"X Rate" stands for "Exchange Rate," and is a metric by which the value of one currency is compared to another. It can be thought of as a measure of how much of the second currency can be "bought" with an amount of the first currency. The X rate refers to the value of one currency in terms of another. Simply put, an X rate is the price at which one can swap one currency for another. Whether you're buying a souvenir on vacation, importing goods for your business, or investing in foreign stocks, you're likely to encounter this term. X rates fluctuate over time, influenced by various factors ranging from economic indicators to geopolitical events. The purpose of an X Rate is to figure out the buying power of a currency as compared to another currency. Not all currencies have the same buying power per unit, so knowing the x rate helps determine the "value" of an amount of money. For example, the exchange rate of US dollars (USD) to Pound sterling (GBP) is 1.29. This means that it takes $1.29 to equal £1. Put another way, if a US citizen traveled to the UK with $10,000 to exchange into pounds, they would get about £8,034. Fluctuations in X rates directly impact the competitiveness and affordability of a country's exports and imports. When a currency depreciates, it makes exports more affordable for foreign buyers, boosting a country's export sector. Conversely, when a currency appreciates, imports become relatively cheaper, influencing consumer choices and potentially impacting domestic industries. X rates have a profound impact on foreign investments and capital flows. Investors consider X rates when making investment decisions in foreign markets. Fluctuations in x rates can significantly affect the returns and value of investments denominated in foreign currencies. X rate movements can also influence the flow of capital between countries, affecting financial stability, economic growth, and the overall investment climate. X rates help adjust trade imbalances between countries. When a country experiences a large trade deficit, a depreciation of its currency can make its exports more competitive, potentially reducing the trade imbalance. On the other hand, if a country has a trade surplus, an appreciation of its currency can make imports more affordable and help rebalance trade. By managing X rates, policymakers can aim to stabilize their economies and promote sustainable growth. Higher interest rates tend to attract foreign capital, leading to an appreciation of the domestic currency. Conversely, lower interest rates can result in capital outflows and currency depreciation. Similarly, countries with lower inflation rates often see their currencies appreciate as their purchasing power increases relative to other currencies. On the other hand, robust economic growth can lead to higher demand for a country's currency, pushing up its value. Understanding these factors can provide valuable insights into currency movements and help anticipate future trends. Countries with stable governments and sound policies tend to attract foreign investment, supporting their currency values. In contrast, political uncertainty or turmoil can lead to capital flight, leading to currency depreciation. Additionally, major geopolitical events, such as elections, referendums, or conflicts, can cause significant currency volatility. Monitoring political developments is thus essential for managing currency risks and making informed investment decisions. If the demand for a currency exceeds its supply, its value will rise. Conversely, if the supply of a currency surpasses demand, its value will fall. These forces are influenced by a myriad of factors, including trade flows, investment trends, market sentiment, and speculative activity. For instance, a country with a trade surplus will likely see its currency appreciate due to increased demand. Similarly, a bullish market sentiment can lead to higher currency values as investors flock to buy. Keeping an eye on market dynamics can help predict currency movements and identify investment opportunities. X rates have a direct impact on international trade. They determine the price of a country's goods and services on the global market, affecting its exports and imports. A weak domestic currency makes a country's exports cheaper and imports more expensive, potentially boosting its trade balance. Conversely, a strong currency can make exports more expensive and imports cheaper, possibly leading to a trade deficit. These dynamics can have significant implications for a country's economy, affecting growth, employment, and inflation. For businesses engaged in international trade, managing X rate risks is critical to maintaining competitiveness and protecting profit margins. X rate volatility refers to the fluctuations in currency values over time. High volatility can pose risks to traders and investors as it increases uncertainty and potentially erodes profits. For importers and exporters, X rate volatility can lead to unpredictable costs and revenues, affecting their financial performance. On the other hand, volatility can create trading opportunities for investors and speculators who aim to profit from currency movements. Managing X rate volatility requires sophisticated risk management strategies, including the use of financial derivatives and hedging techniques. Currency risk, or X rate risk, arises from changes in currency values. It is a significant concern for businesses and investors engaged in international operations. Unfavorable currency movements can erode profits, disrupt cash flows, and increase financial risks. Effective currency risk management involves identifying exposure, assessing potential impacts, and implementing strategies to mitigate risks. These can include financial hedging using forward contracts or options, diversification of currency exposure, and operational strategies like pricing adjustments or sourcing decisions. A robust currency risk management framework can protect businesses from adverse currency movements and enhance financial resilience. Under a fixed X rate system, a country's currency value is pegged to a specific value, usually a major currency like the U.S. dollar or a basket of currencies. The central bank maintains the X rate within a narrow range by buying or selling its own currency in the foreign exchange market. Fixed X rates can provide stability and predictability, facilitating international trade and investment. However, they require significant foreign exchange reserves to defend the peg and may limit a country's monetary policy independence. They can also be vulnerable to speculative attacks if market participants doubt the central bank's ability or commitment to maintain the peg. In a floating X rate system, a currency's value is determined by market forces of supply and demand. The central bank does not actively intervene in the foreign exchange market to maintain a specific X rate. However, it may occasionally step in to prevent excessive volatility or misalignments. Floating X rates can absorb economic shocks and reflect a country's economic fundamentals more accurately. They also allow for greater monetary policy independence. However, they can be volatile and unpredictable, posing risks to economic stability and financial markets. Central bank interventions involve buying or selling currencies in the foreign exchange market to influence X rates. They can be used to stabilize the currency, counteract speculative movements, or achieve economic objectives. Interventions can be effective in smoothing X rate volatility and preventing misalignments. However, they can also distort market dynamics and lead to tensions in international economic relations. Therefore, central banks typically use interventions sparingly and in conjunction with other monetary policy tools. X rates have significant implications for a country's trade balance, which is the difference between its exports and imports. A depreciation of the domestic currency can boost exports and curb imports, improving the trade balance. Conversely, an appreciation can make exports more expensive and imports cheaper, potentially leading to a trade deficit. Changes in the trade balance can have broad economic impacts, affecting economic growth, employment, and inflation. They can also influence a country's international investment position and its external debt dynamics. Therefore, X rate policies are often closely linked with trade policies and strategies. A depreciation of the domestic currency can increase the cost of imported goods and services, leading to higher inflation. This can erode consumers' purchasing power, particularly in countries heavily reliant on imported goods. On the other hand, an appreciation of the domestic currency can lower the cost of imports, potentially reducing inflation. However, it can also hurt the competitiveness of domestic industries and dampen economic growth. Therefore, managing X rates is a key aspect of monetary policy and price stability. A weaker domestic currency can make a country's products cheaper on the global market, boosting their competitiveness. This can stimulate exports, promote economic growth, and create jobs. Conversely, a stronger domestic currency can make a country's products more expensive on the global market, reducing their competitiveness. This can hurt exports, dampen economic growth, and lead to job losses. Therefore, X rate policies can have significant implications for industrial policies, employment strategies, and economic development. Fundamental analysis involves evaluating economic indicators, market conditions, and geopolitical events to predict future X rates. It assumes that X rates are determined by underlying economic fundamentals and will adjust to reflect them over time. Indicators used in fundamental analysis include interest rates, inflation rates, trade balance, economic growth, political stability, and market sentiment. By assessing these factors, analysts can form expectations about future currency movements and make investment decisions accordingly. Technical analysis focuses on past market data, primarily price and volume, to predict future X rates. It uses various tools and techniques, such as charts, trend lines, and mathematical indicators, to identify patterns and trends in currency movements. Technical analysts believe that history tends to repeat itself and that market psychology influences currency values. By studying past market behavior, they aim to forecast future currency movements and identify trading opportunities. While technical analysis can be useful in predicting short-term trends, it may not always accurately capture long-term economic fundamentals. They provide insights into a country's economic health and future prospects, influencing investor sentiment and currency values. Commonly used economic indicators include Gross Domestic Product (GDP), unemployment rate, inflation rate, interest rates, trade balance, and consumer confidence index. By closely monitoring these indicators, analysts can assess the state of the economy, anticipate policy changes, and predict future X rate movements. Several factors influence exchange rates. Most exchange rates are free-floating, meaning they rise and fall in accordance with fluctuations in supply and demand in the foreign exchange market. Other currencies may be pegged, meaning that their value is tied to the value of another currency within a certain margin; the Hong Kong dollar, for example, is pegged to the US dollar at a range of 7.75 to 7.85, so its value will stay within this range of the USD. Some currencies have different exchange rates depending on whether or not the funds are held inside or outside a country's borders. The Chinese Yuan (CNY), for instance, has an exchange rate of ¥7.05 per $1 outside its borders, but ¥7.04 per $1 inside. X rates serve as a measure of a currency's value compared to another and play a crucial role in international trade, investment, and economic stability. Fluctuations in X rates directly affect the competitiveness of exports and imports, influencing trade balances and economic growth. X rates also play a vital role in foreign investments and capital flows, shaping the investment climate and financial stability. Understanding the factors influencing X rates, such as economic indicators, political developments, and market forces, is crucial for anticipating currency movements. Effective currency risk management strategies are essential for businesses and investors to mitigate the impact of unfavorable X rate fluctuations. X rate policies, including fixed and floating rate systems, and central bank interventions, influence currency values and have implications for trade, investment, and monetary policies. Monitoring and analyzing X rates are vital for navigating the complexities of the global economy and making informed decisions.What Is an X Rate?

What Does X Rate Mean in Finance?

Importance of X Rates

International Trade

Investment and Capital Flows

Macroeconomic Stability

Factors That Influence X Rate

Economic Factors

Political Factors

Market Forces

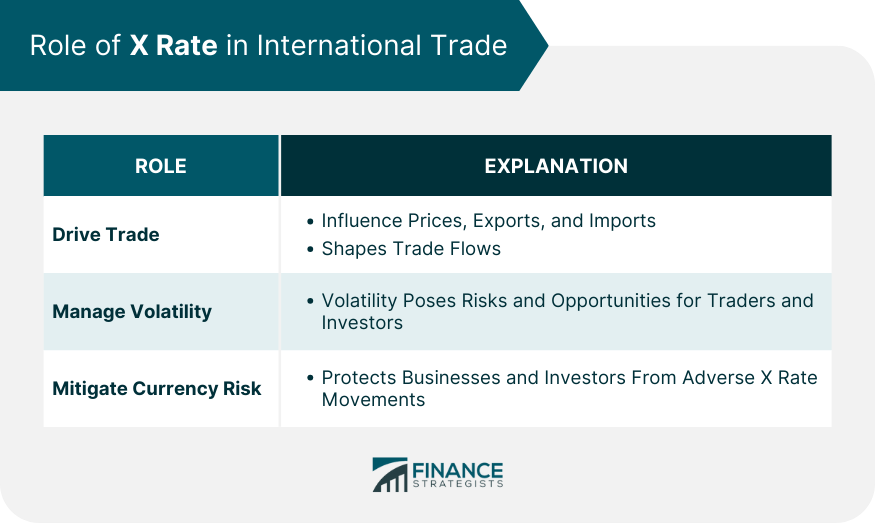

Role of X Rate in International Trade

Exports and Imports

Volatility

Currency Risk Management

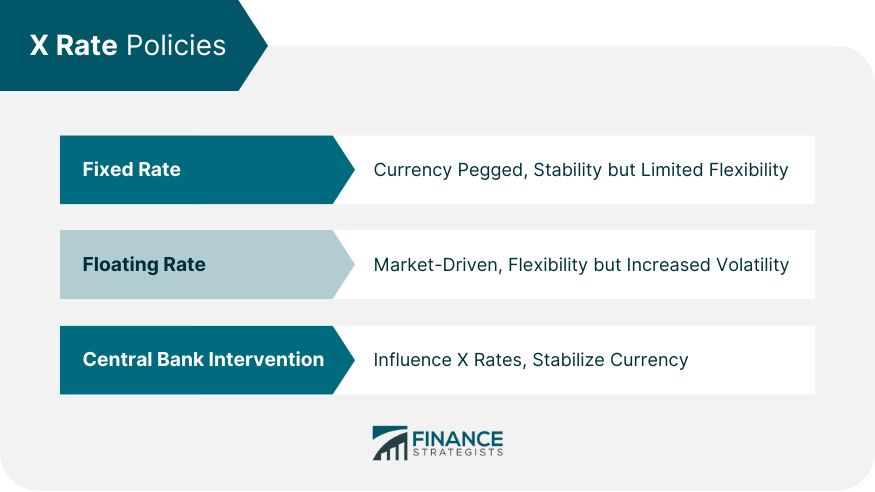

X Rate Policies

Fixed X Rate System

Floating X Rate System

Central Bank Interventions

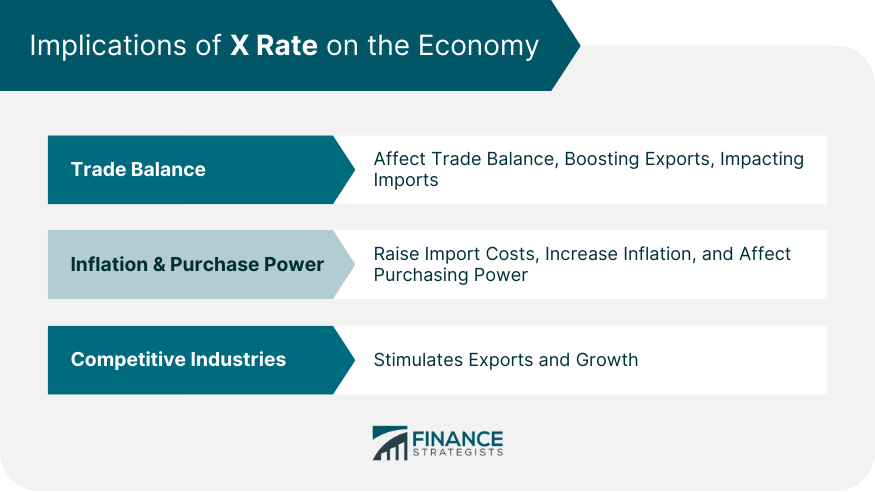

Implications of X Rate on the Economy

Trade Balance

Inflation and Purchase Power

Competitive Domestic Industries

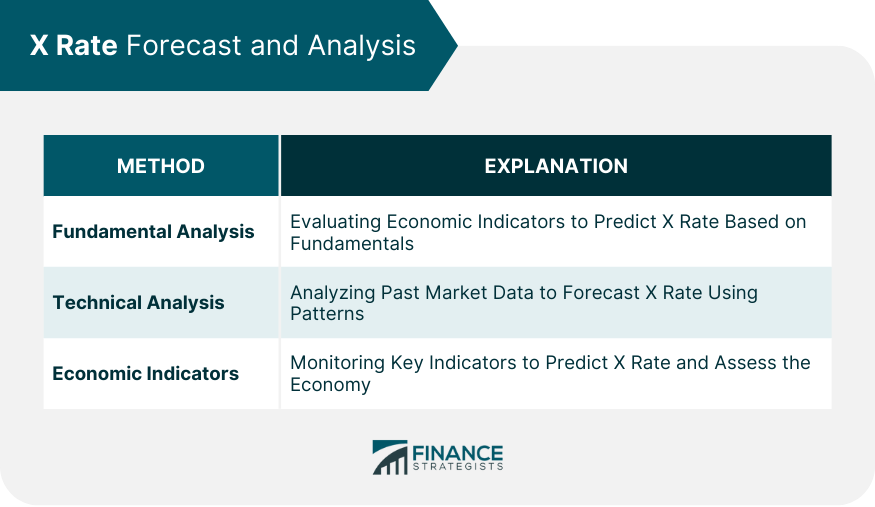

X Rate Forecast and Analysis

Fundamental Analysis

Technical Analysis

Economic Indicators

X Rate Example

Conclusion

X Rate FAQs

X Rate stands for Exchange Rate in finance.

X Rate is a metric by which the value of one currency is compared to another. It can be thought of as a measure of how much of the second currency can be bought with an amount of the first currency.

The purpose of an X Rate is to figure out the buying power of a currency as compared to another currency.

Not all currencies have the same buying power per unit, so knowing the exchange rate helps determine the value of an amount of money.

Exchange rates are determined by the interaction between demand for and supply of currencies in the foreign exchange market, taking into account a variety of factors such as interest rates, political stability, and economic performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.