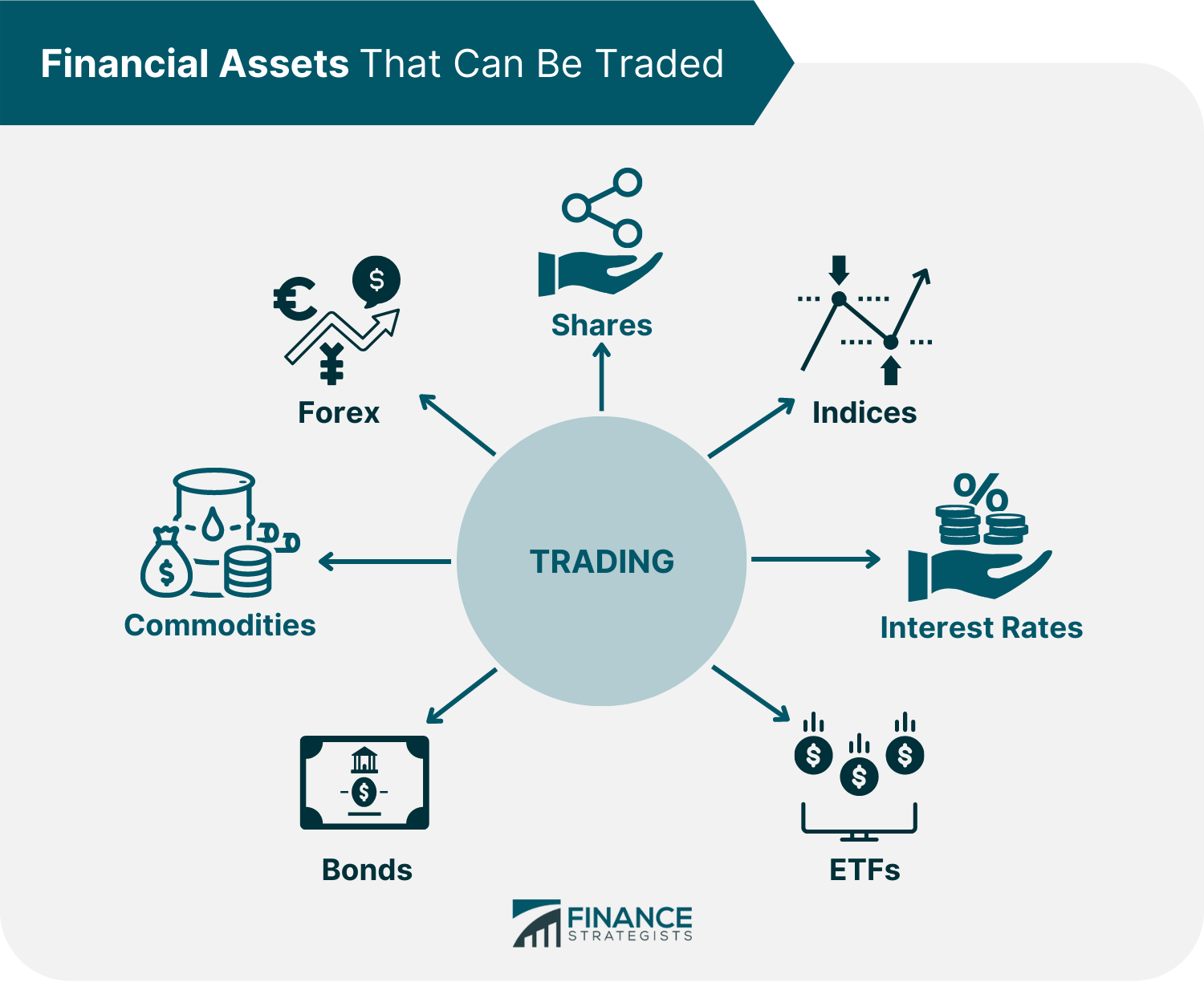

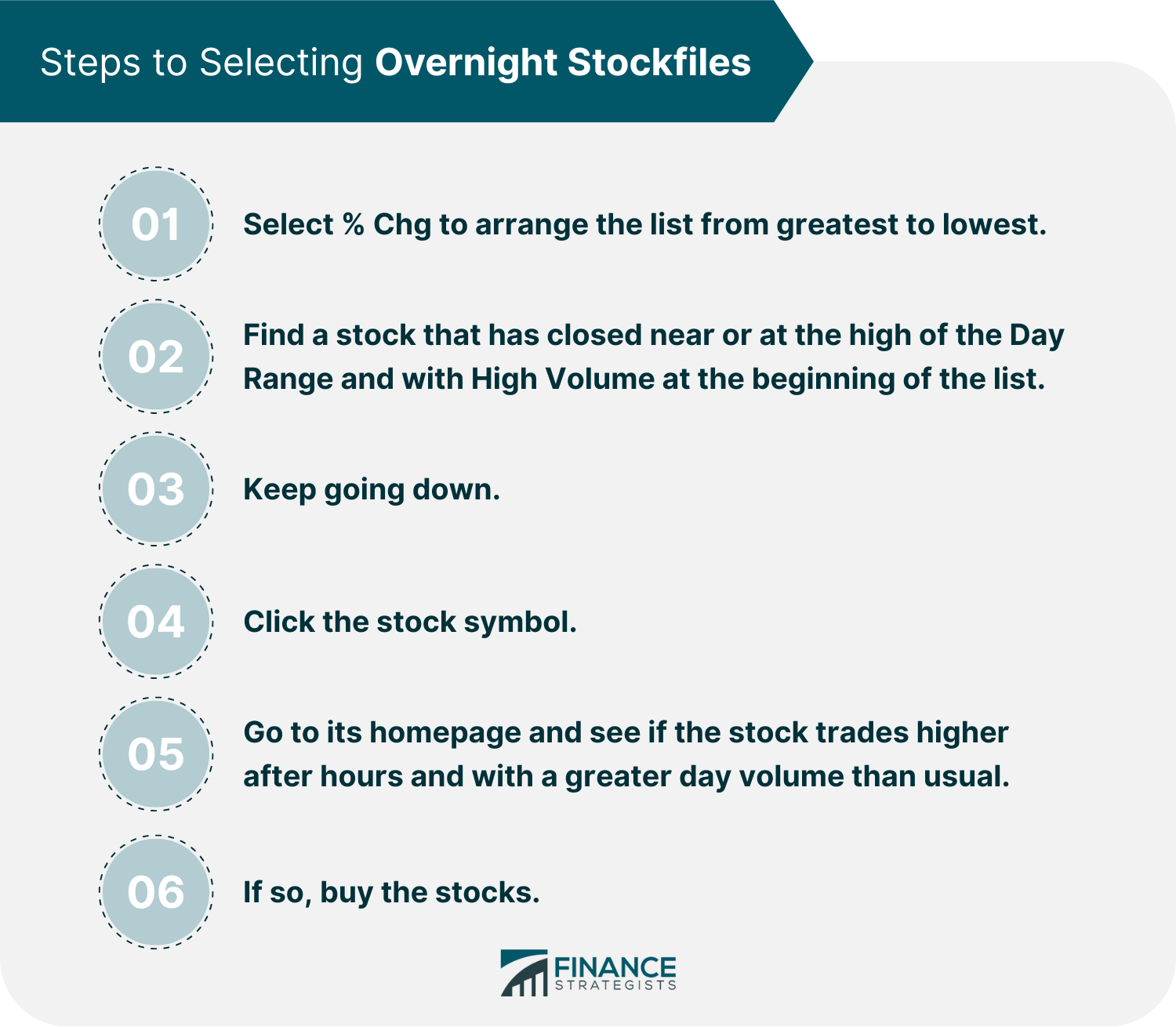

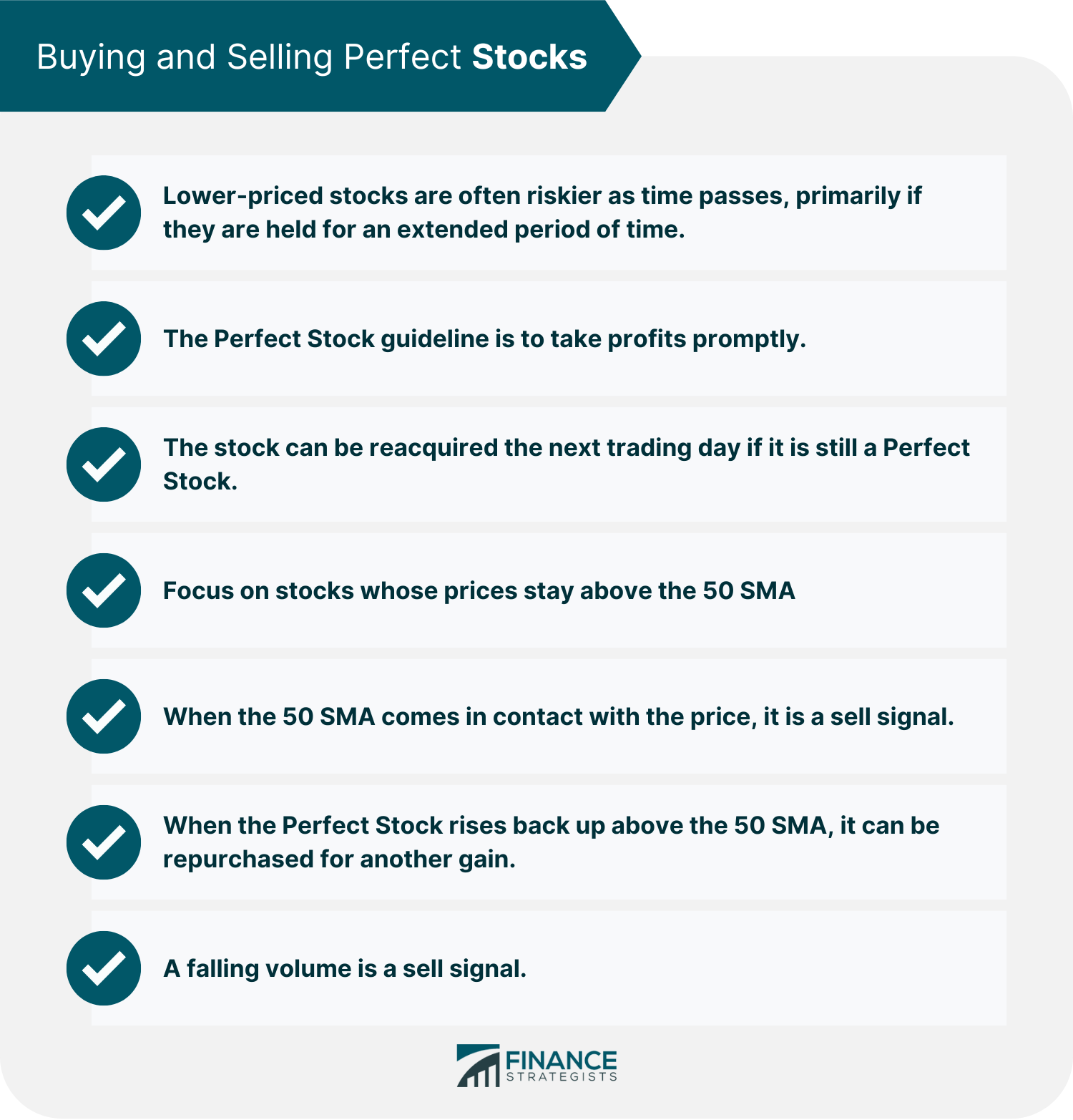

Contrary to investing, which implies a buy-and-hold strategy, trading refers to the buying and selling of securities such as stocks, bonds, currencies, and commodities. Trading success depends on a trader's capacity for sustained profitability. In other words, a trader needs to be able to string together multiple wins (or profitable trades) in order to offset any losses incurred along the way. There are different ways to trade, but most traders will either buy and hold a position for a short period of time or day trade by buying and selling securities within the same day. Trading can be done either online or through a broker. When you trade securities, you are essentially betting that the price of the security will go up or down. If you think the price will go up, you buy the security. If you think the price will go down, you sell the security. Trading is all about making money by correctly predicting which way the prices of securities will move. Have questions about stock trading? Click here. A trading strategy is a plan that traders use to determine when to buy and sell assets in the financial markets. Trading strategies can be based on technical analysis, fundamental analysis, or a combination of both. Technical analysis is a method of predicting future price movements by analyzing past market data, while fundamental analysis focuses on economic factors that may impact asset prices. When developing a trading strategy, traders will often use objective data and analysis using technical indicators and chart patterns to spot potential buying or selling opportunities. They will also consider factors such as risk management and position sizing to ensure that their trades are profitable. It is important to note that there is no one-size-fits-all approach to trading; different strategies will work for different people, depending on their individual goals and risk tolerance. It is also important to remember that no trading strategy is guaranteed to be successful, and there is always the potential for loss. The Overnight Trade takes the principles of a typical swing trade and distills them down to a simple, clear, and effective approach: buy after hours and sell your products or services before the market opens. The Pattern Day Trader Rule does not apply to swing trades, which means that the Overnight Trade is advantageous to traders under the PDT Rule. You need a brokerage account with a broker that offers full pre-market and after-hours trading to participate in the Overnight Trade. The pre-market begins one hour before the market opens and continues for four hours after it closes. Small accounts generate small profits for traders with limited initial capital, but they allow room to grow and improve The Overnight Trade. The best way to learn about trading is through first-hand experience, and if The Overnight Trade carries little risk, the real-life training it provides is invaluable. How much money is required for the strategy to be effective? Why wait until the market closes? It is the most effective approach to finding a suitable stock for The Overnight Trade. The plan aims to pick the best Overnight Stock After Hours, manage the trade after hours, and then sell the stock over the following days before the market opens. 1. Using the Yahoo Portfolio Watch list: Select % Chg to arrange the list from greatest to lowest. 2. Find a stock that has closed near or at the high of the Day Range and with High Volume at the beginning of the list. 3. Keep going down. 4. Click the stock symbol. 5. Go to its homepage and see if the stock trades higher after hours and with a greater day volume than usual. 6. If the stock fulfills the requirements, then it is a buy. The Overnight Trade Stock should continue to rise in price after hours. If the commodity price decreases and is not enough to cover the commission costs, sell. For instance, if you purchase 250 shares of a $1 stock, the price will need to appreciate by $.04 to cover commission costs for both the buy and sell side. The goal is always to extend well beyond those initial costs so that traders earn a profit; however, if prices begin to decline, it is important to sell before it reaches that $0.40 gain mark, just enough breakeven point where all commissions have been covered. Again, an Overnight Trade Stock should continue to rise in price throughout the course of after-hours trading. If the price of the item you are selling falls and will no longer cover the commission costs, sell it. It is easy as that! The trader can check the watch list for purchasing the next Overnight Trade Stock. Manage only one trade at a time. When the right stock is selected, one that hits The Overnight Stock Criteria should continue gaining until the after-hours close. A strategy for stock trading that is ideal for an afternoon-day trade. The Breakout Trade distills down the elements of a typical breakout day trade to a compact, precise, and profitable technique: buy a breakout stock in the afternoon and sell it before the market closes. If you are a trader who falls under the Pattern Day Trader Rule, there is a method to trade The Breakout Trade daily. The Breakout Trade is a day trading method that focuses on breakouts. The goal is to find a Breakout stock in the afternoon, buy it when it breaks out, and sell it before the market closes. In comparison to morning breakouts, afternoon breakouts have a better chance of continuing. Multiple, free, no-minimum brokerage accounts are possible for the daily trader under the Pattern Day Trader Rule. Popular trading platforms such as Robinhood, E-trade, Charles Schwab, Fidelity, and TD Ameritrade. If you open a brokerage account with any of the five firms listed below, you can make up to three trades per day or 15 trades per week. The objective of The Breakout Trade is not to make three trades a day; instead, it is to keep three trade positions open. Small accounts may not be worth much, but they allow aspiring day traders to practice and master The Breakout Trade daily. There is no better teacher than experience; if you trade small, the risk is also small. However, real-life trading training is priceless. How much money will be required to make the strategy work? Follow these steps to begin using Yahoo Portfolio Watch lists: 1. Sort the watch list in ascending order by volume, from greatest to lowest. 2. Begin with the stock symbol that has traded the most shares today, then click on said symbol to open its home page. 3. On the stock's home page, look for the Day High, Day Low, and whether the stock is rising from low to high. 4. When the stock breaches through the Day High, it creates a Breakout. 5. The Breakout Trading Criteria are as follows: a high volume, a day's low support level, and an uptrend from the day's high. Sell the Breakout Stock before the market closes if it keeps rising as expected. Why? Market conditions can rapidly and unexpectedly change after closing, affecting The Breakout Trade. A Press Release After Hours can negatively impact a Breakout Stock. If traders manipulate the market by pushing prices up during trading hours, this can abruptly stop when the markets close. The breakout Trade sells before the end of trading for the day. There is no profit objective. The Breakout Trade exploits a strong price increase aided by high volume and a robust upward trend, too, and through the market close's high near. If the price no longer rises, sell. If done correctly, the profits will take care of themselves. The Breakout Trade is about identifying a stock with high volume, a clear day low, and a solid upward trend from there to the day's high. When it breaks through the day's high, you buy it when it is cheap and ride it higher in price before the market closes to sell before the end of trading. The Breakout Trade is the best afternoon-day trade. The Breakout Trade Watch list is essential to finding the best Breakout Stocks. The Breakout Trade Stock Criteria helps find the top breakouts by screening for stocks with a high probability of success. Managing the Break-Out Trade and When to Sell helps traders stay focused. Picking shares with a lot of volumes, a solid rise from a recent day’s low, and either riding their jump to sell before the close or cutting their position quickly if it fails to continue higher in price are all good ways to avoid losing money on your trades. Successful stock traders always adhere to the same basic strategy. This method goes by various names, such as the Keep It Simple Stock Trader Strategy. The KISST Strategy should be mastered before an aspiring trader attempts to grasp several stock trading techniques. Other trading methods will be simpler to learn and apply since they incorporate parts of the KISST Strategy. The KISST Strategy was created to assist the budding trader (particularly a day trader) in understanding the one, basic, tried-and-true stock trading technique on which successful stock traders rely. If the prospective day trader is under the Pattern Day Trader Rule (PDTR), they may trade multiple times each day. Numerous trading accounts also assist traders in being able to cut losses quickly and not be concerned about using only one of the three daily trades available per account for each five trading days under the PDTR. Small profits should be anticipated if there are several little accounts. Small accounts should focus on learning the KISST Strategy, preventing losses or quickly cutting losses, and taking small profits. As accounts grow with small profits, larger position sizes can eventually be purchased, resulting in more significant gains. If traders take care to learn the KISST Strategy slowly, trade by trade over time, it will ultimately pay off handsomely. To begin your search, sort the watch lists by volume from highest to lowest when pre-market opens. KISST Stocks are found through this method. The key to the KISST Strategy is volume. A stock's volume is a crucial metric, as it can show whether there is buying or selling pressure. When there is high volume, traders notice and start buying the stock, driving the price up. Volume helps ensure that prices fluctuate enough to enable buying and selling. Check the market volume levels often during the Pre-market hours. Make a separate list (KISST List) of the five stocks with the greatest pre-market volume and Pre-market stock price growth from the various $ amount watch lists. The KISST List is a compilation of the five stocks with the highest pre-market volume and price increase. It is time to start on KISST Due Diligence with the KISST List. KISST's Due Diligence includes: Catalysts and Lines of Demarcation (Lows and Highs) We need to investigate the reason for the High Pre-market volume and Pre-market price increase. To search for a Catalyst, scroll down to the News Feed. The catalyst is any news that a company releases to the public and helps boost its popularity. It might be an announcement about a major contract win, the firm's success, a drug trial's successful outcome, or an FDA approval or positive presentation feedback at a conference. The more significant the Catalyst, the stronger the stock's positive and long-term price reaction. A KISST Stock generally reacts to the announcement of a new PRD Catalyst. Only keep stocks on the KISST List with excellent Catalysts. KISST Due Diligence becomes more involved at this stage. In addition to the KISST List of stocks, please note the pre-market high and low. The Pre-market High and Low are subject to change, so adjust your notation as needed. Make a note of the prior day's highs and lows. The First Lines of Demarcation are the Pre-market High and Low, as well as the Previous Day's High and Low. Then track the five-day, 1-month, 3-month, six-month, and one-year highs and lows. Make a note of each High and Low for each stock symbol on the KISST List next to it. These highs and lows set the buy and sell parameters. The lowest points of support and the highest points of resistance become your buy and sell guidelines. A KISST Stock that is a buy has a high pre-market volume, a price increase before the market opens, and an excellent catalyst. A KISST stock generally falls to a support level low early in the market's opening, such as the Pre-Market Low or Previous Day's Low. KISST Due Diligence kicks in during sell-offs, lasting anywhere from half an hour to sixty minutes. Multiple timeframes' Support Levels provide insight into what to anticipate and search for. Does support remain steady at the pre-market low, lows from previous days, or a five-day low? The greater a Support Level Low is, the likelier it is that there will be a strong stock price move upward. When the stock price reaches one of the KISST Due Diligence Support Level Lows and refuses to break below it, the KISST Buy Signal is triggered as selling volume decreases. There will be a switch from a drop in sales volume to an increase in buying volume at that time. It is called transitioning from red to green. That is the KISST Buy Signal. If the low of the day support level was reached, the stock price should start and continue to rise. If the stock price does not advance and breaks the Support Level Low, exit and do not think twice about it. Being in a trade wishing, you had stayed in is preferable to being in one wishing you had gotten out. This is where KISST's Resistance Levels for Due Diligence are crucial. After identifying the Day's Support Level Low, a series of resistance levels act as trigger points for selling. The Prior Day's High and the Pre-market High become the Immediate Resistance Levels and Sell Signals. If the stock price approaches either level and fails to break through, or if Buying Volume Drops while Selling Volumes Up (green to red), you should sell. If the trading volume remains high and the stock price breaks past resistance levels, the next resistance level becomes a sell signal. This could be a 5-day, 1-month, 3-month, 6-month, or 52-week high. When the stock price reaches a Resistance Level and fails to break through as buying volume tapers off, and selling volume rises, it is called the KISST Sell Signal. The most effective stock traders keep their methods uncomplicated and only use techniques that have been proven successful. The KISST Strategy is a very simple stock trading strategy that expert traders have mastered. If a day trader (aspiring trader) masters and employs the KISST Strategy, they will be well on their way to becoming a successful trader. The basic concepts of the KISS Strategy can be applied to other trading strategies. Take the time to set up KISST Watchlists and learn and master the KISST Methodology. If you fulfill the above criteria, you will become a KISST Trader. While the name suggests a flawless investment, is it too good to be true? Finding the ideal stock is neither complicated nor mysterious. There are countless excellent stocks available every day that can be found and traded. Having success in the stock market comes down to finding the right stocks and knowing what criteria to use when evaluating them. The Perfect Stock will lay out its concepts in a simple and easy-to-understand way, much to the reader's surprise and pleasure. The author wants to assist the trader in identifying the best stock. It took years to figure out the ideal stock. I learned about this, that, and the other, as well as what a variety of traders teach about which stocks to trade. This was something of a revelation for me. Everything we learned was boiled down to a few basic and steadfast criteria for the perfect stock. The qualifications should be well-known to the trader since most traders are already familiar with them. The challenge was to filter out the noise, eliminate the unneeded, boil things down to their essence, and then use what remained as qualifications for the perfect stock. The Perfect Stock makes a profit. The Perfect Stock is a stock that has been sold for a profit. The goal of trading stocks is to make a profit. The trader's profit and what it implies to him are subjective. The meaning of profit is not subjective. Profit, in other words, is what determines whether a stock is The Perfect Stock. The Perfect Stock is easy to find because it has specific, unchanging qualities. The Perfect Stock defines them as Qualifiers. The issue is not where to look for The Perfect Stock but what to search for. The Qualifiers will take the trader to The Perfect Stock and warn them of potential trouble spots. They know that trouble always lurks around the corner, so they avoid it when they see the first signs appearing. They also know not to wear out their welcome. The Perfect Stock eventually stops being perfect, and even if there are no apparent signs of trouble, experienced traders will look to bow out quickly when things start looking less than ideal. And with that, let us introduce the Qualifiers. A skilled trader understands that volume indicates where the action is and knows that volume makes for successful trades. Not just any volume: High Relative Volume. HRV is a volume that significantly exceeds the average trading volume for a stock, indicating traders are rapidly buying or selling the security. HRV stocks offer price action volatility necessary for profitable trades. The Perfect Stock has High Relative Volume. The 50 SMA is a sign of a stock's trend. Traders who have been trading for some time take the trend into account. It is like swimming against the current to buy a stock that is not ahead of the trend, as it lies below the 50 SMA. Catching a wave that might grow into the Big Kahuna is similar to purchasing a stock increasing price above the 50 SMA. Many long-term successful traders keep things simple by focusing on HRV and 50 SMA's. There is a reason why they call it “The Trend Is The Stock Trader's Friend.” Power resides in trends. The 50 SMA marks the beginning of this phenomenon. The 200 SMA is a clear indicator of the trend's strength. The 50 Simple Moving Average (SMA) illustrates the trend, while the 200 SMA demonstrates its strength. A seasoned trader recognizes that a stock trading above the 50 and 200 SMA has a higher chance of continuing the trend. The 200-day moving average (SMA) demonstrates the longevity of the trend. A stock riding a trend above the 50 and 200 SMA provides a longer window of opportunity to profit from a trade. The 200 SMA measures the strength and durability of a trend. The octane, or catalyst, is the juice. The seasoned trader is on the lookout for a High-Octane Catalyst. A high-octane catalyst can propel a company's share price and volume higher every day, keeping the stock moving forward. Some examples of company events considered a HOC are reported profitability, a substantial contract win, favorable legal action, positive study results, and FDA designations or approvals. If a catalyst is a HOC, it can support a price move for an extended period of time before the stock pauses. High-Octane Catalysts are required for the ideal stock. A stock that breaks through a resistance level enjoys a clear road ahead. This is especially true if the resistance was at the 52-Week-High. When resistance levels are broken, it means that buyers are pushing the stock price higher. When a resistance level is broken, more traders are attracted to the market, which results in increased volume. Seasoned traders use scanners to identify when resistance levels have been broken, attracting other traders, like sharks in a feeding frenzy. Different degrees of resistance have different levels of significance and importance for the stock and its potential and strength. The 52-Week High is the most important resistance level. HH&HLs (High High and Higher Low) show strength in both the support level and price. Both are vital. After a stock stops making new higher lows, experienced investors sell their shares and avoid the stock. A trader who has been in the business for a while will try to find Higher Highs and Higher Lows. If the market is making higher highs and higher lows, it indicates that prices are strengthening and there is support at various levels. The Perfect Stock is a stock that has both higher highs and higher lows. A high percentage gainer indicates a stock that is receiving lots of attention and moving in the right direction. An excellent place to start looking for The Perfect Stock is with a large % Gainer. The seasoned trader ensures that the % Gainer is not a one-hit-wonder or flash-in-the-pan by ensuring that the percentage gain is attributable to a High Octane Catalyst. Big gainers that go both HRV and HOC tend to be more perfect than other stocks deemed perfect. When the Big % Gainer surpasses resistance levels and is located above the 50/200 SMA, it can trigger a significant price increase. This method's success depends on two things: HRV and a HOC. A closing that is within the uppermost 25% of what the Day's High was. This suggests that the stock is doing well and might continue to increase in value. You can check the strength of stocks by their price action after hours. If the after-hours price is above the closing price, it signals that investors are bullish about the stock and believe its value will continue to rise. Of course, the better the stocks' prospects for a strong, continuing rise, the more Qualifiers the stock has. A Top 25% Close stock may not be visible on a % Gainers list, but it could still yield significant returns. Factors to consider when selling the ideal stock include: The Trendy Trade takes the approach of a standard swing trade and reduces it to its most basic, exact, and successful form: buy a stock in an upward trend and sell it when that trend ends. The Pattern Day Trader Rule does not apply to swing trades; therefore, the Trendy Trade benefits traders under the PDT Rule. The Trendy Trade Technique is about identifying a stock that closes at a high, is in an upswing, has a lot of volumes, and has the right kind of catalyst. The trend should continue for a few days if the appropriate stock is picked, resulting in the most profit potential. You need a brokerage account with a broker that provides order entry during pre-market and after-hours trading to use The Trendy Trade. There is no greater trading teacher than actual trading experience, and if The Trendy Trade is limited, the risk is likewise. But the real-life training you will get from actual trading is invaluable. With only $250.00, you could turn a small profit from Trendy Trade stock trading by selling stocks worth under $1 up to $2. The right stock must be selected to make a small profit out of $250 with The Trendy Trade. If you begin with a small account, your goal should be to master The Trendy Trade's methods one small trade at a time rather than focusing on the size of your gains. The objective of a tiny account should be to pick the best Trendy Trade Stock, manage the trade, and, if necessary, swiftly cut a loss. Before an inevitable pullback, the Trendy Trade Stock should continue to climb in value for a few days. Sell when the price fails to make new highs and looks to close at or below the previous day's close. A Trendy Trade Stock should continue to increase in price for a few days, creating higher highs and lows. Sell if the price fails to make new highs and appears to close at or below the previous day's close. As easy as that. The trader may then look for the next Trendy Trade Stock on the watch list and try again. If the correct stock is picked, one that fulfills The Trendy Trade Stock Criteria, it should continue to rise in value for a few days. The Trendy Trade is a search for a % Gainer stock that breaks out and closes above the 50-day simple moving average (Uptrend), with high volume and a significant catalyst. The Trendy Trade is a great multiday swing trade. The Trendy Trade Watch list is essential in identifying the best low-cost Trendy Trade Stocks. The Trendy Trade Stock Criteria screens stocks to find the most promising investments. The chapters on finding, buying, and selling trendy trade help traders stay focused. To find the safest swing trading stocks, look for ones close at or near the Day High, breakthrough, and close above the 50-Day SMA, with high volume and a substantial catalyst. A stock trading strategy that can be used before the market opens. Pre-market Trade is a strategy that involves buying and selling during the pre-market hours. This technique has been distilled down from typical day trade strategies and proven successful. A brokerage account with a broker that provides comprehensive pre-market trading is required for the Pre-market Trade. The pre-market starts 1 hour before the main market opens. Small accounts produce little earnings for traders with a small amount of money to start with, but they provide an opportunity to practice and perfect their trading skills. If you want to learn how to trade, there is no better teacher than experience. And if The Pre-market Trade is small, the risk is small too. But the real-life trading training is priceless. Multiple, free, no-minimum balance required accounts may be set up so that the novice trader can trade The Pre-market Trade daily. $250.00 is enough to trade stocks for a small profit from $1 to $2. If you want to make a small profit through pre-market trading with only $250, you must be very careful in choosing the perfect stock. If a tiny account is established, the novice trader should concentrate on mastering The Pre-market Trade's methods one small trade at a time rather than on the size of earnings. A small account should be focused on selecting the proper Pre-market Stock, managing the trade, and, if required, cutting a loss promptly. The Pre-market Trade Strategy entails finding a stock with a high volume to trade pre-market and selling it before the market opens. Why sell your product before the market opens? Because of high-volume, volatile pre-market, equities are prone to a sharp sell-off when the market opens. The Pre-market Stock may surge when the market opens, but this is not a risk for the Pre-Market Trader to undertake. The stock may suddenly decrease in value after a market opens, which can cause the trader to miss their chance to sell and end up making a loss even though they were profitable. Stock Trading Solids are time-tested methods that successful traders use to ensure their success. So-called “solids” are a set of tried-and-true techniques that successful traders share with others who want to learn how to trade. Often, successful stocks will continue being successful and unsuccessful ones will keep losing. Successful stock traders allow their winning trades to succeed and cut their losing bets swiftly to avoid continuing to lose. This, of course, equates to greater profits and lower losses. A successful stock trader has a higher profit margin and a lower loss margin. There might be a variety of causes for you to believe that a stock will move one way, only to have it reverse direction. Successful traders do not believe they are always right and that the market is wrong. Millions of traders view the same stock charts and chart patterns, and when signs of a setup emerge and high volume follows, they come together with the crowd to be a part of something lucrative. Successful trading is about being strategic, and an excellent way to do that is to trade with high volume and positive price action. Find a group, get involved, and leave with a profit before things go wrong because they always do. The exit of a trade, known as the seller, is just as crucial as the entry or buy. Successful traders have already decided where to sell for a profit or loss before they begin trading. Having a plan to sell at either a profit or loss prevents Greed and Optimism from wrecking your investment plans. Each stock transaction is a unique event that is disconnected from prior transactions. Experienced stock traders are aware of this, and even if they have recently lost a streak, they think the next trade will be successful. A “next is a winner” mentality creates powerful motivation. The more indicators, research, and lines of various significance on a chart, the more difficult it is to make a trading decision. Successful traders reduce stock charts to a few tools, such as the Volume and a 50-Day Simple Moving Average, which they use to analyze many chart time frames for an uptrend surpassing the 50-Day SMA. When things are simpler, it is easier and quicker to make decisions. Keep it simple, sweetheart. It is still effective. Trading can be an uneasy experience. Successful traders are okay with being uncomfortable during a trade, even if it is squirming in their seat, because they know that a properly picked and placed trade, no matter how discomforting it is during the actual process, will result in a comfortable conclusion when sold for profit. Learn to squirm and get used to being uncomfortable because it fosters a unique stock trading skill that permits the trader to stay in a correctly chosen and placed trade long enough to make a profit. The best profits come from stocks that are in the middle of an upward move. Successful traders understand that it is nearly impossible to forecast a stock price bottom or top and that attempting to do so may result in a wrong entry, missed opportunity, or catastrophic loss. When you learn how to exploit the middle of a move, it is like finding the sweet spot in trading. You will be satisfied with your profits and have a big smile on your face. A promising sign for the market is when an uptrend produces higher highs. Successful traders take the High Road, which is the uptrend that makes higher highs. They avoid potholes or stock price manipulation. A high road is a well-maintained road on which an upward trend of higher highs with a lot of volumes ensures that the road remains in good condition, allowing for pleasant travel to your profit goal. If you want to be successful, take the high road and follow the trend of higher highs. There is no telling how far a failed trade may go; backfilling it with more cash to establish a position might result in it becoming a money trap. Those who are successful in trading never bet on a losing trade. It is impossible to know how low a stock's price will go during a downtrend. If a stock is weak, manipulated, or shorted, it may sink to delisting and become defunct. Avoid quicksand, even if it appears to be a great investment. The amount of money you make is directly proportional to your position size. Profitable traders continue to add to the share size of their winning position, increasing the profit potential when the moment to sell arrives. When the trade is going well, and there is more room for the stock price to rise, increase your stake and buy additional shares as soon as possible to maximize the gain potential. There will be another trading session. No matter the outcome of a trading day, successful traders know not to let emotions control them. This is especially important when things are going bad, as there is always a tomorrow to trade again. Do not dwell on mistakes or try to make grandiose gestures as if the current trading day is your only chance. The market will open the next trading day and provide another chance to correct mistakes or benefit from a trading edge. To make a profit consistently, the trader must have an advantage or edge that they can use repeatedly. Successful traders sharpen their skills, hone them and keep them sharp to maintain an edge. Finding a workable trading skill, edge, or style is pivotal to success. Develop it until it is second nature, and then use the advantage regularly to perfect your technique and earn a profit. Trading solids can help an aspiring trader succeed in stock trading. They can help safeguard the trader from making costly trading errors if they are considered and stored in mind. By definition, a trading strategy is a set of objective rules used to identify and enter trades. The above-mentioned strategies are merely examples of what can be deployed. These have been found to be successful by some traders, but each person's success will depend on their own ability to find an edge, stick to the rules, and remain disciplined. When constructing a trading strategy, it is important to consider many factors such as risk tolerance, account size, time horizon, and investment objectives. It is also essential to monitor the strategy's performance and make adjustments as needed to ensure that it continues to be effective. Every trader is different, so there is no one-size-fits-all approach when it comes to developing a trading strategy. What works for one person may not work for another. The most important thing is to find a strategy that fits your own trading style and personality.Defining Trading

Trading Strategy

The Overnight Trader

The Overnight Trade: What Is It About?

Set Up an Overnight Trade Account

How to Fund Your Overnight Trade Account

The Overnight Trading Strategy

Finding and Purchasing an Overnight Stock

The Criteria for Overnight Stockfile Screening

Managing The Overnight Trade

When to Sell: The Overnight Trading Profit Target

In Conclusion

The Breakout Trade

What Is the Breakout Trade?

The Breakout Trade Method

Setting Up a Breakout Trade Account

How to Fund the Breakout Trade Account

How to Find Potential Breakout Trade Stocks

How To Manage A Breakout Trade

Making Profits From The Breakout Trade

The Profit Target for Breakout Trades

The KISST Strategy (Keep It Simple Stock Trader)

What is the KISST Strategy?

The KISST Trade Account

Get Started On Your Trading Day Before the Markets Open

The List of KISST

Catalysts from KISST

The KISST Technique: Lines of Demarcation (Lows and Highs)

KISST Buy and Sell Restrictions

KISST Buy Signal Indicator

KISST Sell Signal

KISST Traders Take The Safe Option

In Conclusion

The Best Stock: What the Stock Traders Are Searching For

About The Perfect Stock

To the Person Reading This

What Is the Ideal Stock?

What Is the Best Way to Locate a Good Stock?

The Right Stock Qualifiers

Volume is King

The 50-Day Simple Moving Average

The 200-Day Simple Moving Average

The Catalyst

Breaking Through Resistance

Higher Lows and Higher Highs

The Gainer's Percentage

A Close at or Near the High of the Day

How to Buy and Sell the Perfect Stock

Please Be Aware of the Following

Trendy Trade: Swing Trade a Stock for Reliable Profits

The Trendy Trade System

Setting Up Your Trendy Trade Account

Investing in the Trendy Trade Account

The Trendy Trade Stock: Managing and Selling

Trading Before the Market Opens

Setting up a Pre-market Trade Account

Pre-market Trade Account Funding

Pre-market Trading Strategy

How to Find and Purchase a Pre-market Stock

How to Manage the Pre-market Trade

Ideally, the trade should advance after you buy it so that your commission fees are covered, and you also make a significant profit.

Solid Trading Stocks

Trading Truths That Traders Live By

Winners Thrive While Losers Crumble

Wrong Is Sometimes Right

A Stock Chart Is Similar to a Social Gathering App for the Crowd

You Have Arrived at Your Final Destination

The Next Trade Is a Winner

Fewer Is More

Expand Your Creativity by Learning to Squirm

Eat the Cinnabon’s Middle

Take the High Road and Avoid Making a Mistake

Backfilling Quicksand

Size Is Important

The Sun Will Rise Tomorrow

Moisten the Edge

Final Thoughts

Trading Stocks FAQs

Trading stocks can be a great way to make money, but it is important to understand the risks and take the time to research before investing. It is also wise to have a strategy in place and stick with it. It is always recommended to start slowly and learn as you go. Utilizing a demo account can be very helpful in developing trading skills and strategies.

When developing a trading stocks strategy, you should consider many factors such as risk tolerance, account size, time horizon, and investment objectives. It is also essential to monitor the strategy's performance and make adjustments as needed to ensure that it continues to be effective.

Trading stocks involves potential risk since prices can fluctuate drastically. Investors should also be aware of the related investment costs, such as broker commissions and taxes. Additionally, it is important to do research on any stock before investing to make sure that the company is financially sound.

Choosing the right stocks for trading requires research and analysis. It is important to analyze a company’s financial statements, watch market news, and evaluate technical factors such as chart patterns or moving averages. Trading with a watchlist of stocks can also help narrow down potential trades. Additionally, many traders use sector rotation strategies to identify opportunities in certain industries.

The amount of money required to begin trading stocks will depend on the stock broker and their requirements. Generally, most brokers require a minimum deposit of $500 or more. However, some brokers offer low-cost or even zero-balance accounts for beginner traders. Additionally, there are other options such as trading with a paper trading account or a practice account to get started without investing any money.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.