The Russell 2000 is a market-cap weighted index that bases its weighting on shares outstanding. Frank Russell started the Index in 1984. It primarily focuses its attention on 2,000 of the US's small-cap companies and is the standard for any investor looking to invest in small-cap companies. Created by the Frank Russell Company, it encompasses a wide range of small-cap stocks, effectively offering a panoramic view of this sector of the American stock market. The Russell 2000 Index is made up of the smallest 2000 companies in the Russell 3000 Index, which tracks about 98% of the U.S.'s publicly traded stock. The Russell 2000 shares a lot of similarities with the S&P 500. Both are market-weighted indexes, and base their weighting on outstanding shares. In fact, it could be said that the Russell 2000 is to small-cap investors what the S&P 500 is for large-cap investors. In other words, it is the most popular and widely looked to authority on the status of America's small-cap companies. As a result, the Russell 2000 is often looked to as an indicator of the American economy's health. Given that typically, small, domestic-focused businesses are hit first and hardest in times of economic downturn. The purpose of the Russell 2000 Index extends beyond mere representation of small-cap stocks. It provides investors, analysts, and economists with a reliable, broad-based benchmark for the performance of small-cap companies. The significance of this index lies in its ability to shed light on trends in the small-cap sector and provide insights into the overall economic conditions of the United States. Understanding the composition of the Russell 2000 Index is essential to interpreting its performance and significance accurately. The selection and weighting of companies in the Russell 2000 Index are based on their market capitalization. The index includes the smallest 2000 companies in the Russell 3000 Index, which is a broader index comprising the 3000 largest U.S. companies. Each company within the Russell 2000 is weighted according to its market capitalization, ensuring the index accurately represents the collective performance of small-cap stocks. The Russell 2000 Index spans multiple sectors, representing a wide array of industries. The diverse sector representation within the index reflects the broad scope of the small-cap market in the United States, which includes industries such as healthcare, technology, financial services, consumer discretionary, and more. The market capitalization of companies within the Russell 2000 Index varies widely, reflecting the diverse nature of the small-cap market. However, as a general rule, the index includes companies with a market capitalization ranging from a few hundred million dollars to a few billion dollars. This range can fluctuate based on market conditions and the annual reconstitution of the index. Analyzing the performance of the Russell 2000 Index involves various metrics that gauge both return and risk. This measure encompasses both the capital appreciation of the index's constituent stocks and the income generated from their dividends, providing a comprehensive view of the index's overall performance. By accounting for both the magnitude and timing of the index's returns, annualized measures can offer a more nuanced understanding of its long-term performance patterns. Risk measures, such as volatility and beta, are also used to assess the Russell 2000 Index. These metrics shed light on the potential risks associated with investing in the small-cap market, as compared to broader market benchmarks. The Russell 2000 Index wields a significant influence over market analysis, investor sentiment, and economic perceptions. Its performance is closely watched by analysts and investors alike, as it can provide early signals about economic trends, risk appetite, and market sentiment. It can also influence investment strategies, particularly those focused on small-cap stocks. Its performance can provide insights into the health and prospects of smaller companies, which are often more sensitive to economic conditions and have higher growth potential compared to large-cap companies. As smaller companies are typically more domestically focused, the index can serve as a proxy for domestic economic activity and provide a useful lens through which to assess the state of the U.S. economy. The Russell 2000 Index serves as a comprehensive benchmark for small-cap stocks in the United States. Its composition, based on market capitalization and sector representation, accurately reflects the performance of small-cap companies. The index's performance is evaluated using various metrics, including total return, annualized returns, and risk measures, providing insights into its overall performance and risk profile. Beyond its role as a performance indicator, the Russell 2000 Index holds significant influence in the financial markets. It serves as a key tool for market analysis and investor sentiment, offering early signals of economic trends and risk appetite. The index also acts as a barometer for small-cap stocks, providing insights into the health and prospects of smaller companies with higher growth potential. Additionally, the index tracks market trends and economic conditions, providing valuable information about the domestic economy.What Is the Russell 2000 Index?

Defining Russell 2000 Index in Simple Terms

Similar to the Russell 2000

The Purpose of the Russell 2000

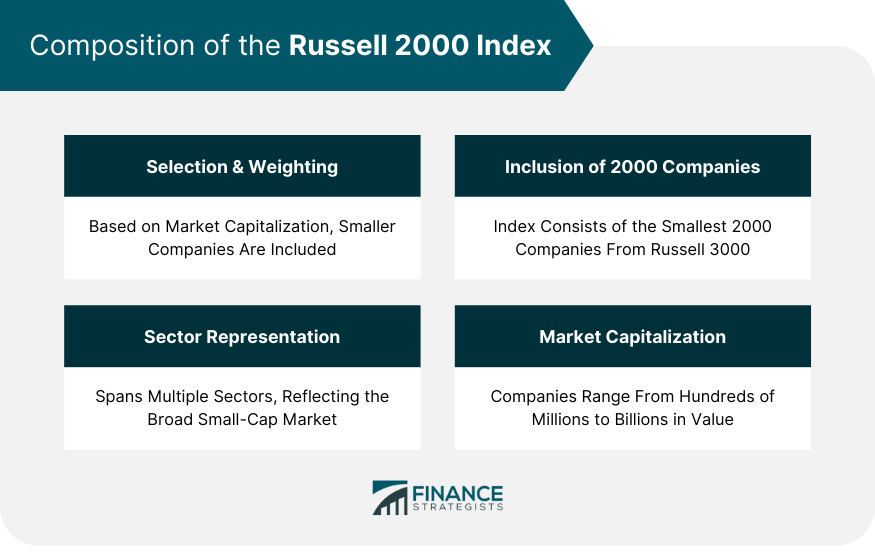

Composition of the Russell 2000 Index

Selection and Weighting Methodology

Sector Representation Within the Index

Market Capitalization Range of Constituent Companies

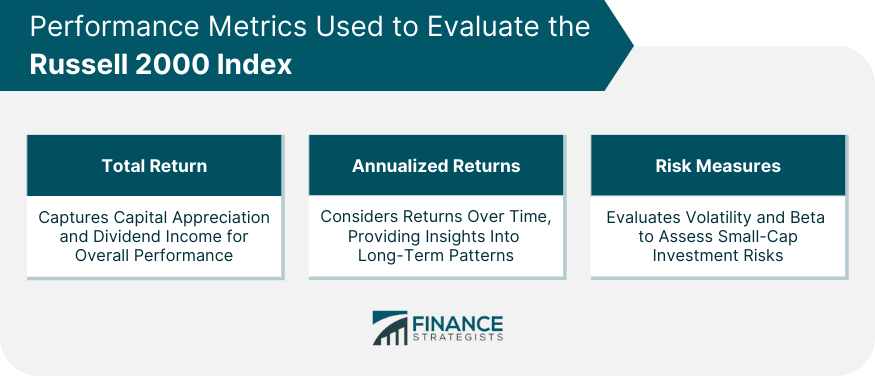

Performance Metrics Used to Evaluate the Russell 2000 Index

Total Return

Annualized Returns

Risk Measures

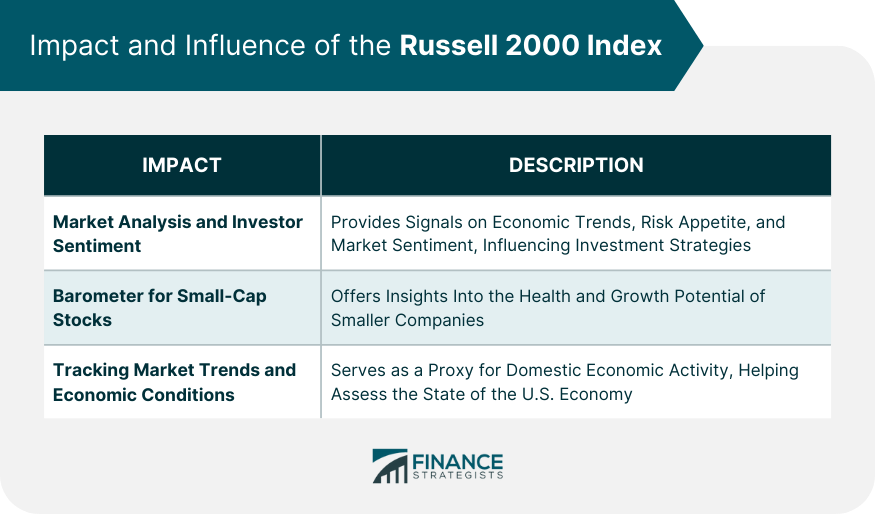

Impact and Influence of the Russell 2000 Index

Market Analysis and Investor Sentiment

Barometer for Small-Cap Stocks

Tracking Market Trends and Economic Conditions

Conclusion

Russell 2000 Index FAQs

The Russell 2000 is a market-cap weighted index that bases its weighting on shares outstanding.

The Russell 2000 Index is made up of the smallest 2000 companies in the Russell 3000 Index, which tracks about 98% of the U.S.’s publicly traded stock.

The Russell 2000 Index is intended to reflect the status of America’s small-cap companies.

Some experts say the Russell 2000 is to small-cap investors what the S&P 500 is for large-cap investors.

Typically, small, domestic-focused businesses are hit first and hardest in times of economic downturn. These types of businesses are exactly what the Russell 2000 tracks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.