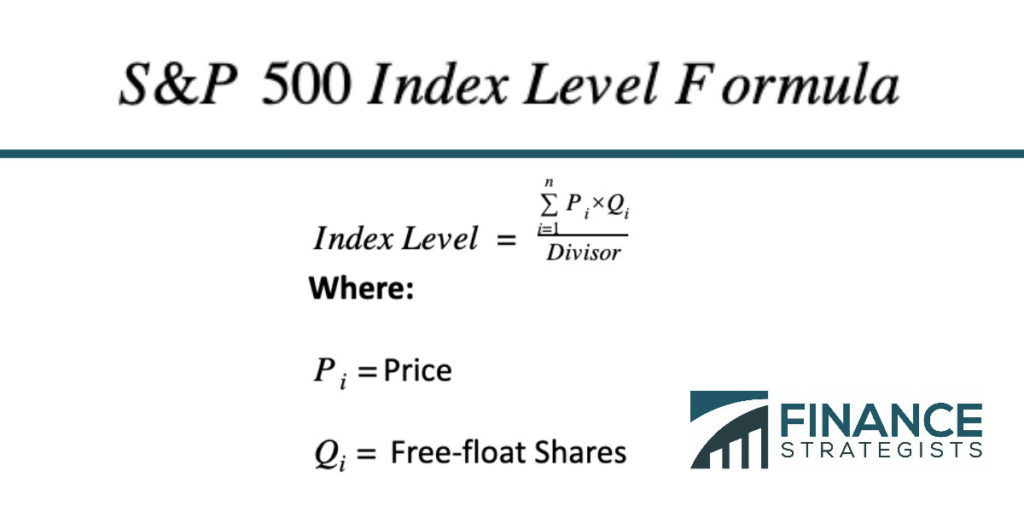

The S&P 500, short for Standard and Poor's 500, is a stock market index that tracks performance of 500 U.S.-based large-cap companies from various sectors. It is widely considered a gauge of investor sentiment and its returns reflect the state of the American economy. Thus, returns from the S&P 500 typically go up when the economy is doing well and typically trend downwards during a recession. The S&P 500 is a market cap-weighted index, meaning companies with the highest valuations have the most impact on the index's value. To calculate the index value, take the price of each share times the number of shares that can be traded on the open market (known as "float" ), to give you a company's "float-adjusted market cap." Then add the value of all the float-adjusted market caps of the companies in the S&P 500 and divide by the S&P 500's divisor. The divisor is used to account for changes, such as stock splits and new companies entering or exiting the index. Also, the sum of market capitalization of companies listed in the S&P 500 amounts to trillions of dollars, so the divisor normalizes the value to a more digestible figure. To be included in the S&P 500 index, companies must satisfy seven criteria. Some of them are: The index's composition is reviewed each quarter, and new companies are added to it or previous ones are removed from it. The S&P 500 got its name from a merger between two financial data publications: The Standard Statistics Bureau and Henry Varnum Poor's publication. The S&P 500 index was launched in 1957 and had 425 companies from the industrial sector, 25 companies from the railroads sector, and 50 utility firms. Over the years, the index's composition has changed to reflect the current American economy. Technology is currently the dominant sector, accounting for more than 1/4 of the overall index. The Dow Jones Industrial Average (DJIA), which consists of 30 stocks, is another popular index used as a bellwether for the overall economy. But the S&P 500 is considered a more accurate barometer of the economy because it has more sectors and companies in its index. While it is not possible for the average consumer to invest directly in the S&P 500 index, they can invest in one of the numerous indexes or exchange traded funds tracking it.Standard & Poor's 500 Index Definition

How to Calculate S&P 500 Index Value

S&P 500 Index Formula

How Companies are Added to the S&P 500 Index

How Did the Standard & Poor's 500 Index (S&P 500) Get Its Name?

DJIA vs S&P 500

Standard & Poor's 500 Index FAQs

The S&P 500, short for Standard and Poor’s 500, is a stock market index that tracks performance of 500 U.S.-based large-cap companies from various sectors.

The index is widely considered a gauge of investor sentiment and its returns reflect the state of the American economy.

The S&P 500 is a market cap weighted index, meaning companies with the highest valuations have the most impact on the index’s value.

The S&P 500 index was launched in 1957 and had 425 companies from the industrial sector, 25 companies from the railroads sector, and 50 utility firms. Over the years, the index’s composition has changed to reflect the current American economy.

There are seven criteria to be listed in the S&P 500 Index, a few of which are 1) there is a minimum market cap, 2) must be publicly-listed in the United States, 3) must have reported positive earnings for the last four quarters.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.