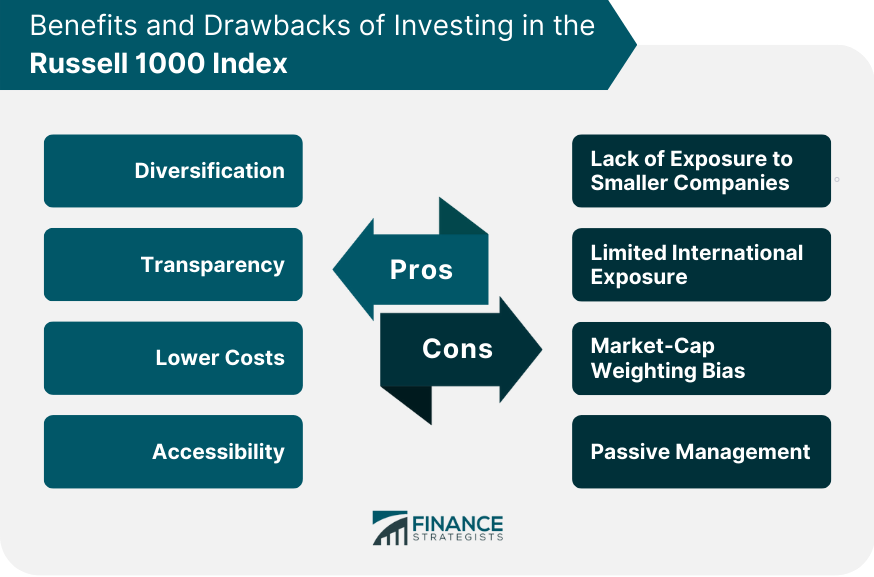

The Russell 1000 Index is one of the most recognized and used benchmarks in the US equity market, representing the highest-ranking 1,000 stocks in the Russell 3000 Index. It is a market-capitalization-weighted index, meaning that companies are included based on the total market value of their outstanding shares. This index represents approximately 92% of the total market capitalization of the Russell 3000, covering a significant portion of the investable US equity market. The primary purpose of the Russell 1000 Index is to serve as a benchmark for the US large-cap segment. This index offers investors a comprehensive, unbiased, and stable barometer of the broad market and is completely reconstituted annually to ensure new and growing equities are reflected. The Russell 1000 Index includes the largest 1,000 publicly traded companies in the U.S. by market capitalization. The exact rankings are determined annually, based on the latest market data. This ensures the index accurately represents the ever-changing landscape of the U.S. equity market. The Russell 1000 Index is diverse, with representation from various sectors of the economy. As of 2024, the information technology sector comprises the largest portion of the index, followed by healthcare, consumer discretionary, and financials. However, the exact composition can vary year by year as the market evolves. The Russell 1000 Index is calculated using a capitalization-weighted methodology. This means companies with a larger market capitalization exert a greater influence on the index's price. The index is recalculated annually during Russell's "reconstitution" process, which happens every June. During this process, the index is adjusted to account for changes in the market over the past year, such as IPOs, mergers, and acquisitions. Corporate actions like stock splits, dividends, and restructuring events are accounted for in the index calculation. The index is adjusted to ensure that only movements in share price caused by market activity affect the index. Historically, the Russell 1000 Index has provided solid returns for investors, with performance largely in line with the broader U.S. stock market. This is due to its comprehensive nature and the fact that it includes a large proportion of the total U.S. stock market capitalization. When compared to other major indexes like the S&P 500 or Dow Jones Industrial Average, the Russell 1000 is often seen as a better representation of the entire U.S. market because of its broader scope. It includes a larger number of companies, which gives a more comprehensive picture of the market's health and trends. Many ETFs track the performance of the Russell 1000, providing investors with an easy way to gain broad exposure to the U.S. large-cap market. Examples include the iShares Russell 1000 ETF (IWB) and the Vanguard Russell 1000 ETF (VONE). Similarly, numerous mutual funds use the Russell 1000 as their benchmark. These funds aim to replicate the performance of the index by investing in the same stocks and in the same proportions. Investing in an index that represents a large segment of the U.S. equity market offers significant diversification benefits. It reduces exposure to individual company risk. The Russell 1000 Index is transparent. The methodology used for its composition and calculation is public knowledge, allowing investors to understand exactly what they are investing in. Investing in index funds or ETFs that track the Russell 1000 can be a cost-efficient way to gain exposure to the U.S. large-cap equity market. These funds generally have lower fees than actively managed funds. With numerous ETFs and mutual funds tracking the Russell 1000, it's easy for individual investors to invest in this index, even with a small amount of capital. The Russell 1000 only includes large-cap companies, which means investors miss out on the potential higher returns (and higher risk) that smaller companies might offer. The index is focused on U.S. stocks, limiting exposure to international markets. This could be a drawback for investors looking for global diversification. The index's market-cap-weighted methodology means it is heavily skewed towards the largest companies. This can lead to overexposure to certain sectors if those sectors contain the largest companies. While passive management leads to lower costs, it also means the index won't adapt to market changes as quickly as an actively managed fund might. Many active fund managers use the Russell 1000 as a benchmark to compare their performance. It serves as a standard against which they measure their success in picking stocks. The Russell 1000 Index is also a popular choice for passive investment strategies. Investors who believe in efficient market theory often choose to invest in index funds or ETFs that track this index, as it provides broad market exposure at a low cost. The performance of the Russell 1000 can provide insights into market sentiment. If the index is performing well, it often indicates that investors are confident in the health of the U.S. economy. The Russell 1000's performance is often correlated with key economic indicators, such as GDP growth, interest rates, and unemployment rates. Observing these correlations can provide useful insights for investors and analysts. The Russell 1000 Index is a widely recognized benchmark in the US equity market, representing the top 1,000 stocks by market capitalization from the Russell 3000 Index. It serves as a comprehensive and stable barometer of the US large-cap segment, offering investors diversification, transparency, and lower costs through various investment vehicles such as ETFs and mutual funds. While it provides a broad picture of the market, there are limitations, including limited exposure to smaller companies, a focus on US stocks, market-cap weighting bias, and the passive management approach. Investors should carefully consider these drawbacks to make informed decisions about their investment strategies. It is highly recommended to consult with a financial advisor or investment professional who can provide personalized guidance based on individual goals, risk tolerance, and market conditions. By seeking professional assistance, investors can make well-informed decisions and optimize their portfolio management strategies, whether through active or passive approaches, to achieve their financial objectives.What Is the Russell 1000 Index?

Composition of the Russell 1000 Index

Criteria for Inclusion

Sector Breakdown

Methodology of the Russell 1000 Index

Calculation and Rebalancing Process

Handling of Corporate Actions

Performance of the Russell 1000 Index

Historical Performance and Trends

Comparison With Other Major Indexes

Russell 1000 Index and Investment Vehicles

Exchange Traded Funds (ETFs)

Mutual Funds

Benefits of Investing in the Russell 1000 Index

Diversification

Transparency

Lower Costs

Accessibility

Potential Drawbacks of Investing in the Russell 1000 Index

Lack of Exposure to Smaller Companies

Limited International Exposure

Market-Cap Weighting Bias

Passive Management

Use of the Russell 1000 Index in Portfolio Management

As a Benchmark for Active Portfolio Management

In Passive Investment Strategies

The Russell 1000 Index and Market Analysis

Using the Index for Market Sentiment Analysis

Correlation With Economic Indicators

Final Thoughts

Russell 1000 Index FAQs

The Russell 1000 Index is a market-capitalization-weighted index of the 1,000 largest publicly traded companies in the U.S.

The Russell 1000 Index is calculated using a capitalization-weighted methodology, meaning companies with larger market capitalizations have more influence on the index's price.

Benefits include diversification, transparency, lower costs, and accessibility.

Drawbacks include lack of exposure to smaller companies, limited international exposure, market-cap weighting bias, and passive management.

You can invest in the Russell 1000 Index by buying shares in an ETF or mutual fund that tracks the index.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.