A wealth strategist is a professional who provides guidance and advice to individuals or organizations seeking to manage and grow their wealth. They are financial experts who specialize in developing long-term investment strategies, tax planning, risk management, retirement planning, estate planning, and portfolio management services to help clients achieve their financial goals. Wealth Strategists have the necessary training, skills, and experience to help individuals or organizations navigate the complex world of finance and achieve their financial goals. These professionals can create customized wealth management plans tailored to their client’s specific needs and objectives. Whether it is maximizing returns on investments, protecting against potential risks and losses, or planning for retirement, a wealth strategist can provide invaluable guidance and advice.

Several types of individuals or organizations can benefit from the services of a wealth strategist, including: These individuals are typically defined as having assets worth over $1 million. High-net-worth individuals often have complex financial needs that require specialized attention. A wealth strategist can help high-net-worth individuals manage their investments, minimize their tax liabilities, and plan for retirement. Wealth strategists can help entrepreneurs with business planning, investment management, and wealth preservation methods. They can assist in managing cash flow, raising capital, and planning expansion. A wealth strategist can help entrepreneurs protect their wealth by developing plans that minimize potential business risks and losses. Individuals or organizations that invest in stocks, bonds, real estate, and other assets can benefit from the services of a wealth strategist. Investors often have a diverse portfolio of investments that require regular monitoring and adjustments. These professionals can help investors maximize investment returns, manage risks, minimize potential losses, protect their wealth, and stay on track with their financial goals. Banks, insurance companies, and investment firms often require the services of wealth strategists to help manage their portfolios, develop investment strategies, meet regulatory requirements, and achieve financial goals. Wealth strategists can guide financial institutions to stay on top of market trends and changes. Financial markets are constantly evolving, and a wealth strategist can provide the necessary expertise to help financial institutions navigate these changes and stay competitive. Wealth Strategists offer various services to help clients manage and grow their wealth. Some of the most common services provided by Wealth Strategists include: Wealth strategists can aid clients in developing investment strategies that are designed to achieve their long-term financial goals while minimizing risks. They have the expertise to analyze market trends, identify investment opportunities, and develop customized investment designs tailored to clients' needs and objectives. Wealth Strategists can help clients minimize their tax liabilities by developing tax-efficient investment strategies, taking advantage of tax deductions, and implementing other tax planning techniques. These professionals have a deep understanding of tax laws and regulations and can help clients navigate the complex world of taxation. Wealth Strategists can help clients manage risks associated with their investments by creating plans that minimize potential losses. They can analyze market trends, identify potential risks, and develop customized risk management to protect the client's wealth. Wealth Strategists can develop a savings plan that provides sufficient income during retirement. They can help clients manage multiple retirement accounts, develop a retirement savings strategy, and ensure sufficient income during their latter years. These professionals can facilitate the transfer of a client’s wealth to future generations by developing an estate plan that minimizes tax liabilities and ensures that their assets are distributed according to their wishes. Wealth strategists have a deep understanding of the laws and regulations in the complex world of estate planning. Wealth Strategists can monitor performance, making adjustments as needed, and ensuring that the portfolio is managed and aligned with the client's financial goals and risk tolerance. They have the necessary expertise to analyze market trends, identify investment opportunities, and make informed decisions about a client’s investment portfolio. These experts can protect clients’ wealth by developing methods that minimize potential risks and losses. Wealth strategists can analyze market trends, identify potential risks, and develop customized wealth preservation strategies to protect the client's wealth. Working with the right wealth strategist is essential to achieving financial success. When selecting a wealth strategist, it is important to consider the following factors: Wealth Strategists should have the necessary credentials and qualifications, such as a Certified Financial Planner (CFP) designation, to provide expert financial advice. A CFP designation requires the completion of rigorous coursework and passing a comprehensive exam, demonstrating that the wealth strategist has a deep understanding of financial planning principles and practices. Candidates should have a proven track record of success and experience working with clients in similar financial situations. Look for a wealth strategist with experience managing investments, minimizing tax liabilities, developing retirement plans, and managing risk. You may also check their track record and public disclosures through the BrokerCheck tool or the Securities and Exchange Commission’s (SEC) Investment Advisor Public Disclosure (IAPD) website and the SEC Action Lookup - Individuals (SALI) database. Their investment philosophy should be aligned with the client's financial goals and risk tolerance. Look for a wealth strategist with a clear plan who can explain how their investment strategy will help you achieve your financial goals. A good wealth strategist should also be able to explain how they manage risk and minimize potential losses. Wealth strategists should communicate regularly with clients to keep them informed about the performance of their portfolios. They should also be accessible through various means like phone calls, email, or others should clients require assistance. They should be upfront about their fees and charges and should provide clients with a clear understanding of the costs associated with their services. A wealth strategist should be able to explain how their fees are structured and calculated. Managing and growing wealth can be a complex and challenging task that requires specialized knowledge and expertise. Wealth strategists have the necessary training, skills, and experience to help individuals or organizations achieve their financial goals. Whether it is maximizing returns on investments, protecting against potential risks and losses, or planning for retirement, a professional wealth strategist can provide invaluable guidance and advice. When selecting a wealth strategist, it is important to consider their credentials and qualifications, experience and track record, investment philosophy, communication, and fees and charges. By choosing the right professional for their wealth management needs, individuals and organizations can achieve financial success and peace of mind.What Is a Wealth Strategist?

Who Needs a Wealth Strategist?

High-Net-Worth Individuals

Entrepreneurs

Investors

Financial Institutions

Services Provided by Wealth Strategist

Long-Term Investment Strategies

Tax Planning

Risk Management

Retirement Planning

Estate Planning

Portfolio Management

Wealth Preservation

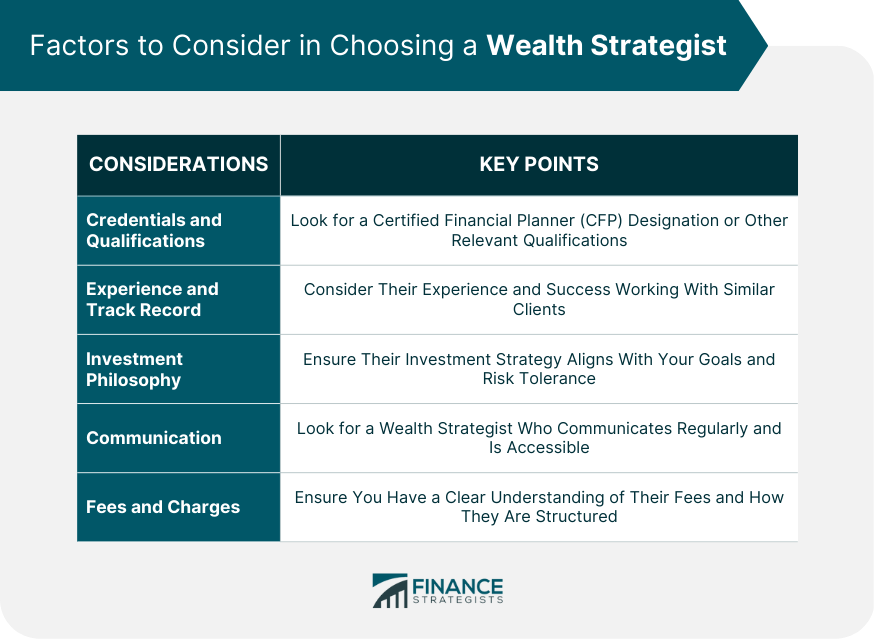

Factors to Consider When Choosing a Wealth Strategist

Credentials and Qualifications

Experience and Track Record

Investment Philosophy

Communication

Fees and Charges

Final Thoughts

Wealth Strategist FAQs

A wealth strategist is a financial expert who specializes in managing and growing wealth. They offer a wide range of services, including long-term investment strategies, tax planning, risk management, retirement planning, estate planning, portfolio management, and wealth preservation.

Anyone can benefit from the services of a wealth strategist, but high-net-worth individuals, entrepreneurs, investors, and financial institutions stand to benefit the most. A wealth strategist can provide expert advice on managing and growing wealth, develop customized wealth management plans, maximize investment returns, protect against potential risks and losses, and help individuals and organizations achieve their financial goals.

When selecting a wealth strategist, it is important to consider their credentials and qualifications, experience and track record, investment philosophy, communication and transparency, and fees and charges. Look for a wealth strategist who has the necessary credentials and qualifications, a proven track record of success, an investment philosophy that is aligned with your financial goals, transparent communication, and fair fees and charges.

Wealth strategists offer a wide range of services, including long-term investment strategies, tax planning, risk management, retirement planning, estate planning, portfolio management, and wealth preservation. They can also provide advice on managing cash flow, raising capital, and planning for expansion for entrepreneurs and business owners.

You can check their registration status and employment and disciplinary history using resources like the Securities and Exchange Commission (SEC) Investment Adviser Public Disclosure (IAPD) website, the Action Lookup - Individuals tool, and BrokerCheck.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.