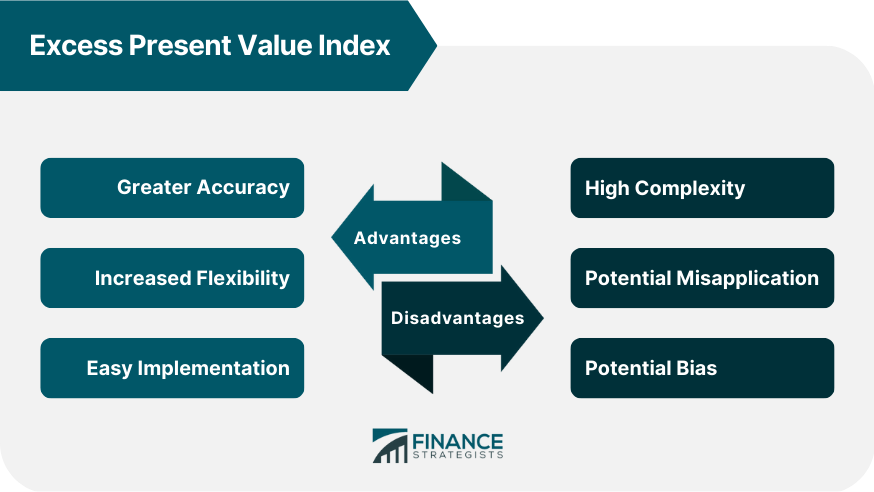

Excess present value index can be defined as the total present value of future net cash inflows divided by the total cash outflow. It can also be used to compare competing investments or to analyze the effectiveness of cost-saving initiatives. There are four common types of Excess Present Value Index, which each have different features and characteristics that can be used for different purposes. The simplest form of the excess present value index is simply subtracting the initial investment from the total present value of expected future returns and dividing that number by the initial investment. The Discounted Cash Flow EPV index is a type of excess present value index that builds on the simpler version, taking into account factors such as inflation, tax rates, and other economic variables to more accurately project future cash flows. This type of excess present value index uses options pricing methods to take into account potential risks and opportunities when assessing investments, allowing companies to make more informed decisions in volatile markets. This type of index is designed for leveraged buyouts, where a company is purchasing another using borrowed money. It takes into account higher risk levels associated with these types of investments, as well as the expected return on the debt used to finance them. Advantages of the EPV index include having greater accuracy, increased flexibility, and its ease of implementation. By taking into account cash flows over a period of time, rather than just the initial investment, the EPV index can more accurately assess a company's potential return on its investment. The excess present value index is flexible enough to be applied to different types of investments or scenarios, making it a useful tool for assessing all sorts of financial decisions. Excess present value indexes are relatively easy to implement, making them ideal for business owners and other non-experts who need to make quick decisions about their finances. Certain downsides of the EPV index must also be taken into account, including its high complexity, potential misapplication, and potential bias. The excess present value index is an advanced financial analysis tool that requires considerable knowledge and expertise in order to use it most effectively. Due to its complexity, there is a risk that the excess present value index will be misapplied or misunderstood by users who do not have sufficient financial acumen. Depending on how it is used, the excess present value index may provide inaccurate results if certain economic variables are not taken into account properly or other factors are ignored. The Excess Present Value Index can be a powerful tool for assessing investments and financial decisions, provided it is applied correctly. It takes into account cash flows over time, as well as other economic variables, in order to provide more accurate results than simpler investment assessment tools. However, it can be complex to use correctly and there is a risk of misapplication or bias when using it. While the EPV index provides an accurate and flexible way to assess investments and financial decisions, it is important to bear in mind that it requires a good understanding of economics and finance in order to achieve reliable results. Additionally, the results should be carefully scrutinized for any potential bias or misapplication.What Is Excess Present Value (EPV) Index?

Types of Excess Present Value Index and Their Features

Simple EPV Index

Discounted Cash Flow (DCF) EPV Index

Real Options EPV Index

Leveraged Buyouts (LBOs) EPV Index

Advantages of Excess Present Value Index

Greater Accuracy

Increased Flexibility

Easy Implementation

Disadvantages of Excess Present Value Index

High Complexity

Potential Misapplication

Potential Bias

Conclusion

Excess Present Value Index FAQs

The excess present value takes into account cash flows over time, as well as other economic variables, which provides more accuracy than simpler investment assessment tools. Additionally, the EPV allows for comparison of different investment options in terms of their present value.

The EPV can be used to make more accurate decisions when assessing investments and financial decisions, allowing for more informed decision-making. Additionally, it allows for the comparison of different investment options in terms of their present value.

It is essential to have a firm grasp of economics and finance when utilizing the EPV index for accurate outcomes. Moreover, it is crucial to carefully evaluate any findings from the index for potential bias or inappropriate application.

Yes, the EPV allows for the comparison of different types of investments in terms of their present value. However, it is important to consider other factors such as risk levels when comparing different investment options before making a decision.

There’s a handful of drawbacks with using the EPV index, like its potential bias and misapplication. It’s also highly complex, meaning you’ll need significant knowledge to be able to maximize its use.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.