A short sale is a financial transaction in which an investor borrows a security from a broker and sells it in the open market with the intent to repurchase it later at a lower price. The primary objective of this strategy is to profit from the anticipated decline in the security's price. The process is known as 'going short,' and it stands in contrast to the traditional 'long' investment approach, where investors profit from price increases. The investor engaging in a short sale, often referred to as the short seller, is betting that the price of the borrowed security will drop. The objective is to buy the security back at a lower price and return it to the lender, pocketing the difference between the selling price and the repurchase price. Unlike traditional long investing, where potential gains are limited to the amount the security can increase in price, short selling offers profit potential even in declining or bear markets. Short selling can also be used as a hedging strategy. Portfolio managers often use short sales to offset potential losses from long positions in similar securities. The first step in a short sale is to borrow the securities you wish to short. Typically, this involves opening a margin account with your broker, who will lend you the securities. The broker usually sources these securities from their own inventory, another customer's margin account, or another brokerage firm. Upon borrowing the securities, the short seller is required to post collateral, usually in the form of cash or other securities, to cover potential losses. This collateral is typically a percentage of the borrowed securities' value and is adjusted as the price of the security changes. Once the securities have been borrowed, the short seller can proceed to sell them in the open market. The proceeds from this sale are credited to the short seller's account, but the short seller does not own these funds outright. These funds, along with any additional margin required by the broker, act as collateral for the borrowed securities. The selling of borrowed securities constitutes the second stage in the short-selling process. The short seller's objective here is to profit from a subsequent decline in the security's price. After selling the borrowed securities, the short seller monitors the market, waiting for the security's price to fall. If the price drops as expected, the short seller can buy the security back at a lower price. This process is known as "covering" the short position. It's worth noting that short sellers are not obligated to cover their positions within a specific timeframe as long as they can meet any additional margin requirements. However, if the lender of the securities wants them back, the short seller must comply, potentially necessitating a forced buyback regardless of the current market price. The final step in a short sale transaction is the return of the borrowed securities. Once the short seller has bought back the securities at a lower price, they can return these securities to the lender. This marks the completion of the short sale transaction. If the price of the security fell as anticipated, the short seller would profit from the difference between the initial selling price and the lower repurchase price, minus any fees or interest paid to the broker for the borrowed securities. One of the primary reasons investors engage in short sales is for speculation. Speculators are investors who make high-risk financial transactions with the aim of profiting from short-term market fluctuations. In the case of short selling, speculators predict that a particular security's price will decline. If their prediction is correct, they can make a profit by buying the security back at a lower price than they initially sold it for. However, if the price increases, they could incur significant losses. Another reason for short selling is hedging. Hedging is a risk management strategy used by investors to offset potential losses in their investment portfolios. For instance, if an investor holds a significant amount of a particular security and fears its price might drop in the near future, they can short-sell the security. If the price indeed drops, the profit from the short sale can offset the loss from the decrease in value of the held securities, thereby neutralizing the risk. Arbitrage is another situation where short sales can be used. Arbitrage involves taking advantage of price discrepancies for the same security in different markets. An investor might short-sell a security in a market where its price is higher and simultaneously buy the same security in a market where its price is lower. The profit is the difference between the selling price in the higher-priced market and the purchase price in the lower-priced market minus transaction costs. One of the primary advantages of short sales is the potential for profit in a declining market. While traditional long investors can only profit when prices rise, short sellers have the opportunity to earn returns even when prices fall. By correctly predicting the price decline of a security, short sellers can sell high and buy low, pocketing the difference as profit. Short selling can also serve as an effective hedging tool against downside risk in a portfolio. By shorting securities that are similar or related to long positions in their portfolio, investors can offset potential losses if the market moves against them. This can be particularly useful in volatile markets, where price swings can be significant and sudden. Short selling can contribute to market efficiency by facilitating better price discovery. By betting against overvalued securities, short sellers can help bring prices more in line with their intrinsic value. This can create a more efficient market where prices better reflect the underlying fundamentals of the securities. Arguably the biggest risk of short selling is the potential for unlimited losses. Since there is no upper limit to how high a security's price can go, the potential losses for a short seller are theoretically unlimited. This contrasts with traditional long investing, where the maximum potential loss is the initial investment. Short selling involves borrowing securities through a margin account, which exposes the short seller to margin calls. If the price of the borrowed securities increases significantly, the short seller may be required to deposit additional funds or securities into their margin account to meet the minimum margin requirement. If unable to meet the margin call, the broker could force the short seller to cover their position at an unfavorable price. Not all securities are available for short selling. The availability of securities to short depends on the broker's inventory and the willingness of other investors to lend their securities. If a short seller cannot borrow the securities they wish to short, they cannot execute the short sale. Short selling is subject to various regulatory constraints, which can limit its viability as an investment strategy. For instance, regulations might prohibit short selling in certain securities or during certain market conditions. In addition, regulatory bodies may impose additional reporting requirements on short sellers, adding to the complexity and cost of short selling. Short selling can influence the price movements of securities. When a large number of investors short a specific security, it can drive the price down, creating a self-fulfilling prophecy. However, a sudden increase in short selling can also trigger a short squeeze, where short sellers rush to cover their positions, driving the price up. By adding more sellers into the market, short selling can increase the liquidity of securities. Greater liquidity can lead to tighter bid-ask spreads, making transactions easier and less costly. Furthermore, by allowing investors to trade on negative information, short selling can contribute to market efficiency. Short selling can impact investor sentiment. A high level of short interest in security may signal negative market sentiment, potentially causing other investors to sell their holdings. However, it can also attract contrarian investors who believe the short sellers are wrong and the security is undervalued. A short sale is a financial transaction where an investor borrows a security and sells it, intending to buy it back later at a lower price. This strategy allows investors to profit from a decline in the security price. It stands in stark contrast to traditional long investing, which benefits from price increases. Investors engage in short sales for several reasons. Some speculate on the price of securities, hoping to profit from predicted declines. Short sales offer the potential for profit in a declining market and serve as a useful hedging tool. They can also contribute to market efficiency by facilitating better price discovery. However, short sales come with significant risks, including potentially unlimited losses, margin calls, difficulties in borrowing securities, and regulatory constraints. They are an integral part of the financial markets, offering investors unique opportunities and challenges.What Is a Short Sale?

Mechanics of a Short Sale

Borrowing Securities

Selling Borrowed Securities

Buying Back Borrowed Securities

Returning Borrowed Securities

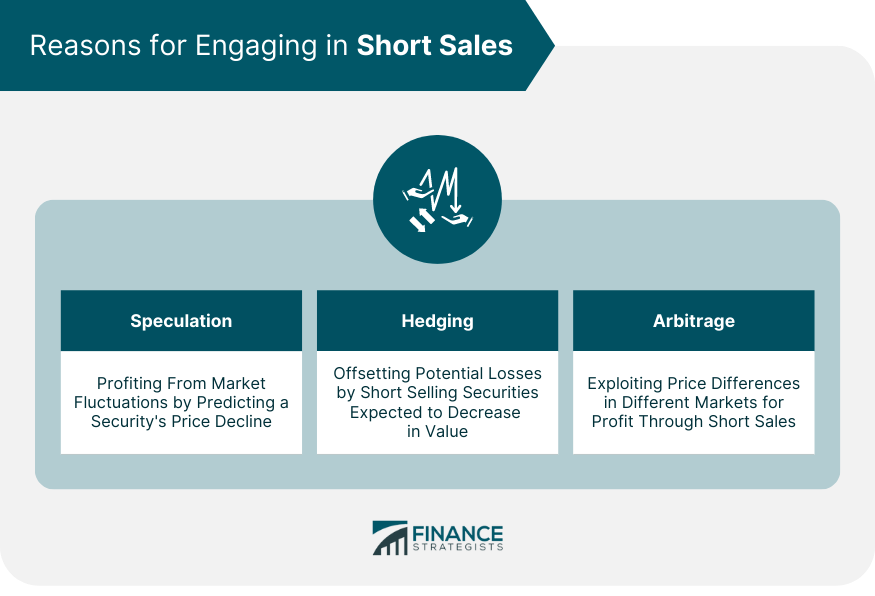

Reasons for Engaging in Short Sales

Speculation

Hedging

Arbitrage

Advantages of Short Sales

Potential for Profit in a Declining Market

Hedging Against Existing Long Positions

Opportunity for Price Discovery and Market Efficiency

Risks of Short Sales

Unlimited Loss Potential

Margin Calls

Availability of Securities for Borrowing

Regulatory Constraints

Market Impact of Short Sales

Price Movements

Liquidity and Market Efficiency

Impact on Investor Sentiment

Conclusion

Short Sale FAQs

A short sale is a financial transaction where an investor borrows a security and sells it, intending to buy it back later at a lower price to profit from a price decline.

Investors engage in short sales for speculation, hedging, or arbitrage. They might anticipate a price decline, wish to offset potential losses from long positions or take advantage of price discrepancies in different markets.

Short sales can provide profit opportunities in a declining market, serve as a hedging tool, and contribute to better price discovery, leading to more efficient markets.

Short sales come with the risk of potentially unlimited losses and margin calls. Additionally, the availability of securities for borrowing and regulatory constraints can pose challenges.

Short sales can influence price movements, liquidity, and market efficiency. They can also impact investor sentiment by signaling market views about a security's future price movement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.