The New York Stock Exchange (NYSE) is the world's largest stock exchange on Wall Street in lower Manhattan, New York City. The physical stock exchange handles trades for securities listed on the NYSE. The NYSE used to operate with traders on the floor who would physically and verbally conduct trades with other investors. These days, the majority of trades are done electronically. Stocks, bonds, and other assets are traded on the NYSE. Investors receive reports on these trades for review and utilize this data to guide their trading choices. The NYSE sets market-wide rules regarding liquidity, price stability, and other factors to ensure safe investing for its members. It also works with regulatory bodies such as the Securities and Exchange Commission (SEC) to monitor all trades conducted on their exchange. It is home to over 2400 of the world's top businesses, inventors, and problem solvers. Their market is the world's largest and most liquid capital resource, transacting an average of $123 billion daily. Trading stocks on the NYSE follows a two-pronged approach that includes both brokers and an all-electronic marketplace. At its core, each method of exchange functions as an auction, creating competition between buyers and sellers to achieve favorable prices. While many transactions take place electronically, much work must be done before making the final sale. The NYSE facilitates these trades by connecting brokers with potential buyers. Brokers submit orders for a particular stock and set the ‘bid’ price. On the other side of the trade is a ‘seller’ who sets an ‘ask’ price which is usually higher than the ‘bid’ – for which they will sell their stock. A dealer acts as a middleman between both parties and takes home a fee from the difference between both prices as payment for their services. The dealer must hold a trading license and be approved by the NYSE. The New York Stock Exchange has been a significant player in stock trading since its inception in 1792. It was founded by 24 brokers and merchants who signed the Buttonwood Agreement and started trading stocks on Wall Street under a buttonwood tree. Over the past two centuries, it has seen tremendous growth, turning into an iconic institution listed on its exchange, with an international influence unparalleled by any other stock exchange. It has established itself as one of the most influential organizations in shaping global trends in financial markets. NYSE's indices, such as S&P 500 and NYSE Composite, are some of the most trusted measures to evaluate investment performance. The NYSE's Rules & Regulations guide brings together essential regulations affecting national security exchanges and their members. NYSE stands strong as a leader in innovative methods for providing liquidity to global capital markets. The opening and closing bells, an essential component of the stock exchange's brand, are also used to commemorate key New York City events or recognize financial-related events. Being asked to ring the bell on the NYSE is an honor. While business executives are frequently asked to ring the bell, numerous celebrities have also done so. To begin the trading day, NYSE officials run an electric bell at 9:30 a.m. Eastern Time, signaling the official start of trading on the exchange. At 4:00 p.m., another ring from the bell signals traders to close trading on NYSE for the day, marking another milestone in stock market history. The New York Stock Exchange allows investors to benefit from 24-hour global markets with its extended trading hours. For six and a half hours during the traditional trading day, which runs from 9:30 am to 4:00 pm Eastern Time (GMT-05:00), investors can buy and sell stocks on the exchange. Preceding this window, a pre-trading session is available from 4:00 am to 9:30 am. Similarly, an additional post-trading session extends availability until 8:00 pm. When U.S. Markets are open, real-time quotes are provided. This traditional schedule still holds for most days when the NYSE is open. However, there are some special circumstances on market holidays and closures due to weather or unexpected events. On these dates, including Christmas Day, Thanksgiving Day, and Good Friday, no trades take place at the NYSE. Trading hours also change, leading to other major holidays, such as Easter, Memorial Day, and Independence Day, with altered opening and closing times. It is important to remember that while U.S. Markets may observe a holiday, other exchanges worldwide may still be open for business. Listing a company on the NYSE increases visibility and access to a much larger investor base. For this reason, becoming an NYSE-listed company is highly competitive. To be listed, a company must comply with the following: As part of the application process, companies must also submit their financial records, company by-laws, and other important information for examination and approval from the NYSE board of directors. If a company's profile looks good and meets all the criteria, it can become listed on the NYSE within four to six weeks. The New York Stock Exchange is the largest stock exchange in the world. It is located on Wall Street in Manhattan and serves as a hub for traders, brokers, and investors to trade stocks. The NYSE has been a significant player in stock trading since its inception in 1792. It has acquired its enormous size and widespread prominence through mergers. Except on holidays and special occasions, the NYSE is open from 9:30 am to 4:00 pm Eastern Time (GMT-05:00). Investors can sell and buy stocks on the exchange during this official operating hours with pre-trading and post-trading sessions. A company's exposure and access to a broader investor base grow with an NYSE listing. However, getting a company listed on the NYSE follows stringent requirements. Consider consulting a financial advisor if you require assistance choosing what stocks to buy or how to buy them on the NYSE.What Is the New York Stock Exchange (NYSE)?

How the NYSE Works

History of the NYSE

NYSE Opening and Closing Bells

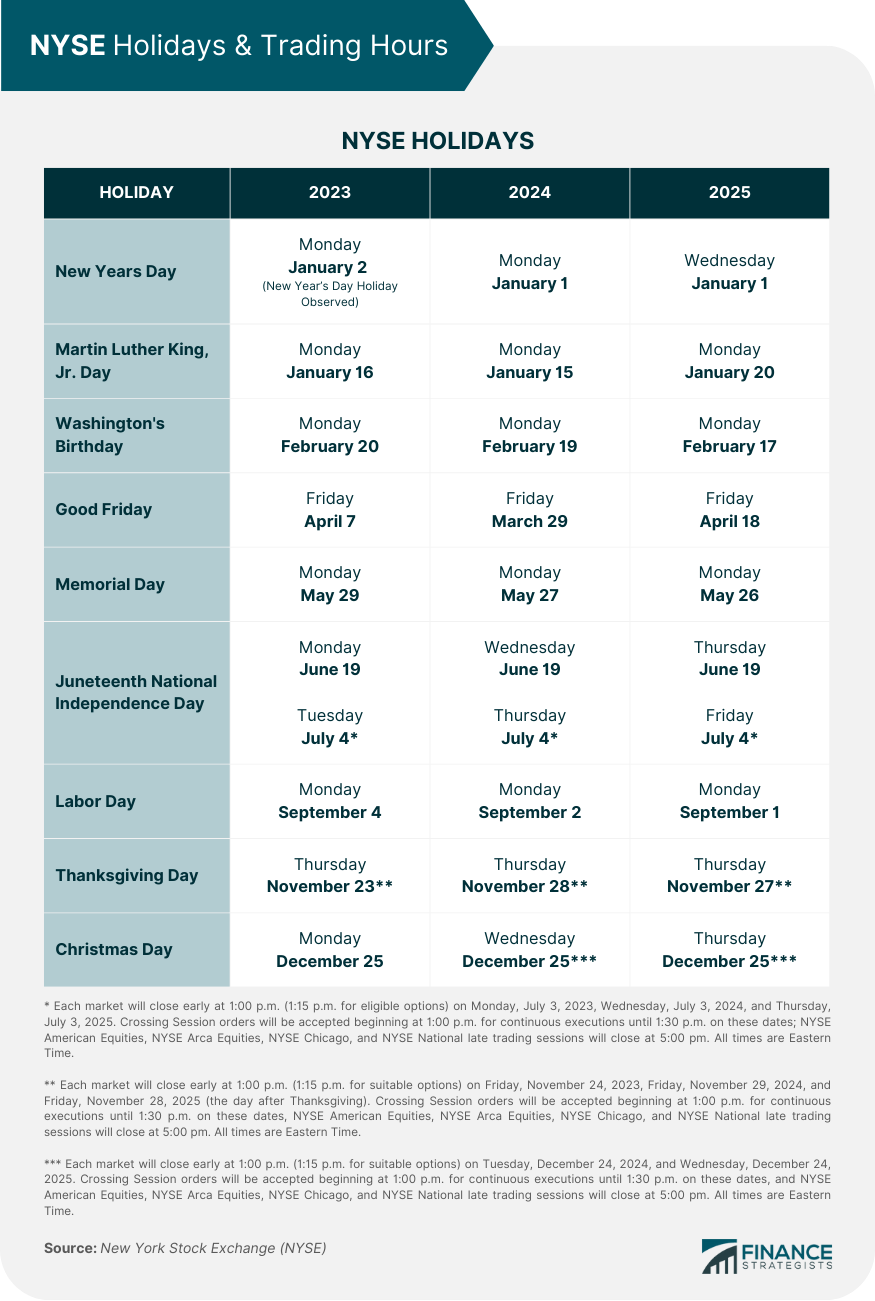

NYSE Holidays & Trading Hours

NYSE Listing Requirements

Final Thoughts

New York Stock Exchange (NYSE) FAQs

The main difference between the NYSE and Nasdaq is that the NYSE is an auction market, while Nasdaq is a dealer market. In an auction market like the NYSE, buyers and sellers submit their orders to a specialist who matches them to get the best price for both parties. In a dealer market like Nasdaq, investors trade directly with dealers who buy and sell securities from their inventory.

The New York Stock Exchange (NYSE) is owned by Intercontinental Exchange, Inc. (ICE). ICE is a global network of exchanges and clearing houses for financial and commodity markets.

Yes, anyone can purchase stocks listed on the NYSE. However, you must open an account with a broker or online trading platform.

The NYSE currently has 2,400 plus listed companies.

On regular trading days, the NYSE opens at 9:30 am Eastern Time (ET) and closes at 4:00 pm ET. The market may be closed on some holidays or have shortened trading hours. It is essential to check with your broker for the most up-to-date information on market hours before making any trades.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.