The Russell 3000 Index is a market-capitalization-weighted equity index that seeks to track 3000 of the largest U.S.-traded stocks. It's a benchmark representing approximately 98% of the investable U.S. equity market. Financial professionals, investors, and economists use the index to gauge market performance and trends within the U.S. economy. The Russell 3000 Index was established by the Frank Russell Company in 1984. The company, now known as FTSE Russell, is a subsidiary of the London Stock Exchange Group. The index has provided a broad and comprehensive barometer of the U.S. stock market since its inception, aiding in various financial analyses and investment strategies. The Russell 3000 Index includes stocks based on their market capitalization. Eligibility criteria include being incorporated in the U.S., trading on a U.S. exchange, and having a calculable market price. Companies must also meet certain liquidity and minimum market capitalization thresholds. The index uses a capitalization-weighted methodology, meaning companies with larger market capitalizations have a higher influence on the index's performance. This method reflects the actual market environment and provides a realistic depiction of market movements. The Russell 3000 Index undergoes reconstitution annually, typically in June. This process involves updating the index to reflect changes in the market over the past year, including the inclusion of new companies and the exclusion of others. The S&P 500 is another key index, representing the 500 largest U.S. companies. While both are used as benchmarks for the U.S. stock market, the Russell 3000 Index covers a broader scope of the market, including small- and mid-cap companies, thus offering more comprehensive exposure. The Dow Jones Industrial Average (DJIA) tracks 30 large, publicly-owned U.S. companies. Compared to the DJIA, the Russell 3000 Index offers a more extensive representation of the U.S. market, encompassing a wider range of sectors and company sizes. The Nasdaq Composite includes all the securities listed on the Nasdaq stock market, heavily skewed towards technology companies. The Russell 3000, on the other hand, provides more diversified exposure across all sectors of the U.S. economy. Several ETFs track the Russell 3000 Index, providing investors a convenient way to gain broad market exposure. Examples include the iShares Russell 3000 ETF and the Vanguard Russell 3000 ETF. Mutual funds like the Columbia Large Cap Index Fund also track the Russell 3000, offering investors another avenue for investment. Index funds, such as the Fidelity Spartan Total Market Index Fund, also track the Russell 3000, offering investors a low-cost option to mirror the performance of the broader U.S. stock market. Investors and portfolio managers often use the Russell 3000 Index as a benchmark to compare the performance of individual securities or portfolios. This helps in evaluating investment strategies and performance relative to the broader market. Investing in funds that track the Russell 3000 Index can be an effective strategy for diversification. It exposes an investor to a wide range of sectors and company sizes, thereby spreading risk across many different stocks. While the Russell 3000 Index is often cited as representing 98% of the investable U.S. stock market, it excludes the smallest companies. Consequently, it may not fully capture the performance of the entire U.S. stock market. The annual reconstitution can create market distortions. As companies are added or removed, high trading volumes and price volatility can occur around the reconstitution date. Changes in interest rates can impact the Russell 3000 Index. Generally, when interest rates rise, stock prices may decline as borrowing costs increase for companies, potentially reducing their profitability. Inflation can also affect the index. High inflation can erode purchasing power and lead to higher input costs for companies, which could negatively impact their earnings and subsequently their stock prices. The Russell 3000 Index, like other stock indices, can be influenced by economic cycles. During expansion phases, the index may rise as companies' earnings grow. Conversely, during a recession, the index may fall due to declining earnings. The Russell 3000 Index represents a broad spectrum of the U.S. equity market. It encapsulates approximately 98% of the investable market, including 3000 of the largest U.S.-traded stocks. Due to its comprehensive nature, it is widely utilized as a yardstick for the performance of the U.S. stock market. The index offers an all-encompassing view of the U.S. stock market, covering various sectors and company sizes. This makes it an indispensable tool for investors, financial professionals, and economists. The Russell 3000 Index aids in understanding market trends, assessing the economic health of the U.S., and formulating investment decisions. Its relevance extends to the many financial products it underpins, such as ETFs, mutual funds, and index funds, enabling investors to achieve diversified exposure to the U.S. equity market. However, investing in the stock market, even through broad indices like the Russell 3000 Index, involves risks. Individuals must consult with financial professionals before making any investment decisions. Professional advice can help align investment strategies with personal financial goals and risk tolerance, offering a more tailored approach to market participation. This will ensure that investors can optimally navigate the complexities of the market and make the most of their investments.What Is the Russell 3000 Index?

Composition of the Russell 3000 Index

Criteria for Inclusion

Weighting Methodology

Reconstitution and Rebalancing

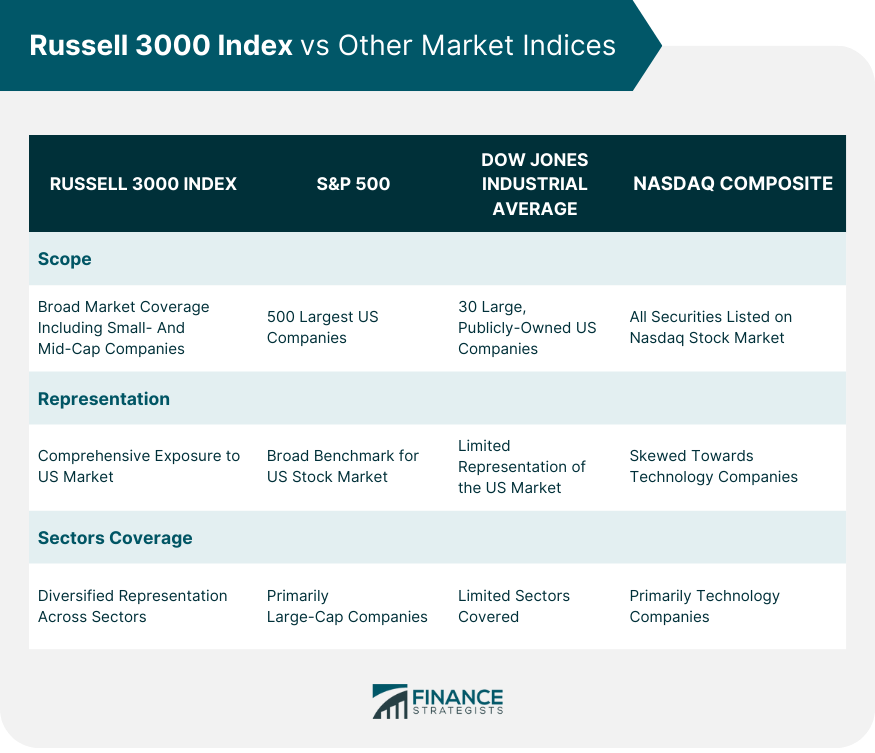

Russell 3000 Index vs Other Market Indices

Comparison With the S&P 500

Comparison With the Dow Jones Industrial Average

Comparison With the Nasdaq Composite

Russell 3000 Index Fund Products

Exchange Traded Funds (ETFs)

Mutual Funds

Index Funds

The Role of the Russell 3000 Index in Portfolio Management

As a Benchmark for Performance

As a Tool for Diversification

Critiques and Limitations of the Russell 3000 Index

Representativeness of the US Stock Market

Implications of Reconstitution

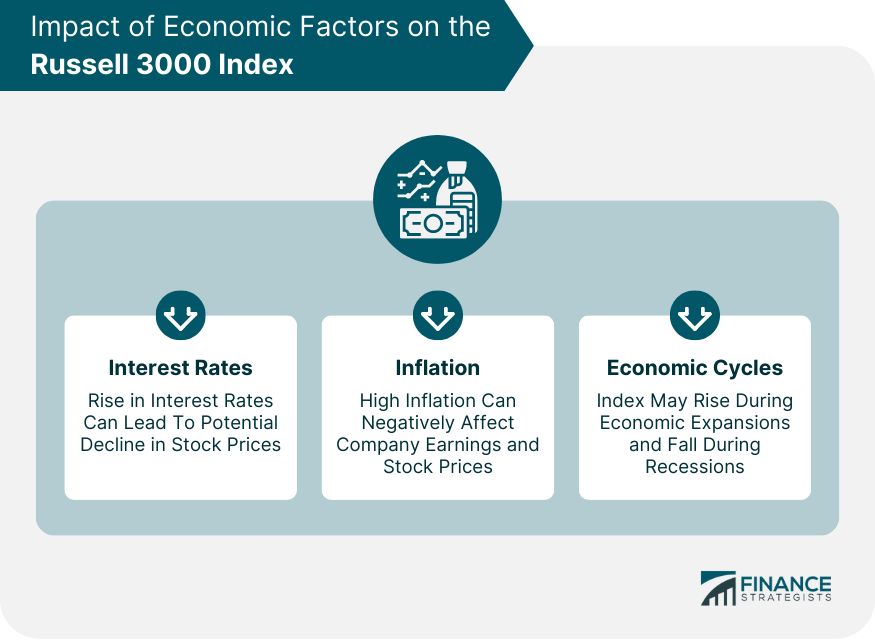

Impact of Economic Factors on the Russell 3000 Index

Interest Rates

Inflation

Economic Cycles

Final Thoughts

Russell 3000 Index FAQs

The Russell 3000 Index is a market-capitalization-weighted equity index that includes 3000 of the largest U.S.-traded stocks. It represents approximately 98% of the investable U.S. equity market, making it a comprehensive benchmark for the U.S. stock market.

The Russell 3000 Index is calculated using a capitalization-weighted methodology. This means that companies with larger market capitalizations have a greater influence on the index's performance.

The Russell 3000 Index and the S&P 500 are both market indices used as benchmarks for the U.S. stock market. However, the Russell 3000 Index covers a broader scope, including small- and mid-cap companies. The S&P 500, on the other hand, represents the 500 largest U.S. companies.

While you cannot directly invest in the Russell 3000 Index, you can invest in financial products that track the index, such as exchange-traded funds (ETFs), mutual funds, or index funds. These funds aim to replicate the performance of the Russell 3000 Index and offer a convenient way to gain broad market exposure.

While the Russell 3000 Index is a comprehensive representation of the U.S. stock market, it does exclude the smallest companies, thus may not fully capture the performance of the entire market. Additionally, the annual reconstitution process can create temporary market distortions due to high trading volumes and price volatility. Lastly, as with any index, it's a passive investment strategy, so it doesn't account for individual company performance beyond their impact on the overall market cap.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.