A turnkey asset management program, or TAMP, is a platform financial professionals use to outsource the management of their client's portfolios. It is a type of program that aims to provide a one-stop solution for asset management, from portfolio construction to performance reporting. Turnkey asset management programs allow the delegation of other tasks, such as research, to other experts. This setup saves time, allowing financial professionals to focus on helping clients in their areas of expertise. TAMPs may also provide users with access to risk profile surveys, software for making proposals, tools for tracking performance, and assistance with billing. The TAMP market has grown significantly, and these wealth management platforms now hold more than $2 trillion. Financial advisors use TAMPs as a third-party tool to help reduce stress and workloads. They provide access to a team of experts who can research investment opportunities, make decisions on what to buy and sell, and manage the overall portfolio on behalf of the advisor. They can also provide the technology and system to delegate tasks like report generation and billing services. TAMP fees are typically incorporated into the advisor's fee schedule. Therefore, it is recommended that these fees be communicated to consumers. In addition, it is crucial for the advisor to ensure that the selected TAMP's investment strategy corresponds with the portfolio and needs of the customer. Below are some fundamental models that TAMPs employ in their operations: This type of account allows advisors to manage many mutual funds at once. Instead of paying individual fees for each one, costs are adjusted to cover all of them. As a result, an advisor can more easily build a portfolio suited to each client's financial goals. This type of account functions is similar to mutual fund wrap accounts. However, their focus is more on exchange-traded funds (ETFs), and they have relatively lower costs. This type of account is aimed at high net-worth investors and works similarly to a mutual fund. However, all the investments in an SMA are held by a single investor. This type of account separates investments into groups. For example, one group might be for mutual funds, while other groups can be for stocks or bonds. Each group is managed in a manner that maximizes potential returns and tax efficiency. This type of TAMP is usually exclusive to investors with a high net worth. This type of account manages investments for multiple individuals who reside in the same household. Families with ultra-high net worth typically avail it. This type of account is specialized to hold and manage digital assets like Bitcoin and Ethereum. There is a growing list of available TAMPs in the market. The most prominent ones include Envestnet, Orion Portfolio Solutions, SEI, Absolute Capital, and Adhesion Wealth. TAMPs offer a wide variety of features and benefits that advisors can tailor to the needs of any customer. The best TAMP is the one that will work in harmony with clients' investment goals. Working with a TAMP offer several advantages, such as the following: TAMP is a valuable resource for accessing other specialists' technical skills, including market research and portfolio management. This option is preferable because advisors can focus on their core strengths, such as building client relationships. Tasks like reporting, compliance, and back-office administrative activities are time-consuming and costly for advisors while they manage expansion. Using TAMPs helps free up time so financial advisors can focus on other revenue-generating activities like looking for new clients. When outsourcing to a TAMP, advisors surrender some influence over managing their client's assets. Advisors may help clients select investment strategists through the TAMP. Once appointed, these strategists will make most decisions about how the funds are invested. TAMPs do not come without downsides. Listed below are some of these disadvantages: When outsourcing to a TAMP, advisors surrender some influence over the management of their clients' assets. Advisors may help clients select investment strategists through the TAMP. Once appointed, these strategists will make most decisions about how the funds are invested. Another drawback of utilizing TAMPs is their additional costs. It is essential to be transparent with clients about these costs, especially if they will be passed on to them. TAMPs fee coverage usually includes charges such as advisory services, platform fees, and transaction expenses. Outsourcing via TAMPs means someone else will take care of the technical part of investing, such as market research. This scenario is a disadvantage for those who find job satisfaction in doing these types of tasks. The cost for TAMP outsourcing often varies from 0.45% to 2.5% and depends on several factors, such as: TAMPs often base their rates on a percentage of the total assets under their management. This pricing system can be tricky because when markets rise, the value of the assets may also rise. As a result, fees tend to increase even though the workload remains unchanged. The cost of using a TAMP might also depend on the duration of the service. Some TAMP providers provide contracts for one year or longer, which are more cost-effective. However, if plans change prematurely, early termination charges may be added. Several TAMPs include bundled services in their quotations. Thus, the total cost often depends on the features selected, and certain payments might be charged for unnecessary components of the bundle. Sometimes TAMPs only sell software and leave execution up to the advisor. In this case, additional human assistance from the supplier might come with an extra cost. Advisors must consider a range of factors before selecting a TAMP. They must review the prospective TAMP's investment philosophy, system, and customer service. Then, they must decide how the TAMP fits with their current process. Finally, they have to weigh additional costs against the features it will provide. Choosing the most appropriate TAMP is based on which one best supports clients' investment goals and objectives. Turnkey asset management programs are fee-based services that help investment advisors manage their clients' portfolios. They also help advisors improve their services in several ways, such as drafting performance reports and assisting with billing. Different types of TAMPs can provide services depending on the financial advisor's needs. Examples include mutual fund wrap accounts and separately managed accounts. TAMPs provide the benefits of easy access to other specialists and the outsourcing of specific tasks. This alternative allows advisers to devote more time to focus on other revenue-generating activities like looking for new clients. However, there are also drawbacks to using TAMPs, like high costs and less control over clients' investments. The cost of TAMPs depends on their pricing structure, how long the contract is, and the features available on their platform. When choosing a TAMP, financial advisors should consider how much it costs and weigh it against the investment strategies and additional services offered.What Is a Turnkey Asset Management Program (TAMP)?

How a TAMP Works

Types of TAMPs

Mutual Fund Wrap Accounts

Exchange-Traded Fund Wrap Accounts

Separately Managed Accounts (SMAs)

Unified Managed Accounts (UMAs)

Unified Managed Household (UMH)

Cryptocurrency Accounts

Examples of TAMPs

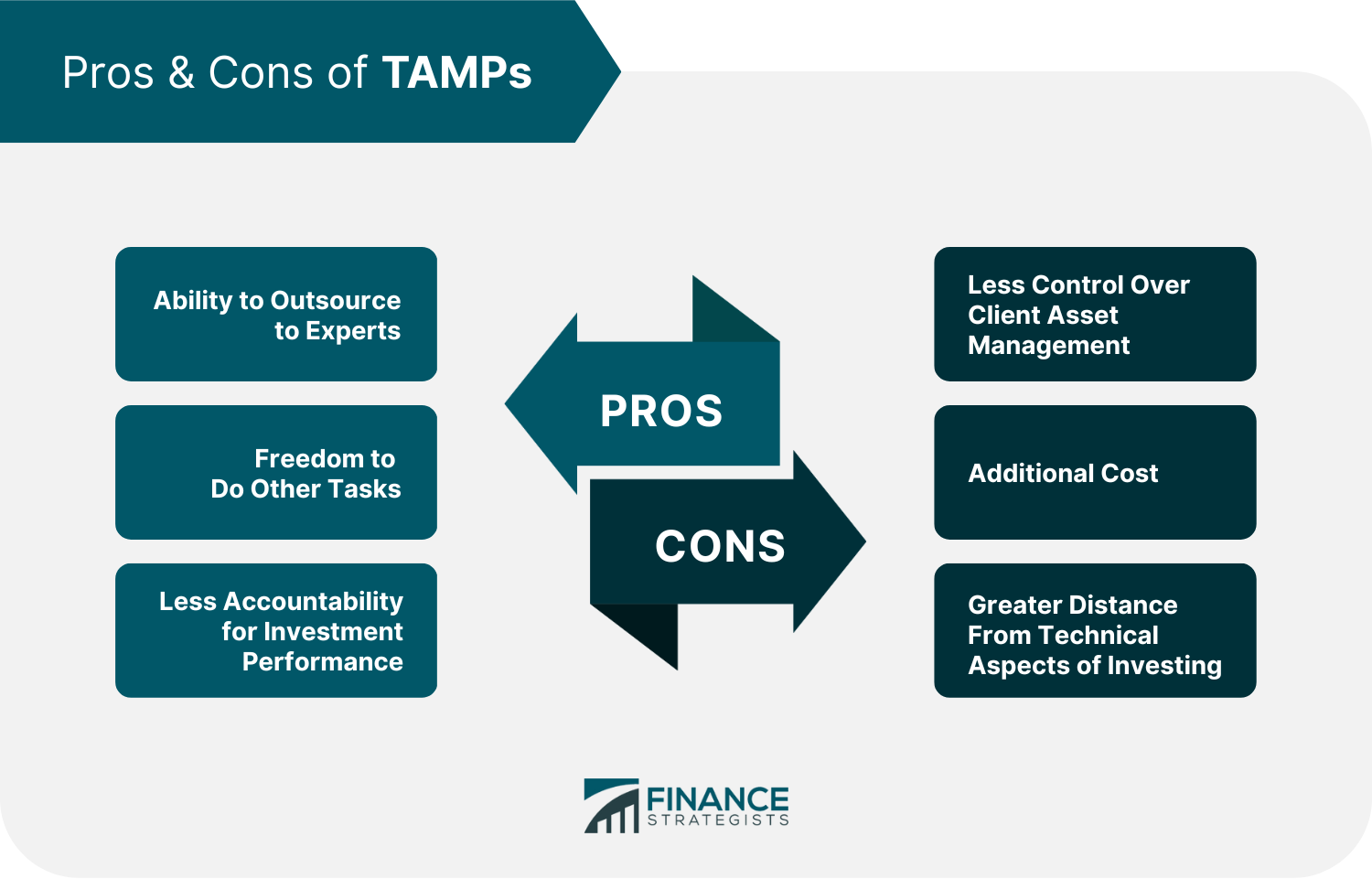

Benefits of TAMPs

Ability to Outsource to Experts

Freedom to Do Other Tasks

Less Accountability for Investment Performance

Drawbacks of TAMPs

Less Control Over Client Asset Management

Additional Cost

Greater Distance From Technical Aspects of Investing

How Much Do TAMPs Cost?

Pricing Structure

Contract Duration

Access to Additional Features

Human Assisted Technology

Choosing a TAMP

The Bottom Line

Turnkey Asset Management Program (TAMP) FAQs

TAMPs are outsourced investment solutions that financial companies and professionals can use to help manage the investment accounts of their clients.

Financial advisors use TAMPs as a third-party tool to outsource tasks such as report generation and billing services. TAMPs also provide access to other specialists who can help with investment strategy and risk management.

A turnkey platform is an investment solution ready to use, with all the necessary components. It follows the concept that it has everything ready and needs only the turn of a key to start operation.

Some examples of TAMPs include Envestnet, Orion Portfolio Solutions, SEI, Absolute Capital, and Adhesion Wealth.

These platforms allow financial advisors to outsource investment management tasks, saving them time and increasing efficiency. This solution can free up advisers to focus on other aspects of their business, such as getting to know their clients better.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.