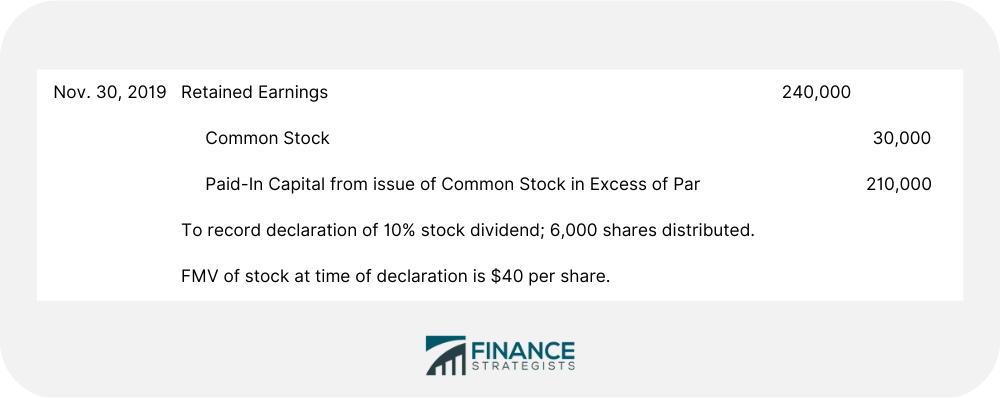

Many corporations issue stock dividends instead of, or in addition to, cash dividends. A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation's own stock. That is, the current holders of stock receive additional shares of stock in proportion to their current holdings. For example, if you own 10,000 shares of common stock in a corporation and it issues a 15% stock dividend, you will receive an additional 1,500 shares (15% x 10,000 = 1,500). Most stock dividends are given to common stockholders. When investors receive a stock dividend, the cost per share of their original shares is reduced accordingly. For example, assume that an individual owns 1,000 shares of South Gulf Oil Company. These shares were purchased at $60 per share, for a total cost of $60,000. Subsequently, South Gulf issues a 20% stock dividend, and so the investor will receive an additional 200 shares (1,000 x .20). Therefore the cost per share to the investor is reduced to $50 per share ($60,000 + 1,200 shares), from the original $60 per share. Thus, no income is recognized on the stock dividends when they are received. The reduced cost per share will increase the gain or decrease the loss on subsequent sales of the stock. There are a number of reasons that a corporation may issue a stock dividend rather than a cash dividend. Clearly, a stock dividend conserves cash and thus allows the firm to use its cash for growth and expansion. Corporations experiencing growth generally are more likely to issue a stock dividend than stable, mature firms. In addition, stock dividends transfer a part of retained earnings to permanent capital. This is referred to as capitalizing retained earnings and makes that part of retained earnings transferred to permanent capital unavailable for future cash dividends. When a stock dividend is declared and issued, the corporation debits Retained Earnings for the total fair market value of the stock dividend. Assuming that the stock is immediately issued, the Common Stock account is credited for its par value, if any. Additional Paid-in Capital from the Issue of Common Stock in Excess of Par is credited for the difference between the market value and par value. If the stock has neither a par nor a stated value, Common Stock is credited for the entire market value (1n this example we assumed that the dividend was declared and issued at the same time. In reality, a period of time may elapse before the declared stock dividend is actually issued to the stockholders. Although this slightly changes the required journal entries, it does not change the effect of the dividend when either declared or issued). After all these entries have been made, total stockholders' equity remains the same, because there has not been a distribution of cash or other assets. The only difference is in the components of stockholders' equity. Retained earnings is decreased, and contributed capital is increased. As noted, this is often referred to as capitalizing retained earnings, because a portion of retained earnings becomes part of the firm's permanent invested capital. In effect, after the stock dividend, each individual shareholder owns the same proportionate share of the corporation as he or she did before. To demonstrate the journal entries to record stock dividends, assume that the stockholders' equity of the Korean Export Corporation immediately before the issue of a 10% stock dividend appears as follows: On November 30, 2019 the corporation issues a 10% stock dividend distributed immediately. At the time of the declaration, the stock is selling for $40 per share. As a result of the dividend, a total of 6,000 shares (10% x 60,000 = 6,000) is issued. Based on this data, the following journal entry is made: The stockholders' equity section of the Korean Export Corporation's balance sheet at November 30, immediately after the issuance of the stock dividend, appears as follows: The most important thing to note by comparing the stockholders' equity section in both balance sheets is that the total is $3 million In both cases. The only difference is the total of the various accounts within stockholders' equity.Stock Dividend - Definition

Explanation

Why Stock Dividends Are Issued

Recording Stock Dividend

Journal Entries to Record Stock Dividend

Stock Dividend FAQs

A stock dividend is when a company issues additional shares of its own stock to its shareholders, usually in proportion to the number of shares they already hold. The value of the dividend is determined by the current market price of the stock.

Dividends are typically paid in cash, but they can also be distributed in the form of additional shares of stock or other investments.

The frequency and amount of dividends paid are determined by the company and normally follow regular patterns, such as quarterly or annually.

A dividend payment includes the amount of cash or other investments distributed to shareholders.

Depending on your individual circumstances, dividends received may be subject to taxation. It is important to consult with a qualified tax professional for more information about how dividends will affect your personal taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.