security that offers investors the potential for stable income, reduced financial obligations for issuers, and lower risk compared to other investment options. However, investors must also be aware of the potential drawbacks of non-cumulative preferred stock, including the potential for missed dividends and lower priority in liquidation. Investors should carefully consider the features, advantages, and risks of non-cumulative preferred stock when making investment decisions. Additionally, it's important to compare non-cumulative preferred stock to other investment options, such as cumulative preferred stock, to evaluate which investment type best suits their goals and risk tolerance. Non-cumulative preferred stock can be a valuable addition to an investor's portfolio, but it's important to conduct thorough research and understand the potential risks and rewards before investing. By carefully evaluating the issuing company's financial strength, dividend history, and market conditions, investors can make informed decisions that align with their long-term investment goals.Definition of Non-cumulative Preferred Stock

Purpose of Non-cumulative Preferred Stock

Features of Non-cumulative Preferred Stock

Dividend Payments

Rights in Liquidation

Conversion Option

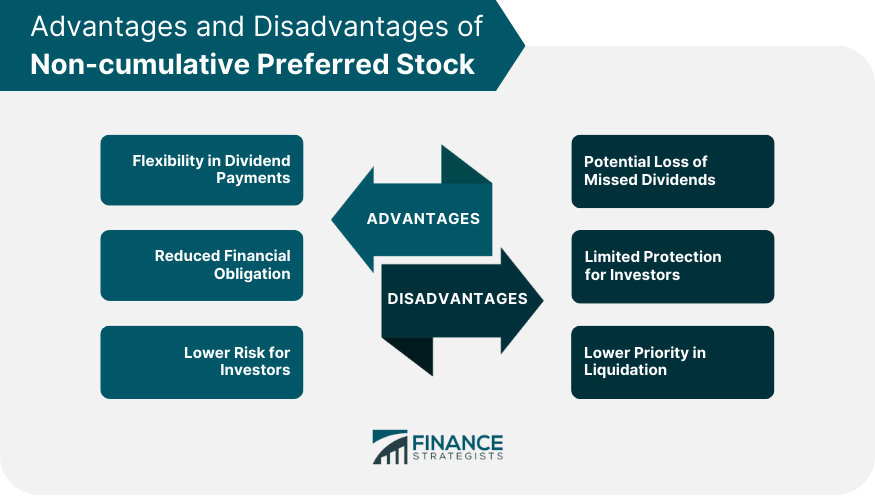

Advantages of Non-cumulative Preferred Stock

Flexibility in Dividend Payments

Reduced Financial Obligation

Lower Risk for Investors

Disadvantages of Non-cumulative Preferred Stock

Potential Loss of Missed Dividends

Limited Protection for Investors

Lower Priority in Liquidation

Comparison With Cumulative Preferred Stock

Differences in Dividend Payments

Differences in Investor Protection

Differences in Risk and Return

Factors to Consider When Investing in Non-cumulative Preferred Stock

Dividend History and Payout Ratio

Financial Strength of the Issuing Company

Market Conditions and Interest Rates

Bottom Line

Non-cumulative Preferred Stock FAQs

Non-cumulative preferred stock is a type of preferred stock that does not accumulate unpaid dividends.

Non-cumulative preferred stock provides flexibility in dividend payments, reduces financial obligation, and carries lower risk for investors.

The potential loss of missed dividends, limited protection for investors, and lower priority in liquidation are the main disadvantages of non-cumulative preferred stock.

Non-cumulative preferred stock does not accumulate unpaid dividends, whereas cumulative preferred stock does. Non-cumulative preferred stock also carries lower risk for investors.

Investors should consider the dividend history and payout ratio, financial strength of the issuing company, and market conditions and interest rates when investing in non-cumulative preferred stock.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.