Wealth management and financial planning are two key concepts in personal finance. They are both used to help individuals achieve a financially stable future and may involve similar activities. However, they have some key differences. Wealth management is an integrated approach that helps high-net-worth individuals preserve and increase their wealth over the long term. Meanwhile, financial planning focuses on assisting clients to reach specific goals over the short or medium term. Both are essential aspects of a sound financial strategy, but depending on the client’s situation and goals, one may be more suitable than the other.

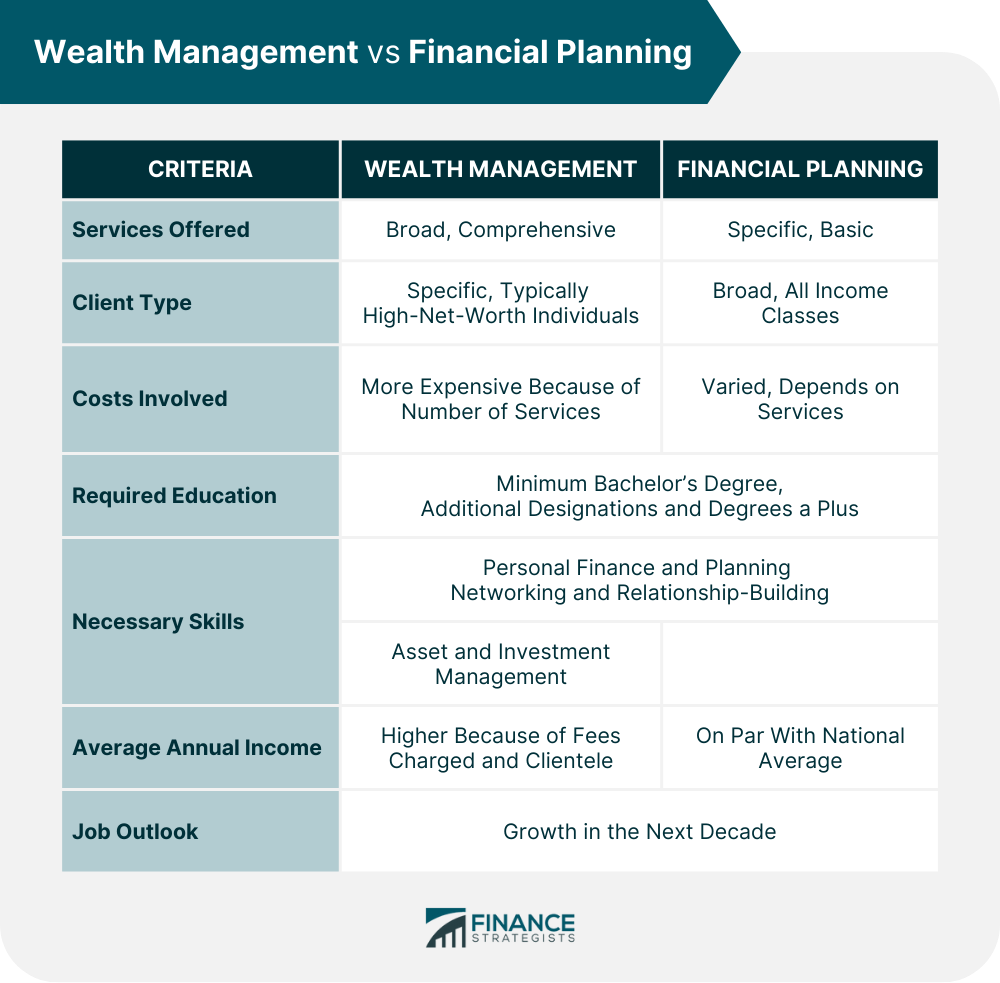

Wealth management is a highly personalized financial management approach that aims to preserve and grow wealth. It focuses on high-net-worth clients and provides them with comprehensive services tailored to their particular needs and objectives. Wealth management services include investment guidance, tax considerations, estate planning, retirement planning, budgeting, insurance coverage, and philanthropic giving. These services can be executed by an individual wealth manager or an entire team of professionals. Overall, wealth management involves more complex strategies than those offered in basic financial planning services. Thus, wealth management service providers often set minimum investment requirements and charge higher fees. Financial planning is the process of assessing a client’s current financial situation and developing a strategy to reach specific goals, such as buying a house or saving for retirement. It typically focuses on short- to medium-term needs and goals. Financial planning services include budgeting, tax management, debt reduction, insurance coverage reviews, and asset allocation strategies. Financial planners generally do not manage investments directly but help create a plan for achieving particular objectives. Additionally, financial planning has a broad range of clientele. It is suitable for individuals of any income class. For example, financial planning can provide average-income earners with guidance in meeting their financial obligations. Wealth management can be distinguished from financial planning in several ways, including services offered, client type, costs involved, required education, necessary skills, average annual income, and job outlook. Wealth management offers a broad range of services like investment management, asset preservation, charitable giving advice, debt management, and insurance services. It integrates all aspects of a client’s finances and is more comprehensive. While wealth management and financial planning can involve similar services, such as retirement or estate planning, the latter involves more basic and specific finance management services like budgeting, saving for emergencies, buying a car, or getting insurance. Wealth management and financial planning primarily differ in their clientele. Wealth management is specifically geared towards high-net-worth individuals. It also typically has minimum investment requirements that limit who can avail of its services. On the other hand, financial planning has a more broad market for potential clients. They can cater to individuals of any income class who needs help meeting their financial goals. Wealth management fees are often higher than those of financial planning. This is because the former offers a more comprehensive suite of services and requires more work from the wealth manager. Meanwhile, costs for financial planning can vary widely depending on what services clients need. However, they typically have a lower cost structure since financial planning is simpler and requires fewer work hours. The minimum requirement for both fields is a bachelor's degree. Advanced degrees or designations also raise the credentials of a wealth manager or a financial planner. The Certified Financial Planner (CFP) designation is the most popular designation for financial planners. Some wealth managers also possess the CFP designation. However, the Chartered Wealth Manager (CWM) designation is the most renowned one. Since they must be equipped to provide more services, wealth managers may possess higher degrees and more designations. Financial planners must understand personal finance and related topics like investments, debt management, taxes, and insurance. They should also be able to create effective financial plans for their clients. Wealth managers must possess the above skills and more advanced knowledge in areas like asset management and business strategy. Both financial planners and wealth managers must have strong networking and relationship-building skills to help them meet and land clients. Specific data on wealth managers and financial planners are absent. However, according to the latest data from the US Bureau of Labor Statistics (BLS), the average annual income of financial advising professionals is $94,170 per year. The top 10% earned more than $208,000, while the bottom 10% earned less than $47,570. It is likely that wealth managers belong to a higher salary tier because they charge higher fees, while financial planners might earn an income equal to the national average. The professional financial advising field is expected to grow by an average of 30,500 job openings annually until 2031, wealth managers and financial planners included. This growth is expected to be more closely accurate for financial planning than wealth management. This is because the demand for wealth management grows and contracts according to the state of the economy. When the economy is doing well, demand is higher. Conversely, when the economy is not doing well, demand might decrease. Thus, its job outlook might be more volatile. Whether you are seeking a financial planner or a wealth manager, it is vital to consider the following criteria: When hiring a wealth manager or financial planner, it is crucial to ensure they have the necessary credentials. If you are looking for a financial planner, consider looking for a CFP at the minimum. For wealth managers, seek those with additional certifications, such as a CWM. Make sure to ask potential candidates about their experience, such as how long they have worked in the industry and what clients they have had. Try to find someone with experience helping clients who share similar goals and objectives as you. Understand the fees associated with the services you need. Ask potential candidates how they are compensated since this may affect the quality of their advice. Also, consider your budget and financial situation when choosing which services to get. To ensure that you select a professional with a clean record, you can check the Securities and Exchange Commission’s (SEC) Individual Adviser Public Disclosure website or the Financial Industry Regulatory Authority's (FINRA) BrokerCheck feature on their website. You can also speak with former clients, read online reviews, and check awards received. These strategies will provide insight into a financial planner's or wealth manager's history or reputation and aid in your decision-making. When choosing between a wealth manager and a financial planner, consider your financial situation and long-term goals. Are you looking for investment advice? Do you need help creating a budget or figuring out how to pay off debt? A financial planner may be the best option if your primary goal is reducing debt. A wealth manager may be the better choice for assistance with investment decisions. Also, think about the complexity of your finances. Financial planning may be sufficient for meeting your needs if your finances are relatively simple—for example if you do not have any complex assets or outside investments. On the other hand, if you own multiple properties, business interests, or stock options, you may need wealth management services since wealth managers are experienced in dealing with such complex investments. Wealth management and financial planning are related services that help individuals better manage their assets and plan for their future. They differ in services offered, costs involved, typical clientele, required education, necessary skills, average annual income, and job outlook. Wealth management focuses on high-net-worth individuals. It offers more comprehensive services, involves minimum investment requirements, and may cost more than financial planning. Wealth managers generally have more designations than financial advisors. Financial planning caters to individuals of all income classes. It offers more specific and basic services. Financial planners might have a lower average annual income than wealth managers, but demand for their services is more stable and expected to grow in the next decade. When hiring a financial planner or wealth manager, consider their credentials, experience, fees, and reputation before selecting one. Doing so will ensure you find the right professional to help you achieve your financial goals.Wealth Management vs Financial Planning: Overview

What Is Wealth Management?

What Is Financial Planning?

Key Differences Between Wealth Management & Financial Planning

Services Offered

Client Type

Costs Involved

Required Education

Necessary Skills

Average Annual Income

Job Outlook

Factors to Consider When Hiring a Wealth Manager or Financial Planner

Credentials

Experience

Fees

Reputation

Wealth Management vs Financial Planning: Which One Do You Need?

The Bottom Line

Wealth Management vs Financial Planning FAQs

Wealth management focuses on high-net-worth individuals. It offers more comprehensive services and costs more than financial planning. On the other hand, financial planning caters to individuals of all income classes and offers more specific and basic services.

Financial planning is important because it involves creating a concrete plan for your financial future. It helps you understand your current financial situation, set achievable goals, and take the necessary steps to reach them. It can also be the first step in wealth management.

Wealth managers can be paid in various ways, including commissions, asset-based fees, hourly rates, or retainer agreements. The exact payment structure varies depending on the individual wealth management firm and the services they offer.

Wealth management services are often tailored toward those with significant assets. For example, wealth management companies often set a minimum investment requirement which ultimately limits which individuals can avail of their services.

Financial planning is primarily focused on helping you achieve your financial goals. It involves analyzing your current financial situation, setting realistic goals, and taking the necessary steps to reach those goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.