Family business valuation refers to the process of determining the economic value of a business owned and operated by family members. This value is critical for various reasons such as estate planning, succession planning, tax purposes, or potential sale or merger of the business. The valuation process requires a thorough analysis of the business's financial statements, assets, liabilities, and various other factors to arrive at an accurate and fair valuation. There are several methods to value a family business, each with its own set of considerations and limitations. The choice of the method depends on the specific circumstances of the business and the objectives of the valuation. Regardless of the method chosen, the goal is to provide an objective and comprehensive understanding of the business's worth.

Family business valuation plays a critical role in a multitude of operational and strategic decisions. When considering transactions like buying or selling shares to employees, or retiring and selling to other family members, it offers a fair market value that ensures equitable transactions. It's invaluable in succession planning, such as gifting shares to heirs, and in mitigating potential estate tax issues. A proper valuation is also instrumental in securing appropriate key man insurance coverage. Another reason to value a family business is to facilitate negotiations for the potential sale or merger of the company. A well-established valuation helps both the buyer and seller in understanding the worth of the business, making it easier to agree on a fair price. For non-family key management, a solid valuation provides a basis for phantom stock plans, ensuring that their contribution is duly recognized and rewarded. Additionally, the valuation process helps business owners identify areas for improvement and growth, which can ultimately increase the value of the business. Hence, a comprehensive valuation is a significant tool in maintaining the health, growth, and sustainability of a family business. The market approach to valuation involves comparing the family business to similar businesses that have been sold or are listed for sale in the market. This method relies on the assumption that businesses in the same industry and market share similar characteristics and can be used as benchmarks for determining the value of the subject company. Two commonly used techniques under the market approach are the guideline public company method and the guideline transaction method. The guideline public company method compares the family business to publicly traded companies in the same industry. This method takes into account various valuation multiples such as price-to-earnings, price-to-sales, or price-to-book value ratios. The guideline transaction method, on the other hand, focuses on analyzing transactions of similar businesses that have been sold or acquired, considering factors such as transaction size, industry, and timing. The income approach to valuation is based on the present value of the expected future cash flows generated by the family business. This method estimates the value of the business by calculating the present value of the cash flow that the business is expected to generate in the future, discounted at an appropriate discount rate. The two main techniques used under the income approach are the discounted cash flow (DCF) method and the capitalization of earnings method. The DCF method involves projecting the company's cash flows over a specific period, discounting them back to their present value, and then adding the present value of the terminal value at the end of the projection period. The capitalization of earnings method, on the other hand, involves estimating the company's future earnings, which are then divided by a capitalization rate that reflects the risk associated with the investment. The asset-based approach to valuation focuses on the net asset value of the family business, which is calculated by subtracting the company's total liabilities from its total assets. This method is particularly relevant for businesses with significant tangible assets, such as real estate, machinery, or inventory. The asset-based approach can be used under two main techniques: the adjusted net asset method and the liquidation value method. The adjusted net asset method involves adjusting the company's assets and liabilities to their fair market value, which may differ from the book value recorded in the financial statements. This method provides a more accurate representation of the company's net asset value, taking into account factors such as depreciation, obsolescence, and appreciation of assets. The liquidation value method estimates the net proceeds that would be received if the family business were to be sold off and its assets liquidated. This method is often used when the business is in financial distress or when its ongoing operations are not generating sufficient returns. The liquidation value method considers factors such as the costs associated with selling assets, settling liabilities, and any potential discounts or premiums applied during the liquidation process. Revenue and profitability are important indicators of a company's financial health and growth potential. Higher revenue and profitability typically translate to higher business value. To assess these factors, a valuation analyst will analyze historical financial statements, evaluate profit margins, and consider the growth potential of the business in its industry and market. Cash flow is an essential factor in business valuation, as it represents the amount of cash generated by the company's operations. A business with strong and stable cash flow is generally considered more valuable than a business with erratic or negative cash flow. When valuing a family business, it is crucial to assess the company's historical cash flows, as well as to project future cash flows based on factors such as growth rates, working capital requirements, and capital expenditures. The company's assets and liabilities play a significant role in determining its value, particularly in the asset-based valuation approach. Assets such as real estate, machinery, and inventory can contribute to the business's overall value, while liabilities, such as loans and other obligations, reduce the value. An accurate valuation must take into account the fair market value of assets and liabilities, which may differ from their book value. The strength and experience of the management team can have a significant impact on a family business's value. A strong management team, with a proven track record and industry expertise, can increase the likelihood of the business's success and growth, which in turn, can increase its value. When valuing a family business, the analyst should consider factors such as the management team's experience, expertise, and succession planning. The competitive landscape in the market and industry in which the family business operates can affect its value. A company facing strong competition may have a lower value compared to a company that enjoys a dominant market position or operates in a niche market with limited competition. It is essential to evaluate the company's competitive position, market share, and barriers to entry when valuing a family business. Understanding industry trends and dynamics is crucial for assessing the future growth potential of a family business. Factors such as technological advancements, changes in consumer behavior, and regulatory changes can significantly impact a company's value. A thorough valuation should consider both the current state of the industry and its expected future trends. Restating the operating income involves adjusting the income statement for any transactions that do not reflect the company's economic reality. Such transactions may include owner's compensations that are above or below market rates, personal expenses billed to the company, or one-time expenses that are not expected to recur. This step is important to ensure the valuation is based on the economic earnings of the business, rather than the reported accounting income, which can be influenced by personal family decisions or accounting practices. It provides a clearer picture for potential buyers or investors, and can also be useful for family business owners themselves for strategic planning and decision-making. Valuing a family business can be a complex and time-consuming process. It is recommended to seek the help of a professional valuation expert who has the necessary knowledge, experience, and resources to provide an accurate and reliable valuation. A professional valuator can ensure that the valuation is conducted using the most appropriate methods and takes into account all relevant factors. Relying on a single valuation method may not provide the most accurate representation of a family business's value. It is a good practice to use multiple valuation methods, such as the market, income, and asset-based approaches, to cross-check and validate the results. This approach can help to account for any limitations or biases inherent in each method, leading to a more comprehensive and reliable valuation. When valuing a family business, it is important to consider the long-term outlook of the company and its industry. Short-term fluctuations in financial performance or market conditions can be misleading and may not accurately reflect the true value of the business. Taking a long-term perspective can help to account for these fluctuations and provide a more accurate assessment of the company's potential for growth and profitability. Effective communication among family members is crucial during the valuation process. Family members should be transparent about their expectations and objectives, as well as any concerns or issues that may arise during the process. Open communication can help to minimize misunderstandings and conflicts and ensure that all family members are on the same page regarding the valuation and its implications for the business. Family businesses often face a lack of transparency and information, which can make the valuation process more challenging. Financial records may be incomplete or outdated, making it difficult to assess the company's true financial performance and position. In such cases, it is essential to work with a professional valuator who can help to obtain the necessary information and provide an accurate valuation. Family members often have a strong emotional attachment to their business, which can make it difficult to objectively assess its value. Emotional attachment can lead to unrealistic expectations about the company's worth, resulting in conflicts and disagreements during the valuation process. It is important for family members to recognize and address these emotional attachments and work together to achieve a fair and objective valuation. Family dynamics and conflicts can significantly impact the valuation process. Conflicting interests, personal biases, and differing expectations among family members can make it challenging to reach a consensus on the business's value. To minimize the impact of these conflicts, family members should communicate openly and honestly, seek professional help, and strive to maintain a focus on the best interests of the business. Family business valuation is a complex and essential process that helps business owners understand the worth of their company and make informed decisions about its future. There are several methods for valuing a family business, including market, income, and asset-based approaches. Factors such as revenue, profitability, cash flow, assets, liabilities, management team, market competition, and industry trends should be considered during the valuation process. Common challenges in family business valuation, such as a lack of transparency and information, emotional attachment to the business, and family dynamics and conflicts, should be acknowledged and addressed to ensure a fair and accurate valuation. By understanding the importance of family business valuation, selecting the most appropriate valuation methods, and addressing the various factors and challenges involved, family business owners can obtain a comprehensive and reliable understanding of their business's worth.What Is Family Business Valuation?

Importance of Family Business Valuation

Types of Family Business Valuation Methods

Market Approach

Income Approach

Asset-Based Approach

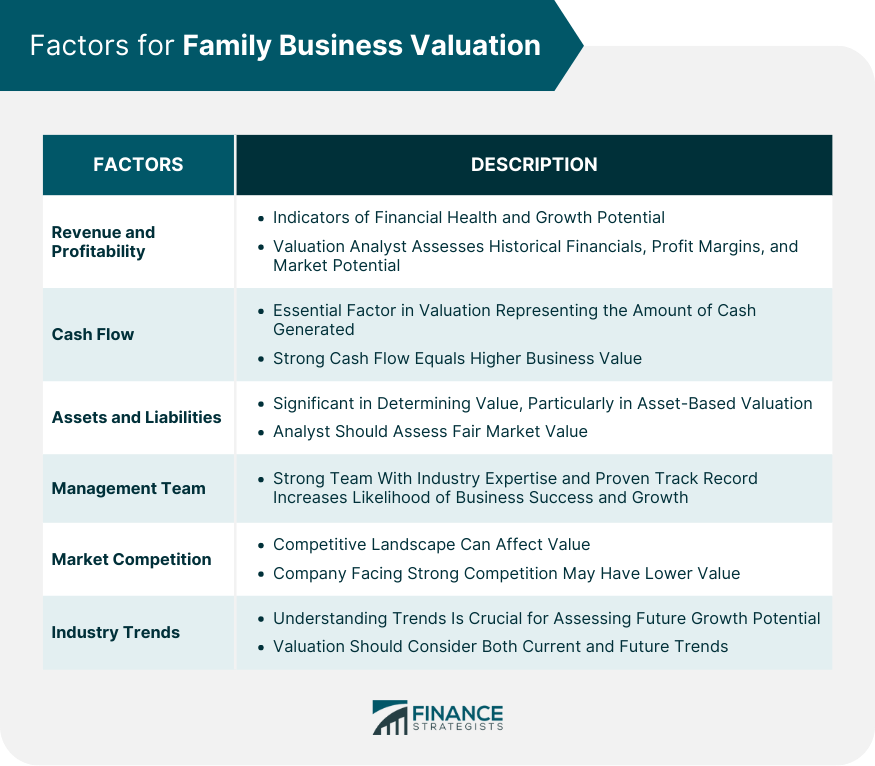

Factors to Consider in Family Business Valuation

Revenue and Profitability

Cash Flow

Assets and Liabilities

Management Team

Market Competition

Industry Trends

Best Practices for Family Business Valuation

Restating Operating Income

Seek Professional Help

Use Multiple Valuation Methods

Consider the Long-Term Outlook

Communicate With Family Members

Common Challenges in Family Business Valuation

Lack of Transparency and Information

Emotional Attachment to the Business

Family Dynamics and Conflicts

The Bottom Line

Family Business Valuation FAQs

Family business valuation is the process of determining the worth of a family-owned business.

Family business valuation is crucial for decision-making, including estate planning, mergers and acquisitions, and selling or transferring ownership.

The three common approaches to family business valuation are market approach, income approach, and asset-based approach.

Financial factors like revenue, cash flow, assets, and liabilities are considered, along with non-financial factors such as management team, competition, and industry trends.

Seeking professional help, using multiple valuation methods, considering the long-term outlook, and communicating with family members are essential best practices for family business valuation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.